Application of corporate governance rules

PZU applies the corporate governance rules laid down by law, in particular the Commercial Company Code and the Insurance and Reinsurance Activity Act, the regulations governing the operation of the capital market and the rules set forth in the documents described below.

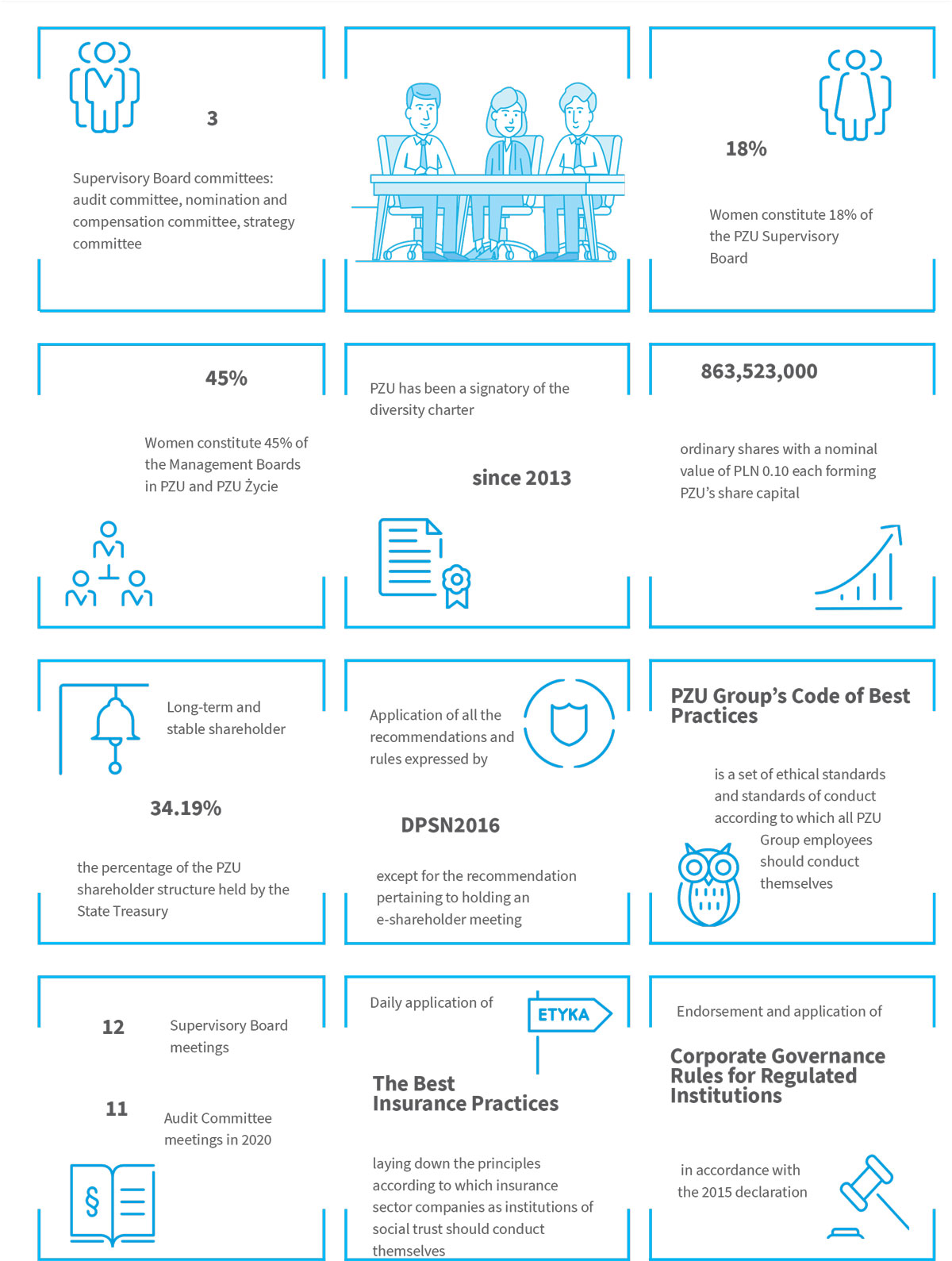

PZU applies the Corporate Governance Rules for Regulated Institutions published on 22 July 2014 by the Polish Financial Supervision Authority (KNF). This a collection of rules that define the internal and external relations of regulated institutions, including their relations with shareholders and customers, their organization, the functioning of internal oversight and key internal systems and functions as well as the governing bodies and the rules for their cooperation. The document is available both on the KNF website (https://www.knf.gov.pl/ dla_rynku/regulacje_i_praktyka/zasady_ladu_korporacyjnego) and the PZU website (https://www.pzu.pl/grupa-pzu/spolki/ pzu-sa/zasady-ladu-korporacyjnego).

Since the day when its shares were admitted to trading on a regulated market, PZU has followed the corporate governance rules laid down in the Best Practices of WSE Listed Companies 2016 adopted by the Supervisory Board of the Warsaw Stock Exchange (WSE) on 13 October 2015. This is a collection of corporate governance rules and rules of conduct that affect how public companies interact with their market environment. The document is available both on the Warsaw Stock Exchange website (www.gpw.pl/dobre-praktyki) and the PZU website (https://www.pzu.pl/grupa-pzu/o-nas/kulturacompliance-pzu/dobre-praktyki-pzu).

The set of principles expressed in the Best Insurance Practices adopted on 8 June 2009 by the General Assembly of the Polish Chamber of Insurance (PIU) informs how PZU conducts its business operations and shapes relations with its stakeholders. This document defines the rules of corporate social responsibility in terms of how insurance undertakings interact with customers, insurance intermediaries, the regulatory authority and the Financial Ombudsman, the media and in public securities trading. By applying the Best Insurance Practices, PZU conducts regular efforts to develop insurance awareness in the public at large.

