Contribution made by the market segments to the consolidated result

The following industry segments were identified in order to facilitate management of the PZU Group:

- corporate insurance (non-life insurance) – a broad scope of property insurance products, liability and motor insurance customized to a client’s needs entailing individual underwriting offered by PZU and TUW PZUW;

- mass insurance (non-life insurance) – property, accident, TPL and motor insurance products offered to individual clients and entities in the small and medium enterprise sector by PZU and LINK4;

- life insurance: group and individually continued insurance – protection, investment (which are not investment contracts) and health insurance; PZU Życie offers it to employee groups and other formal groups, e.g. to trade unions, and persons under a legal relationship with the policyholder (e.g. employer or trade union) enroll in the insurance agreement; individually continued insurance covers persons who acquired the right to individual continuation during the group phase;

- individual life insurance: protection, investment (which are not investment contracts) and health insurance; PZU Życie provides it to individual clients and the insurance agreement applies to a specific insured who is subject to individual underwriting;

- investments – the segment reporting according to the Polish Accounting Standards comprises investments of the PZU Group’s own funds, understood as the surplus of investments over technical provisions in PZU, LINK4 and PZU Życie plus the surplus of income earned over the risk-free rate on investments reflecting the value of technical provisions in insurance products, i.e. surplus of investment income over the income allocated at transfer prices to insurance segments; the segment includes also income from other free funds in the PZU Group, including consolidated mutual funds;

- pension insurance – the segment includes income and expenses of PZU OFE pension funds;

- banking – a broad range of banking products offered to corporate and retail clients by Pekao and Alior Bank;

- Baltic States – non-life insurance and life insurance products provided in the territories of Lithuania, Latvia and Estonia;

- Ukraine – non-life insurance and life insurance products provided in the territory of Ukraine;

- investment contracts – include PZU Życie products that do not transfer material insurance risk and do not satisfy the definition of insurance contract; these are some of the products with a guaranteed rate of return and in unit-linked form;

- other – consolidated companies that are not classified in any of the enumerated segments.

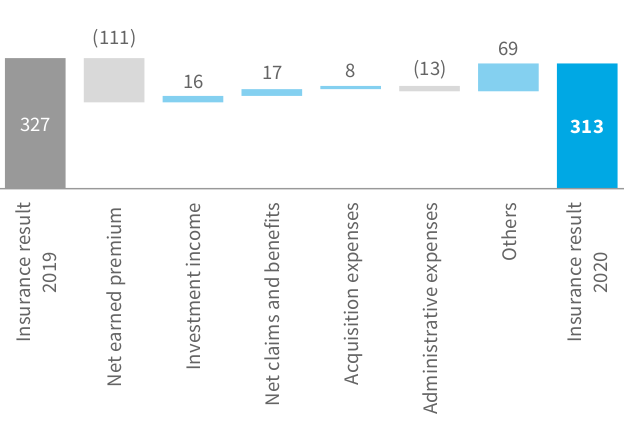

Corporate insurance

The operating result in the corporate insurance segment in 2020 was PLN 313 million, meaning it was down by 4.3% compared to 2019.

The result was affected mainly by:

- net earned premium lower by PLN 111 million (-4.5% y/y) combined with a decrease in gross written premium by PLN 290 million (-8.7% y/y) relative to 2019. The growth rate of the gross written premium was determined by:

- lower written premium on motor insurance (-18.0% y/y) offered to both lease firms and in fleet insurance; was primarily a consequence of a lower number of insurance contracts due to slower sales of new vehicles (the drop in the registration of new passenger cars was as much as 23% y/y) and a downturn in the leasing market as well as the decrease in the average premium as a result of the continuing price pressure; the slowdown in the automotive market is first of all the result of the prolonged COVID-19 pandemic and high uncertainty related to its economic effects,

- lower written premium from insurance against fire and other damage to property (-11.4% y/y) as a consequence of the execution of a high-value long-term contract in 2019,

- retention of the general TPL insurance portfolio at a flat level (-0.3% y/y),

- increased sales of assistance products resulting from the development of strategic partnerships in TUW PZUW and a higher premium of casco insurance of aircraft as an effect of concluding several high-value contracts,

