Business in the face of climate change

The PZU Group is aware that insurance services, banking and investment activity are areas in which decisions of individual companies may influence client behaviors and, as a consequence, also their attitude towards the natural environment. In respect of large clients, such as industrial plants, engineering underwriting is performed to enable the insurer to calculate the premiums. A detailed outcome of the underwriting exercise along with full risk assessment and scenarios are presented to the client. The underwriting covers business risks, which are often combined with environmental risks. For this reason, the actions taken by the client to eliminate or reduce certain elements of its risks, even if induced solely by an attempt to suppress insurance costs, contribute to diminishing the risks to the environment or humans.

PZU is a signatory of the United Nations Environment Programme Finance Initiative established between the United Nations Environment Programme and the financial sector.

The PZU Group participates in the dialog on sustainable development and sustainable finance. A PZU representative chairs the Task Force on Sustainable Finance at the Polish Insurance Association. PZU also participates in the work of the Financial Market Development Council for Sustainable Finance.

Climate change risk management in the PZU Group

The PZU Group keeps monitoring the activities and initiatives undertaken by financial institutions and international organizations. Among them are the United Nations (UN), the Organization for Economic Cooperation and Development (OECD) and the European Commission.

A key initiative for European insurers is the climate agreement entered into by 195 countries in Paris in 2015. Its provisions include the disclosure and management of risks related to climate change in the financial sector, including recommendations issued by the Task Force on Climate-Related Financial Disclosures (TCFD). In turn, a document of major significance from the perspective of efforts aimed at reducing natural disasters is the “Action Plan on the Sendai Framework for Disaster Risk Reduction 2015-2030 – A disaster risk-informed approach for all EU policies”.

Regulations requiring that climate change risk be taken into account in the business of financial institutions, including insurance companies, have also been issued by the European Commission. It is expected that the financial sector will provide increasing support to real sectors of the economy, especially power generation, transport and industry, in reducing climate change caused by greenhouse gas emissions.

In Poland, the potential impact of climate change in the coming decades will result from a combination of the following two factors:

- exposure to climate risks of a physical nature. According to scientific research, floods and cyclones are the most serious risk factors in Poland. In recent years, the risk of heat waves has also emerged. Climate change affects the frequency and scale of potential catastrophic events that may exert a significant impact on the capital position in the insurance sector;

- sensitivity of the country to changes and events related to the climate and resulting from such factors as population density in high flood risk areas, transport infrastructure quality, water management and funds earmarked in the state budget for unexpected expenditures.

These two factors, combined with the country’s adaptability, including those of the public sector (central and local governments), companies and citizens, the health condition and the place of residence, will define the resilience of both the country and the PZU Group’s clients to climate change.

The PZU Group takes a number of initiatives to boost the resilience of both country and its clients to climate change. This is done by:

- improving the recognition of exposures to climate risks of a physical nature;

- supporting the enhancement of adaptability and social awareness.

BEST PRACTICE

Weather alerts, i.e. text messages with information about extreme weather conditions (such as gales, tornadoes, torrential rains, storms, snow storms), which LINK4 sends to clients who have real property insurance or motor insurance, are very popular among clients. In the event of expected sudden and severe weather phenomena clients receive a text message containing a warning and a website link where they can read about how to protect themselves against the adverse consequences of various weather events. In 2019 LINK4’s clients received over 425 thousand such alerts.