PZU has also developed its own code defining the principal ethical standards governing the Company’s behavior in relations with its stakeholders. The PZU Group’s Best Practices are a set of standards followed by all members of the PZU Group. The values and principles laid down therein must be followed by all employees.

Application of Corporate Governance Rules for Regulated Institutions

The PZU Management Board and Supervisory Board have declared in their resolutions the Company’s readiness to apply the standards defined by KNF to the broadest possible extent while giving consideration to the rule of proportionality and the rule “comply or explain” stemming from the wording of the Corporate Governance Rules for Regulated Institutions.

Information on the application of the Rules was presented by the PZU Management Board and Supervisory Board during the PZU Ordinary Shareholder Meeting (PZU OSM) held on 30 June 2015. The PZU OSM declared that, acting within its powers, it will be guided by the Corporate Governance Rules in the wording adopted by the Polish Financial Supervision Authority on 22 July 2014, except for certain specific rules waived by the PZU OSM.

Detailed information is provided on PZU’s website on the application of the Corporate Governance Rules, including rules that are partially applied, namely:

- in reference to the rule laid down in § 8 sec. 4. of the Corporate Governance Rules concerning the enabling of all shareholders to participate in the Shareholder Meeting, including by procuring the possibility of actively participating electronically in the Shareholder Meeting, it should be noted that, presently, PZU shareholders may follow the broadcast of the Shareholder Meeting, however the Issuer decided not to introduce the so-called e-Shareholder Meeting, because, in PZU’s opinion, there are a number of factors of a technological and legal nature which may affect the proper conduct of the Shareholder Meeting; legal concerns include the possibility of identifying the shareholders and verifying their legitimacy; the risk of the occurrence of technical difficulties, e.g. with the Internet connection or possible external interference in the IT systems, may disrupt the work of the Shareholder Meeting and evince doubts concerning the efficacy of the resolutions adopted during its course; the materialization of the above risks may affect the proper application of this rule to its full extent;