- development of the insurance portfolio containing various financial risks, in particular loss of profit insurance;

- drop in the net value of claims and benefits by PLN 17 million (-1.1% y/y), which, combined with the net earned premium lower by 4.5%, resulted in deterioration of the loss ratio by 2.3 p.p., to the level of 67.4%. The increase in the total loss ratio in the corporate insurance segment was driven by the following factors:

- drop in the loss ratio in the motor insurance group resulting from lower frequency of claims but partly offset by the growth in average disbursement (particularly in motor TPL insurance),

- higher loss ratio in the insurance portfolio general TPL and various financial risk insurance, in particular in medical entity insurance;

- income from investments allocated to the segment according to transfer prices increased by PLN 16 million (+16.0% y/y) as a result of the appreciation of the euro against the Polish zloty. At the level of the PZU Group’s overall net result, this effect was partly offset by the increased level of net insurance claims and benefits covered by foreign currency assets;

- decline by PLN 12 million (-2.5% y/y) in acquisition expenses (including reinsurance commissions), which, along with a 4.5% y/y decrease in net earned premium, translated into a deterioration of the acquisition expense ratio by 0.4 p.p. The increase in the acquisition expense ratio was driven chiefly by changes in the portfolio structure, in particular by the higher share of non-motor insurance;

- administrative expenses higher by PLN 13 million (+9.9% y/y), to PLN 144 million, mainly as an effect of higher personnel costs resulting from salary pressure and higher intervention expenses in connection with the COVID-19 pandemic.

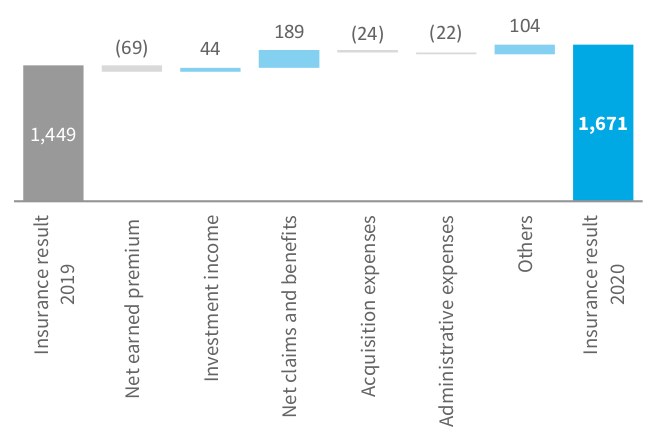

Mass insurance

In 2020, the operating result in the mass insurance segment reached PLN 1,671 million, which is 15.3% more than in the previous year.

This was caused by the following:

-

decrease in net earned premium by PLN 69 million (-0.7% y/y) combined with a decrease in gross written premium by PLN 159 million (-1.5% y/y). The PZU Group posted the following under sales:

-

decrease in gross written premium in motor insurance as the outcome of the lower number of insurance contracts with a simultaneous decline in the average price – slowdown in sales, chiefly in the branches, the Group’s own network and dealership network, was a consequence of their limited availability due to the restrictions imposed in connection with the COVID-19 pandemic. An additional driver was the decrease in the average policy price as a result of the slowdown in the sales of new vehicles and the continuing price pressure,

-

drop in sales of insurance against fire and other damage to property, chiefly in agricultural insurance – it was a result of high competitiveness of the market and the natural erosion of the portfolio in the context of a limited pool of government subsidies; this effect was partly offset by maintaining high growth rate of sales in residential insurance and small and medium-sized enterprise insurance,

-

higher gross written premium in other TPL insurance (+0.7% y/y) and ADD and other insurance (+12.1% y/y), mainly accident insurance – it was a result of the growing sales of insurance offered in cooperation with the Group’s banks for mortgage loans and cash loans and providing insurance cover to physicians and medical personnel against a COVID-19 infection; the effect was partly offset by the decrease in the travel insurance premium in connection with the restrictions on domestic and international traffic imposed during the Covid-19 pandemic;

