Climate change

„We are a leader in the Polish economy. That means we bear a special responsibility. We should care about the natural environment and mitigate the adverse consequences of climate change. And through our management approach and business activity we should support the state which is keen on the appropriate type of prevention”

„We are a leader in the Polish economy. That means we bear a special responsibility. We should care about the natural environment and mitigate the adverse consequences of climate change. And through our management approach and business activity we should support the state which is keen on the appropriate type of prevention”Climate change currently poses one of the biggest global challenges to sustainable development. In January 2021, in its “Global Risks Report”1 the World Economic Forum warned that as many as five out of ten key risks in terms of impact and four out of ten key risks in terms of the probability of materialization were related to environmental factors. Back in 2012, a similar list contained only one environmental risk.

The PZU Group is fully aware of the fact that the need to prevent climate change and adapt to the new conditions requires coordinated efforts by decision-makers, businesses and the financial sector. It actively participates in initiatives pursued in its industry, gets involved in public consultation processes and shares its opinions on draft legislation related to climate protection. The risks related to climate change, both physical ones and those related to transformation, will require an increasingly more consistent and comprehensive inclusion in the management of the PZU Group, because their impact on financial performance will become more and more substantial.

According to the IPCC2 a further increase in greenhouse gas emissions, unless historical trends are halted, would lead to an increase in global temperature by 1.5 degrees Celsius in 2030-2052, which would trigger permanent changes in all elements of the climate system and irreversible consequences for humans and ecosystems. The need to take urgent steps to limit climate change was upheld in the Paris Agreement3 signed in 2015, which provided for a global action plan to put a cap on global warming to below 2°C.

Meanwhile, the scale of catastrophic events in Europe is on the rise. According to data published by Klimada4, the total value of losses caused by strong winds and floods is much greater than the value of losses caused by earthquakes. Globally, this trend has been confirmed by the observations recorded by reinsurers – their analyses reflect a growing trend in both the frequency of natural disasters and the value of damage caused by them.

It is expected5 at the adverse consequences of climate change for Poland will be chiefly manifested by floods, torrential rains, landslides and droughts. Also expected is a greater frequency of regionally occurring strong winds. From the perspective of national-level events, floods are the most severe events due to material losses they cause.

As a member of the Polish Insurance Association (PIU), the PZU Group is involved in analyzing the impact of climate change on the insurance sector in Poland. The purpose of these analyses is to support the regulatory authority in developing stress test methodologies. In PIU’s opinion, stress tests conducted by the European Insurance and Occupational Pensions Authority (EIOPA) or local regulatory authorities may be a better tool than ORSA in terms of taking into account a forward-looking approach based on standardized scenarios, whereas the respective national authorities should encourage insurers to develop scenarios and facilitate their access to data and sources of valuable information and research results.

As one of the largest financial institutions in Central and Eastern Europe, the PZU Group is aware of the scale of its direct and indirect impact on the economy and the natural environment through the insurance services is offers as well as through its banking and investment activities.

The PZU Group’s environmental standard “Green PZU” developed in 2018 defines the key assumptions pertaining to its governance approach to environmental issues. It takes into account, among other aspects, a high level of environmental protection, principles of sustainable development, inclusion of environmental protection elements into business policy and strategy, and partnerships of the Group’s members in joint environmental protection initiatives. The PZU Group’s activities are aimed at curtailing adverse environmental impact by reducing the amount of pollutants and the depletion of natural resources. The PZU Group is a partner of green transformation of the Polish economy by offering financial products to enterprises that use low-emission energy sources. By virtue of the scope and boundaries of its business, the Group strives to support clients at every stage of development and transformation towards low-emission operations. A comprehensive approach to the management of climate impact will be formulated in parallel with the Sustainable Development Strategy (ESG).

The PZU Group’s highest priority is to respond to the current needs of the Polish market and economy in accordance with EU and domestic regulations, including Poland’s Energy Policy until 2040, the National Reconstruction Plan containing reforms in pursuit of climate-neutral and circular transformation (currently undergoing the public consultations process), and the National Energy and Climate Plan 2021-2030, which has been submitted to the European Commission for further consultations.