- in reference to the rule laid down in § 21 sec. 2. of the Corporate Governance Rules stating that the supervising body should have a separate chairperson function in charge of managing the work of the supervising body, and the selection of the chairperson of the supervising body should be accomplished on the basis of experience and team management skills while giving consideration to the criterion of independence; it should be emphasized that, in accordance with the Commercial Company Code and PZU’s Articles of Association, the Chairperson function has been established in the PZU Supervisory Board; the PZU Supervisory Board’s composition and the Chairperson function are shaped using the independence criteria in the Statutory Auditor Act; the Supervisory Board Chairperson is selected using the criterion of knowledge, experience and skills confirming the competences required to discharge duly the duties of supervision; applying the independence criterion to the Chairperson according to the KNF Office’s explanation of this rule may evince doubts concerning a possible collision with the legal regulations pertaining to shareholder rights;

- in respect of the rule laid down in § 49 section 3 of the Corporate Governance Rules concerning the appointment and dismissal, in a regulated institution, of the person managing the internal audit cell and the person managing the compliance cell with the consent of the supervising body or the Audit Committee, it should be pointed out that PZU applies the rules laid down in § 14 of the Rules to their full extent, which means that the PZU Management Board is the sole body empowered to, and responsible for, managing the Company’s activity; moreover, according to the labor law regulations, the managing body exercises labor law activities; on account of the foregoing, PZU has adopted a solution that anticipates that the selection and dismissal of the person managing the internal audit cell is accomplished while taking into account the opinion of the Audit Committee; the person managing the compliance cell is appointed and dismissed in an identical manner; in making these decisions, the Management Board obtains the Audit Committee’s opinions.

In accordance with the resolution of 30 June 2015, the PZU OSM has waived the following rules:

- the rule laid down in § 10 section 2 of the Corporate Governance Rules reading as follows: “The implementation of personal rights or other special rights for shareholders of the regulated institution should be justified and serve the accomplishment of the regulated institution’s material operating goals. The possession of such rights by shareholders should be reflected in the wording of the primary governing document of the regulated institution.” – according to the substantiation presented by the shareholder along with the draft resolution of the OSM, the waiving of this rule is due to the unfinished process of the Company’s privatization by the State Treasury;

- the rule laid down in § 12 section 1 reading as follows: “Shareholders are responsible for recapitalizing without delay a regulated institution in a situation in which it is necessary to maintain the regulated institution’s equity at the level required by the legal regulations or oversight regulations as well as when the security of the regulated institution so requires.” – according to the substantiation presented by the shareholder along with the draft resolution of the OSM, the waiving of this rule is due to the unfinished process of the Company’s privatization by the State Treasury;

- the rule laid down in § 28 section 4 reading as follows: “The decision-making body assesses whether the implemented compensation policy fosters the regulated institution’s development and operating security.” – according to the substantiation presented by the shareholder along with the draft resolution, the waiving of this rule is due to the overly broad scope of the subject matter of the compensation policy subject to assessment by the decision-making body; the compensation policy in respect of persons who discharge key functions but are not members of the supervising body or the managing body should be subject to assessment by such persons’ employer or principal, i.e. the Company represented by the Management Board and supervised by the Supervisory Board.

Furthermore, the following rules are not applicable to PZU:

- the rule laid down in § 11 section 3 reading as follows: “In the event that the decision-making body makes a decision concerning a transaction with a related party, all shareholders should have access to all information required to assess the conditions on which it is implemented and its impact on a regulated institution’s standing.” – in PZU, the Shareholder Meeting does not make decisions on transactions with related parties;

- the rule laid down in § 49 section 4 reading as follows: “In a regulated institution in which there is no audit or compliance cell, the rights ensuing from sections 1-3 are vested in the persons responsible for performing these functions.” – audit and compliance cells operate in PZU;

- the rule laid down in § 52 section 2 reading as follows: “In a regulated institution in which there is no audit or compliance cell or no cell responsible for this area has been designated, the information referred to in section 1 shall be conveyed by the persons responsible for performing these functions." – audit and compliance cells operate in PZU;

- the rules laid down in Chapter 9 entitled “Exercising rights from assets acquired at a client’s risk" – PZU does not offer products entailing asset management at a client’s risk.