-

lower net insurance claims and benefits by PLN 189 million (-2.9% y/y), which, when coupled with net earned premium being down 0.7%, translated into the loss ratio improving by 1.4 p.p. relative to 2019. This change was driven mainly by:

-

lower loss ratio in the motor insurance as a consequence of a lower frequency of claims resulting from traffic restrictions in connection with the COVID-19 pandemic and increase in the average disbursement,

-

growth of the loss ratio in non-motor insurance, including against fire and other damage to property, as a result of above-average number of losses caused by atmospheric phenomena, including rainfall and hail (at the turn of Q3 2020);

-

income from investments allocated to the segment according to transfer prices increased by PLN 44 million (+9.1% y/y), to PLN 525 million, primarily as a result of the appreciation of the euro against the Polish zloty. This effect was partly offset at the level of the PZU Group’s overall net result by the increased level of net insurance claims and benefits covered by foreign currency assets;

-

rise in acquisition expenses (including reinsurance commissions) by PLN 27 million (+1.4%), to PLN 2,010 million, which, when coupled with the net earned premium being down 0.7%, caused growth in the acquisition expense ratio by 0.4 p.p. This was driven, among others, by a higher level of direct acquisition expenses resulting from a change in the product mix (lower share of the motor TPL insurance premium carrying lower commission rates);

-

administrative expenses higher by PLN 22 million (+3.4% y/y), to PLN 673 million. It resulted primarily from the growth in personnel costs as an outcome of salary pressure and introduction of aid packages in the sales area due to the COVID-19 pandemic.

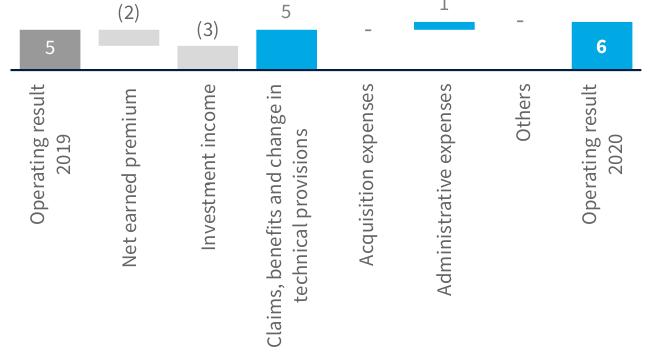

Operating result in the mass insurance segment (in PLN m)

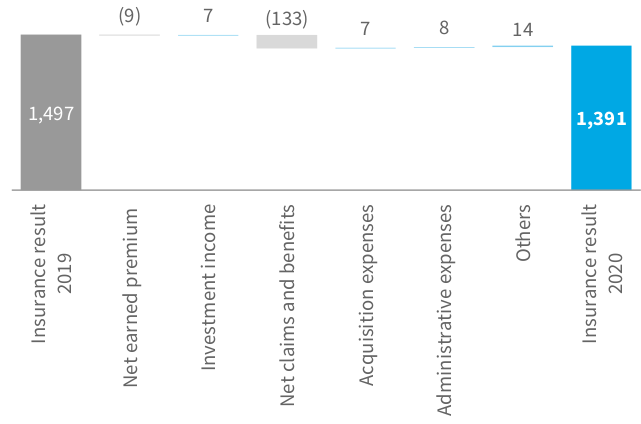

Group and individually continued insurance

In 2020, the operating result in the group and individually continued insurance segment amounted to PLN 1,391 million, which is 7.1% less than in the previous year.

The growth in death-related benefit disbursements in Q4 2020, which was negative for the result, was offset by the increasing portfolio of profitable health contracts.