Responding to the evolving guidelines concerning reporting and growing requirements and expectations of stakeholders in terms of transparent information policy addressing preparation for climate change, this report contains information regarding direct and indirect environmental impact. In accordance with EU guidelines pertaining to non-financial reporting and the Supplement concerning the reporting of climate-related information (2019/C 209/01), the disclosures in this report meet the double materiality perspective, namely, it contains information regarding the climate’s impact on the PZU Group’s business and the Group’s impact on the climate. In particular, in accordance with the general and additional guidelines for financial institutions, this report provides a detailed description of climate-related risks, processes enabling their identification and management, and an analysis of the impact of these risks under two scenarios.

The need to take urgent action to curb climate change was highlighted in the Paris Agreement of 20156 and in the United Nations agenda adopted in the same year, setting sustainable development goals (SDGs)7. In recent years, the European Union has been taking comprehensive steps to encourage a low-carbon economy and sustainable development, for instance by implementing the European Green Deal8 intended to ensure achievement of climate neutrality in EU countries by 2050. Moreover, in 2019, the European Commission published Guidelines on non-financial reporting, providing for the disclosure of detailed climate-related data. The Financial Stability Board has set up the Task Force on Climate-related Financial Disclosures (TCFD) the activities of which include the provision of incentives to financial institutions and enterprises to disclose information on climate-related risks and opportunities.

The PZU Group is aware of the role it may play in mitigating the carbon footprint but also in the effective management of new risk factors that directly affect its financial performance. By taking proper action, the Group seeks to align its business with current trends in this area, including:

- shaping and offering products that contribute to slowing down climate change and those that increase resilience and facilitate adaptation to climate change;

- taking climate change into account in the risk measurement and assessment process;

- disclosure of data related to climate impact and measures taken to adapt to climate change.

In the coming years, the PZU Group intends to continue the development of its strategic approach, policies and practices in the area of indirect environmental impact, in line with sectoral trends and in consideration of the specificity of the Polish economy.

Defining risk factors is the first step towards managing them effectively. This process is accompanied by the following activities:

- assessment of their impact on business and assessment of materiality;

- identification of potential action scenarios;

- development of response plans;

- roll-out of regular monitoring.

The European Commission’s Guidelines on non-financial reporting, providing for the disclosure of detailed climate-related data and TCFD recommendations classify the risks related to the climate’s adverse impact on businesses as physical risks and transition risks. Physical risk is a risk for a business stemming from the physical consequences of climate change and encompasses acute (e.g. storms, fires) and long-term risk (rising sea level). Transition risk is the risk related to the economy’s transition to a low emission economy resistant to climate change and encompasses risk related to policy and legal, technological, market and reputational risks.

A similar approach was proposed in April 20199 by The Network of Central Banks and Supervisors for Greening the Financial System (NGFS), an organization bringing together central banks and regulatory authorities. Based on the conviction that climate-related threats are a source of financial risks and that it is the duty of central banks and regulatory authorities to ensure the financial system’s resilience to such threats, six recommendations were formulated for central banks, regulators, decision-makers and financial institutions to ramp up their role in “greening” the financial system and managing the environment and climate risks.

In the PZU Group’s opinion, the probability that the risk related to the global economy transformation will materialize is much higher, especially in the short and medium term, than the probability that the most extreme physical risk related to the climate change will materialize. The Group takes measures aimed to limit the probability that the transition-related risk will materialize through investments for low-carbon economy. On the other hand, the materialization of the most extreme physical risk (e.g. in the RCP 8.5 ICPP scenario) would constitute a threat to the entire insurance sector. The effects of escalating climate changes might contribute to the materialization of risks for which insurance may become unaffordable.