Application of “Best Practices of WSE Listed Companies”

In 2020, PZU complied with all recommendations and principles set forth in the Best Practices of WSE Listed Companies 2016, except for recommendation IV.R.2., which provides for a possibility for shareholders to participate in a Shareholder Meeting using means of electronic communication, in particular via the following:

- real-time transmission of the Shareholder Meeting;

- real-time bilateral communication where shareholders may take the floor during a Shareholder Meeting from a location other than the shareholder meeting;

- exercising, in person or by proxy, voting rights during a Shareholder Meeting.

PZU shareholders may follow the broadcast of the Shareholder Meeting, although the Company has refrained from adopting the so-called e-Shareholder Meeting, that is the option to cast electronic votes. According to PZU, this is due to the existence of a number of legal, technical and organizational factors that may affect the proper course of the Shareholder Meeting. Legal doubts pertain to the inability to identify shareholders and check their right to participate in the shareholder meeting. The risk of technical difficulties may disrupt the work of the Shareholder Meeting and evince doubts concerning the efficacy of the resolutions adopted during its course. PZU has a stable majority shareholder structure, and a large portion of the minority shareholder structure attends every shareholder meeting.

Furthermore, the following rules are not applicable to PZU:

- rule I.Z.1.10, providing for posting financial projections on the corporate website, insofar as the company has decided to publish them, published for at least the last 5 years, including information about their execution because, as at the date of publication of this report, PZU has not published any financial projections or estimates;

- rule III.Z.6., concerning cases of non-separation of the internal audit function within the company’s organizational structure, because this function has been separated in PZU’s organizational structure,

- recommendation IV.R.3., concerning situations where securities issued by a company are traded in different countries (or in different markets) and in different legal systems, because PZU securities are traded only on the Polish market.

Detailed information on the status of PZU’s application of the recommendations and rules laid down in the Best Practices of WSE Listed Companies 2016 is available on the Company’s website in the Investor Relations section at: www.pzu.pl/en/investor-relations/about-the-group/corporate-governance.

PZU constantly monitors the degree and manner of compliance with the recommendations and principles laid down in the Best Practices of WSE Listed Companies 2016 and, if necessary, takes steps on an as-needed basis to ensure compliance with the Best Practices to the fullest extent and in an unquestionable manner. In particular:

- On its website, the Company publishes, in two language versions, all information and documents referred to in rule I.Z.1. The scope and accessibility of information posted on the website are monitored on an ongoing basis, and in the event of detecting any technical problems posing an impediment to documents, efforts are promptly taken to reinstate the website’s full functionality.

- The Company regularly contacts investors and analysts, enabling them to ask questions and obtain clarification on matters of interest to them, in consideration of the prohibitions arising from the applicable laws. Such contacts take place either using modern electronic communication channels or take the form of direct meetings or telephone conversations.

- Members of the PZU Management Board and Supervisory Board strive to apply the recommendations and rules applicable to them to the fullest possible extent:

- the Company’s website presents an internal allocation of responsibilities across all business areas among the Management Board Members,

- in 2020, discharging the function in the PZU Management Board was the main area of professional activity for the PZU Management Board Members,

- Members of the PZU Supervisory Board put in the time necessary to perform their duties,

- the required number of Supervisory Board Members fulfills the independence criteria set forth in rule II.Z.4., --the Supervisory Board prepared and presented to the Ordinary Shareholder Meeting its assessments and reports provided for in rule II.Z.10.;

- PZU’s organizational structure is commensurate with the scale and nature of its business; separate business units have been established in the Company to perform tasks in the systems and functions set forth in rule III.Z.1., and the efficiency of such systems and functions is properly monitored and evaluated;

- PZU makes every effort to ensure that the Company’s Shareholder Meetings are held in compliance with the requirements set forth in Chapter IV of the Best Practices of WSE Listed Companies, except for recommendation IV.R.2 (as previously described);

- PZU has internal regulations in place that guarantee compliance with the recommendations and rules contained in Chapter V of the Best Practices of WSE Listed Companies regarding conflicts of interest and transactions with related parties.

- PZU adheres to the recommendations and rules of the Best Practices of WSE Listed Companies in the employee compensation area; information on the employee compensation policy, including the elements specified in rule VI.Z.4., is presented in the PZU Management Board’s activity report for the respective year.