Factors affecting this segment’s performance and its movements in 2020:

- rise in gross written premium by PLN 41 million (+0.6% y/y) driven by:

- attracting further contracts in group health insurance products or individually continued products (new clients in outpatient insurance and sales of different options of the medicine product) – at the end of 2020, PZU Życie had more than 2.2 million in force contracts of this type,

- up-selling of other insurance riders as part of individually continued products, including in the insurance rider against permanent bodily injury or bone fractures introduced in Q3 2019,

- reduced revenues from group protection products due to the increased attrition of groups of insureds (work establishments),

- increase in the loss ratio control by reducing the pressure on the average premium growth rate in group protection products;

- decrease in the net earned premium by PLN 9 million (-0.1%) in connection with the establishment of the provision for unexpired risk in the amount of PLN 51 million for the purpose of covering the deficit, if any, of future premiums as an effect of higher mortality due to the COVID-19 pandemic;

- income from investment activity higher by PLN 7 million (+1.0% y/y), composed of income allocated according to transfer prices and income from investment products. It was driven by the improved performance of unit-linked products, in particular EPS and reduced income allocated to protection products as a result of a drop in market rates;

- higher insurance claims and benefits along with the movement in other technical provisions by PLN 133 million (+2.6% y/y), to PLN 5,190 million. They resulted in particular from:

- rise in insureds’ and co-insureds’ death benefits in Q4 2020, corresponding, as follows from Statistics Poland’s data, with a higher mortality in the whole population in the period,

- an increase in technical provisions in EPS (a third pillar retirement security product), which was influenced by higher investment performance than in 2019 coupled with a stable level of contributions and a lower level of withdrawals from insurance accounts of unit-linked funds by clients.

Operating result in the group and individually continued insurance segment (in PLN m)

The negative factors were partly offset by:

- lower benefit payments due to critical illnesses and hospitalization as well as related to permanent dismemberment, which resulted from decreased activity of the insured after the introduction of lockdown, as well as postponement of medical treatments due to reduced access to health care during the COVID-19 pandemic,

- slower pace of converting long-term insurance policies into yearly-renewable term business in type P group insurance. As a result, in 2020 provisions were released for PLN 12 million, i.e. PLN 2 million less than in 2019;

- acquisition expenses in the segment of group and individually continued insurance lower by PLN 7 million (-1.8% y/y). This was determined by the lower fees for insurance intermediaries in group protection insurance related to the decreased sales;

- administrative expenses lower by PLN 8 million (-1.3% y/y), among others, due to the restriction of business activities, which resulted from the restrictions introduced due to the pandemic. This effect was partly offset by the increase in costs of remunerations and intervention expenses related to COVID-19.

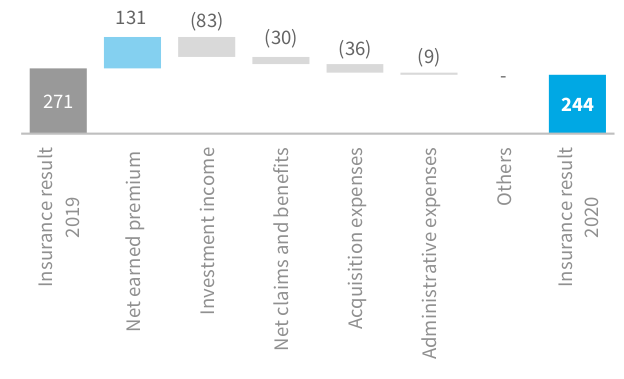

Individual insurance

The operating result in the individual insurance segment in 2020 was PLN 244 million, meaning it was down by PLN 27 million, i.e. 10% year-on-year.

This is an outcome of the further development of protection products in the banking channel and of term products sold in own chain, the decrease in income from investments allocated according to transfer prices, the lower result on expiring portfolio of the annuity product and the decrease in acquisition expenses for unit-linked products.