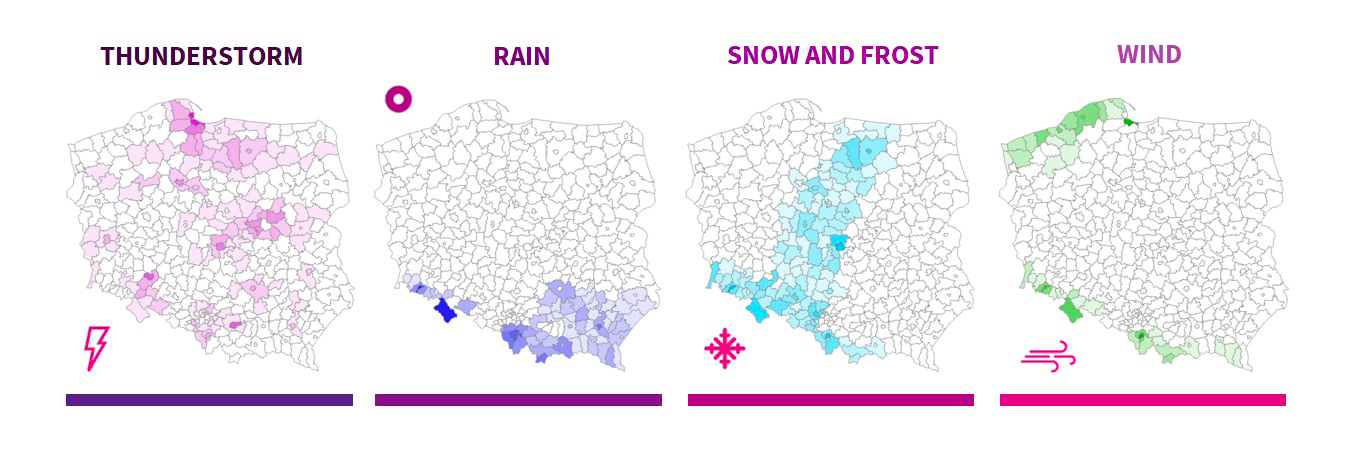

Areas to which alerts were most frequently directed in 2019 broken down by weather phenomena

Remote sensing in agricultural claims handling

Remote sensing is a type of testing performed from a certain distance (remotely) using special sensors. Remote sensing tests may be conducted from airplanes, space vehicles or the Earth’s surface. In 2019, a remote sensing method was tested for determining the date of harvest of insured crops. The test results were so promising that in 2020 PZU is scheduled to sign a contract with a new remote sensing data provider to obtain satellite images covering all of Poland. The remote sensing method was applied in the risk assessment process before executing the crop insurance agreement.

PZU manages its indirect impact on the natural environment through the insurance products it offers

| Counteracting climate risks | Examples of actions taken by the PZU Group |

| Reducing greenhouse gas emissions |

|

| Adaptation: better understanding of risk factors |

|

| Adaptation: customizing the product offer to the risk factors |

|

| Adaptation: innovations to protect the future |

|

The PZU Group’s insurance business is aimed at offering insurance products tailored to the needs of both individual and corporate clients in various sectors of the economy. The Group’s highest priority is to properly respond to the current needs of the Polish market and economy in accordance with national and EU regulations (including those safeguarding the principles of fair competition and permitting cooperation only with those business clients whose activity, according to PZU’s knowledge, complies with the applicable laws). The complexity of needs and, consequently, of the offering has led PZU do provide insurance cover also to entities operating in the mining and power sectors. Besides traditional operations based on coal, clients from this group also develop their activities in the area of renewable energy sources. The PZU Group plans further development of policy and practices in the area of indirect environmental impact, abiding by sectoral trends and the specificity of Polish economy.

Environmental guarantee

The PZU environmental guarantee offers support to businesses, both natural and legal persons. The guarantee is a commitment to pay a specified compensation if the company to which the guarantee has been granted fails to remove adverse environmental effects of its business operations. The beneficiary of this guarantee is the environmental protection authority issuing the relevant administrative instrument giving a permit to use natural resources, e.g. the marshal, provincial governor (voivod) or county governor (starost).

The guarantee offers a form of protection to companies whose activities may have an adverse impact on the environment, e.g.:

- chemical plants;

- companies dealing in trans-border movement of waste;

- municipal services plants.

“PZU – Thinking about safety!” Thinking about the natural environment!

PZU, as the largest insurance company in Poland, has initiated a new solution that is bound to improve road safety and exert a favorable impact on the natural environment. Old, worn-out or damaged car parts which should no longer be installed in vehicles pose a genuine threat to the environment if disposed of improperly. To prevent this, with the help of its partners, PZU collects damage remains resulting from motor accidents suffered by the Group’s clients. Thereby, PZU contributes to the proper disposal of approximately 4 million parts annually. This action is aimed at reducing greenhouse gas emissions resulting from overproduction and preventing damage remains that pose a threat to human health or the environment from being recycled and installed in other vehicles as second-hand replacement parts.

TFI PZU applies the best corporate governance practices resulting in responsible investment dictions

Every investment decision made by TFI PZU is preceded by a process based on an analysis of companies perceived as potential investment targets. In addition to an evaluation of the financial standing of companies and prospects for an increase in their value, every decision is also based on an assessment of investment risk, including in terms of corporate governance principles applied by such companies as part of the socially responsible investing process. This approach enables TFI PZU to develop an in-depth and detailed understanding of the target company’s situation, which translates into fully awareness-based and responsible investment decisions.