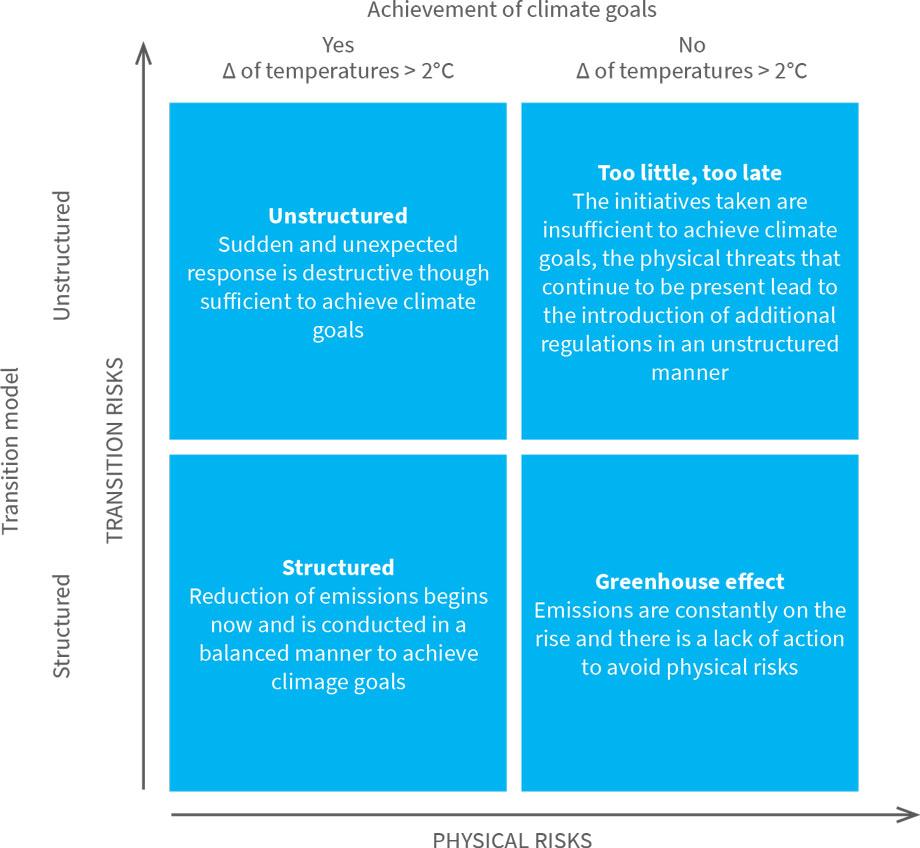

Among the new tools that are consistent with TCFD recommendations and the European Commission’s Guidelines is scenario analysis. This kind of analysis is based on hypothetical models of temperature changes, enabling assessment of a company’s operations depending on the changing climate and resilience of its business model. The need for the conduct of analyses related to climate change by insurance undertakings was also highlighted in an EIOPA consultation document10. The scenario structure proposed by the NGFS was adopted as the starting point for the analyzes conducted by the PZU Group. The scenarios are structured according to the degree of attainment of the climate goals and the transition pattern. In turn, in its document, EIOPA assigned two long-term scenarios of temperature increase (above and below 2 degrees Celsius) to the four global pictures defined by the NGFS.

Structure of scenarios

Source: A call for action; Climate change as a source of financial risk (April 2019)