Factors affecting this segment’s performance and its movements in 2020:

- gross written premium higher by PLN 131 million (+8.3% y/y), to PLN 1,712 million as a result of:

- increase in the portfolio of protection products in the bancassurance channel, in particular sold in cooperation with Alior Bank, where the second product was introduced to the offering in June 2020 – individual insurance for mortgage loans,

- growth in premium generated in investment insurance in the bancassurance channel, on products offered in collaboration with Alior Bank and other banks alike,

- constantly rising level of premiums in the case of protection products in endowments and term insurance offered in own channels – the level of sales and premium indexation under the agreements in the portfolio exceeds the value of lapses;

- income from investment activity lower by PLN 83 million (-15.1% y/y), composed of income allocated according to transfer prices and income from investment products. This was predominantly a consequence of the poorer performance of investment products caused by the downturn in the financial markets in connection with the COVID-19 pandemic. At the same time income from investment products does not affect the result of the individual insurance segment because it is offset by the movement in the technical provisions. Income allocated in protection products fell slightly as a consequence of the market interest rate drop;

- higher insurance claims and benefits along with the movement in other technical provisions by PLN 30 million (+1.8% y/y). Some of the causes were the development of the protection business in cooperation with banks, where in connection with single premiums there are high initial costs of establishment of provisions, as well as the lower decrease in provisions in annuity products relative to the previous year. The higher increase in technical provisions in investment products compared to the previous year was brought about by higher contributions to the unit-linked accounts. From the point of view of the operating result, the latter factor was not of significance – it was offset by a higher level of gross written premium. What partly compensated for the above effects was a decrease in provisions in the structured product, whose sale was suspended at the end of 2019;

- acquisition expenses higher by PLN 36 million (+25.9% y/y), to PLN 175 million. The increase in fees paid to intermediaries for sales of protection products mainly in the bancassurance channel and the additional expenses incurred on sales support in the Group’s own network were partly offset by the lower commissions on sales of unit-linked products in the bancassurance channel;

- administrative expenses higher by PLN 9 million (+12.5% y/y). This is an effect above all of the growing personnel costs and costs related to the aid package for the sales area introduced due to the COVID-19 pandemic.

Operating result in the individual insurance segment (in PLN m)

Investments

The operating income of the investment segment (based exclusively on external transactions) in 2020 was lower by PLN 10 million (-3.0% y/y) than in the last year, primarily due to the greater volatility on the markets due to the COVID-19 pandemic.

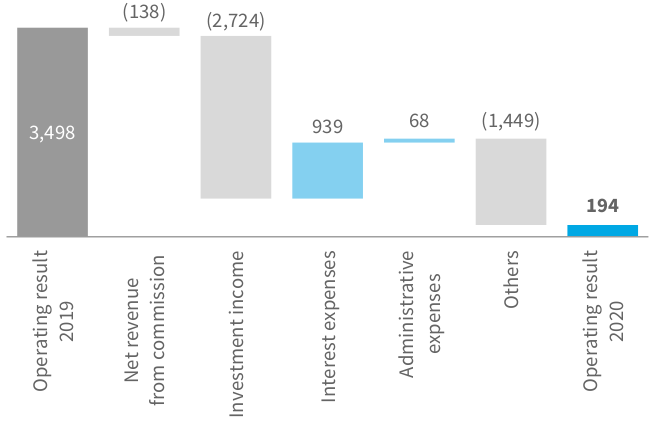

Banking segment / banking activity

The operating profit in the banking segment (without amortization of intangible assets acquired as part of the bank acquisition transactions), composed of the Bank Pekao and Alior Bank groups, amounted to PLN 194 million in 2020 and was lower by PLN 3,304 million, i.e. 94.5%, than in 2019.

The decisive impact on the result was exerted by the COVID-19 pandemic. It considerably increased the costs of risk, the consequence of which was establishment of additional loan provisions for the forecast deterioration in the loan portfolio quality. The interest rate cuts (by approx. 140 bps in total) in 2020 also contributed to the decline in net interest income generated by the banks.

Bank Pekao’s contribution to PZU Group’s operating profit in the banking segment (net of the amortization of intangible assets acquired as part of the acquisition transaction) was PLN 1,725 million, while Alior Bank’s contribution was negative: PLN (228) million. The segment’s performance was affected by Alior Bank’s goodwill impairment of PLN 746 million and Bank Pekao’s goodwill impairment of PLN 555 million.