In their work, members of the TFI PZU team:

- are guided by stringent ethical standards when making investment decisions;

- stimulate the use of corporate governance principles, in particular those that advance transparency, equal treatment of shareholders, independent oversight and the responsibility of shareholders and members of management and supervisory bodies in target companies;

- expect companies whose shares are included or considered for inclusion in their mutual fund portfolios or investment portfolios to apply corporate governance principles broadly accepted on the market, especially those contained in good practices of WSE-listed companies, which seek to strengthen the transparency of listed companies, increase the quality of their communication with investors and enhance the protection of shareholder rights, also in matters not governed by the law.

TFI PZU, bearing in mind the interests of participants in the mutual funds managed by it and clients to whom it provides portfolio management services, is guided by its “Strategy for exercising voting rights”. The basic obligation of the Management Company arising from this strategy is to monitor significant events occurring in the companies mentioned in the strategy, ensuring that the voting rights are exercised in accordance with the investment objectives and investment policy of the respective fund and preventing conflicts of interest that may arise from the exercise and administration of voting rights. The Management Company actively participates in the corporate governance development process in its portfolio companies by participating in their shareholder meetings and pursuing the goal of protection and creation of investment value for fund participants and its clients. Bearing in mind the remaining provisions of the strategy, TFI PZU attempts to adhere to the rule of participation in all shareholder meetings of companies in which it has, on behalf of its funds or clients, the right to exercise more than 5% of the total number of votes.

TFI PZU has adopted a set of principles that guide its choices when voting at shareholder meetings of companies included in its mutual fund portfolios or investment portfolios. These principles include environmental issues, corporate social responsibility and corporate governance in the decision-making process. For instance, they provide for active voting on matters related to social and environmental issues as well as corporate governance issues, among others. Additionally, they include provisions encouraging stringent corporate governance standards, in particular those that advance transparency, equal treatment of shareholders, independent oversight and the responsibility of shareholders and members of corporate authorities.

Since 2006, an additional document has been in force in TFI PZU, entitled “Code of Good Practices of Institutional Investors”, prepared and approved by the Chamber of Fund and Asset Management. For TFI PZU, the Code provides a great deal of support in defining the rules, moral and ethical standards and due diligence levels in the company’s relationships with other institutional investors, clients and issuers of financial instruments. The adoption of the Code by TFI PZU is also a manifestation of the application of good investment practices by the company.

On 22 December 2014, the Management Board of TFI PZU adopted a resolution to adopt the “Corporate governance rules for regulated institutions” issued by the Polish Financial Supervision Authority (KNF) in which the Management Board declared its readiness and will to abide by these rules to an objectively broadest possible extent, taking into account the principle of proportionality resulting from the scale, nature of business and specific characteristics of TFI PZU. The rules are a collection of standards that define the internal and external relations of regulated institutions, including their relations with shareholders and customers, their organization, the functioning of internal oversight and key internal systems and functions as well as the governing bodies and the rules for their cooperation. According to the contents of this document, TFI PZU provides on its website information on the application or non-application of specific principles addressed to the company’s Management Board and Supervisory Board.

TFI PZU employs managers holding the CFA designation who are bound by a code of ethics and standards of professional conduct. In their professional contacts with the public, clients, prospective clients, employers, employees, colleagues in the investment profession, and other participants in the global capital markets, members of the CFA Institute act with integrity, competence, diligence, respect and in an ethical manner, promote the integrity and viability of the global capital markets for the ultimate benefit of society.

TFI PZU also employs investment advisers who are guided in their work by the standards laid down in the Professional Ethics Principles for Brokers and Advisers. Ordinary members of the Association of Brokers and Advisers undertake to act in accordance with the law and the principles of fair trading, heed the interests of their clients, act honestly and behave in a dignified, trustworthy, ethical and professional manner in their professional dealings, especially with clients, employers, colleagues and other brokers and advisers.

TFI PZU will strengthen the management of an indirect environmental impact.

By the end of May 2020, TFI PZU is expected to align its operations with the requirements of the Act of 16 October 2019 amending the Act on Public Offerings and the Conditions for Offering Financial Instruments in an Organized Trading System and on Public Companies and certain other acts. To this end, any fund management company that invests assets in shares of companies admitted to trading on a regulated market is required develop and publish an engagement policy to describe how the engagement of the shareholders of such companies is taken into account by such companies in their investment strategies. The policy will define the methods of monitoring companies, in particular in terms of strategy, performance, financial and non-financial risks, capital structure, social and environmental impact and corporate governance ESG aspects).