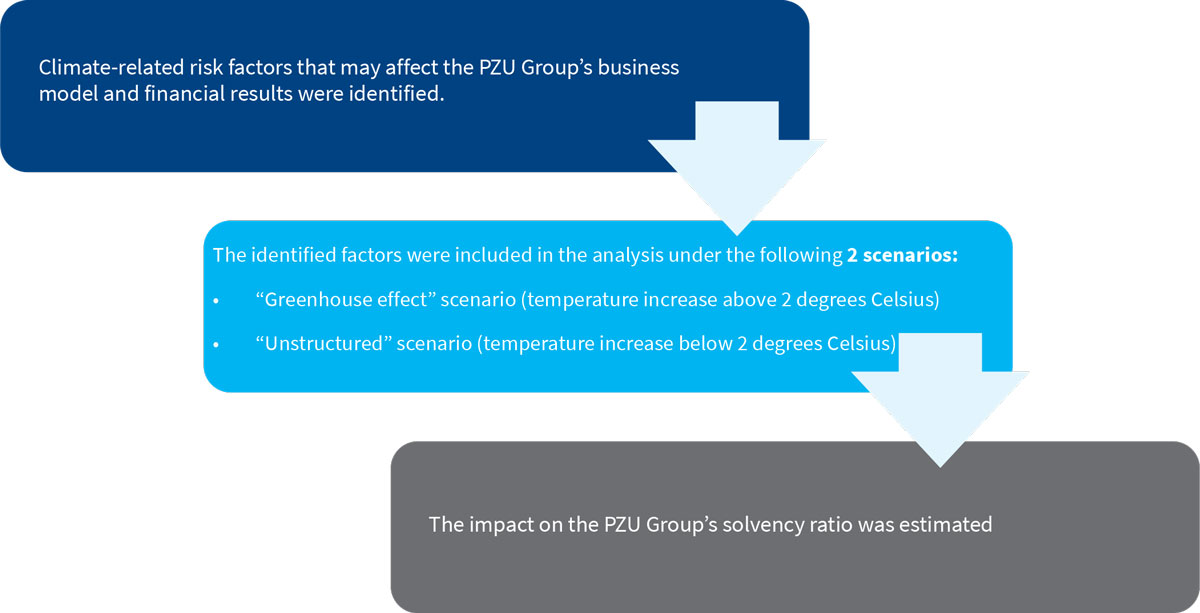

Climate-related risk factors analysis

Source: A call for action; Climate change as a source of financial risk (April 2019)

The PZU Group conducts regular stress tests and sensitivity analyses under its annual analysis of own risk and solvency assessment (ORSA) and stress tests consistent with the requirements of the regulatory authority. In particular, risks related to climate change are analyzed in terms of physical consequences risks and transition consequences. This process facilitates risk analysis in the medium-term and identification and assessment of emerging risks.

As a result, climate-related risk factors that may affect the PZU Group’s business model and financial results were identified. They may be broken down into risk factors resulting from transition and physical risk factors of climate change.

The factors were included in the analysis under two scenarios for which the starting point is the structure of NGFS concepts. The PZU Group examined the “greenhouse effect” scenario and the “unstructured” scenario. According to the outcome of the analysis, the impact on the PZU Group’s solvency ratio would be greater if the “greenhouse effect” scenario materialized. However, the anticipated impact of the scenario is long-term in nature.

In compliance with the Regulation of the European Parliament and of the Council on sustainability-related disclosures in the financial services sector, PZU Życie has prepared disclosures from which it results that both PZU Życie and the PZU Group are considering the deployment, at some point in the future, of an in-depth assessment of the impact of risks to sustainable development on the organization’s activities, and are considering the inclusion, in their analysis, of additional risks related directly to ESG elements, including the climate, with a view to further improving their risk assessment process and investment decision-making process. Having regard for the rising materiality of sustainable development and climate change and their significance to the financial industry, the PZU Group intends to adopt a sustainable development strategy that takes into account ESG risks.

1 http://www3.weforum.org/docs/WEF_The_Global_Risks_Report_2021.pdf

2 https://www.ipcc.ch/ Intergovernmental Panel on Climate Change, an intergovernmental organization operating under the auspices of the United Nations to support climate science-related activities in various countries

3 Paris Agreement, United Nations, 20015. The Agreement provided for a global action plan to put a cap on global warming to below 2 degrees Celsius

4 http://klimada.mos.gov.pl/adaptacja-do-zmian-klimatu/globalne-procesy/

5 Resolution of 13 December 2011 on the adoption of the 2030 National Zoning Concept, Official Journal of the Republic of Poland (Monitor Polski) of 2011 No. 137, item 252

6 Agreement, United Nations, 2015. The Agreement provided for a global action plan to put a cap on global warming to below 2 degrees Celsius

7 Transforming our world, The 2030 Agenda for sustainable development, A/ RES/70/1, United Nations

8 U. von der Leyen, A Union that strives for more. My agenda for Europe. Political guidelines for the next European Commission 2019–2024, https://ec.europa.eu/ clima/policies/strategies/2050_en

9 A call for action; Climate change as a source of financial risk, April 2019

10 Consultation on the draft Opinion on the supervision of the use of climate change risk scenarios in ORSA (https://www.eiopa.europa.eu/content/ consultation-draft-opinion-supervision-use-climate-change-risk-scenarios-orsa)