Investment income, being the key component of the banking segment’s revenue, decreased to PLN 6,248 million (-30.4% y/y). It consists of interest and dividend income, trading result and result on impairment losses. The decline in investment income was primarily due to the lower net interest income and the higher costs of risk stemming from the establishment of additional loan provisions for the anticipated deterioration in the quality of the loan portfolio and of provisions for legal risk related to the portfolio of foreign currency mortgage loans in Swiss francs in Bank Pekao.

The total portfolio of loan receivables in both banks increased by PLN 2.1 billion (+1.1% y/y) in 2020 compared to 2019.

The value of allowances for expected credit losses and for impairment of financial instruments in Bank Pekao amounted to PLN 1,581 million, of which PLN 830 million was estimated as the result of the COVID-19 pandemic.

In Alior Bank, the value of credit allowances amounted to PLN 1,736 million, including PLN 418 million related to COVID-19, of which PLN 270 million was related to changes in model parameters and PLN 149 million was related to allowances.

Alior Bank’s net interest income was driven down also by the impact of the CJEU judgment on the refund of part of the commission in the event of an early repayment of consumer loans. The impact of the judgment was estimated at PLN 344 million, of which PLN 210 million involved current returns charged to net interest income, while PLN 134 million was an additional provision for loans repaid before 11 September 2019, charged to other operating expenses.

Despite the COVID-19 pandemic, loan product receivables grew in both banks – by 1.2% compared to 2019. The increase in loans for individual clients, in particular mortgage loans, was successfully maintained. The sales of loans to business clients dropped, which resulted, among others, from their withholding investments and public support for enterprises in connection with the COVID-19 pandemic, which reduced the demand for bank loans.

The profitability measured by the net interest margin was 2.45% for Bank Pekao and was lower by 42 bps relative to 2019, while 3.91% for Alior Bank, i.e. 61 bps less than the year before. The difference in the net interest margin level between Bank Pekao and Alior Bank results in particular from the structure of the loan receivables portfolio. Interest margin decreased in both banks due to the interest rate cuts that took place in March, April and May and the quicker increase in deposits than in loans.

The net fee and commission income in the banking segment dropped by 4.4% relative to the previous year – to PLN 3,008 million. The main cause of the lower commission income was the lower activity of the clients during the pandemic and higher cards related commission costs, who used bank cards, loans or mutual funds less frequently.

The segment’s administrative expenses dropped to PLN 4,782 million, so they were lower by 1.4% than in 2019. In the case of Bank Pekao they amounted to PLN 3,273 million and of Alior Bank – PLN 1,509 million. The decrease resulted, among others, from maintenance of a strong cost discipline by Bank Pekao despite expenses on investments in operating transformation and digitization, additional costs incurred in connection with the COVID-19 pandemic and dissolution of a part of the provision for deferred remuneration components in Alior Bank.

In addition, other contributors to the operating result included other operating income and expenses, above all the Bank Guarantee Fund fees (PLN 541 million) and the levy on other financial institutions (PLN 881 million). Alior Bank’s result was decreased additionally by: goodwill impairment as a result of the acquisition of Meritum Bank ICB SA in the amount of PLN 104 million and redemption of non-financial assets related to the T-Mobile Banking Services project being closed in the amount of PLN 48 million.

The Cost/Income ratio was 43% for both banks (43% for Bank Pekao and 44% for Alior Bank), i.e. 2.4 p.p. more than the year before, which resulted from lower income, including net interest income in connection with interest rate cuts in Q2 2020.

Operating result in the banking segment (in PLN m)

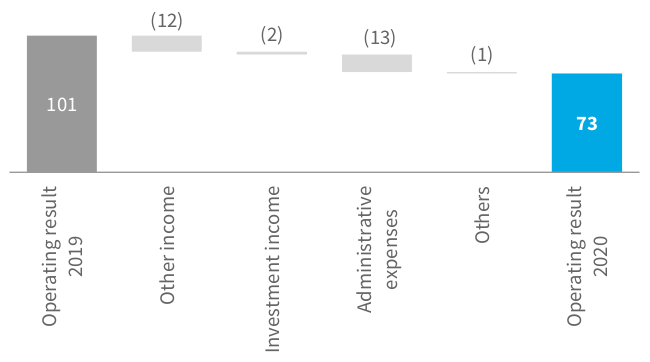

Pension insurance

The operating profit in the pension insurance segment amounted to PLN 73 million in 2020, i.e. 27.7% less than in 2019.

Factors affecting the operating result and its movement:

- other revenue lower by PLN 12 million (8.5% y/y), to PLN 130 million. It was an effect of the lack of revenue from the reserve account and of the lower revenue from management fee;

- administrative expenses higher by PLN 13 million (+30.2% y/y), to PLN 56 million. It was caused by the increased operating expenses of funds due to higher additional contributions to the Insurance Guarantee Fund;

- other items higher by PLN 1 million (+25% y/y), to PLN 5 million, due to higher acquisition expenses and costs of service.

Operating profit in the pension insurance segment (in PLN m)

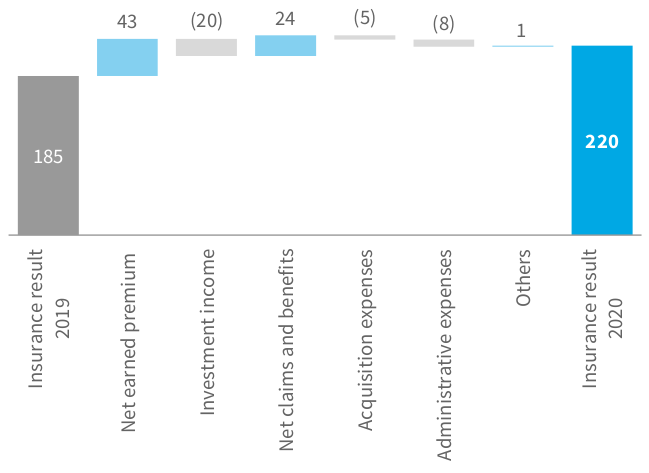

Baltic States

The operating result on the activity in the Baltic States in 2020 was PLN 220 million, which means an increase in PLN 35 million, i.e. 18.9%, compared to 2019 (after eliminating the impact of the EUR exchange rate the increase would be PLN 27 million).

Factors affecting the result:

- net earned premium higher by PLN 43 million (+2.7% y/y) combined with a decrease in gross written premium. The gross written premium was PLN 1,694 million compared to PLN 1,713 million in the previous year (-1.1% y/y). The premium accumulated in non-life insurance decreased by PLN 28 million (-1.7% y/y, and in the functional currency: -5.5% y/y). The highest drops were recorded in TPL and MOD motor insurance (-9.1% y/y in the functional currency), which resulted, among others, from the ban on movement introduced due to the COVID-19 pandemic. This effect was exacerbated by the decrease in insurance rates caused by a strong price pressure in the region, and by the slowdown of sales of new vehicles. An increase was recorded in financial insurance (+24.1% y/y in the functional currency) and health insurance (+6.5% y/y in the functional currency). Premiums in life insurance increased by PLN 9 million (+12.5% y/y);

- investment income lower by PLN 20 million (-52.6% y/y), to PLN 18 million. The cause was above all drops on stock markets;

- net claims and benefits lower by PLN 24 million (-2.4% y/y, and in the functional currency: -6.1% y/y), to PLN 965 million. The restrictions caused by the COVID-19 pandemic contributed to a lower frequency of losses in motor insurance and to a lower frequency of benefits paid in respect of health insurance. The loss ratio in non-life insurance fell 2.5 p.p. to 57.8% relative to the previous year In life insurance, the value of benefits stood at PLN 61 million and was 10.3% lower than in 2019 (-12.5% y/y in the functional currency);

- increase in acquisition expenses to PLN 340 million (+1.5% y/y). In the functional currency, though, acquisition expenses recorded a drop by 2.6% y/y. The acquisition expense ratio calculated on the basis of net earned premium dropped by 0.2 p.p. and stood at 20.7%;

- Increase in administrative expenses to PLN 141 million (+6% y/y). In the functional currency, they increased by 3.2% as a result of the project activity and additional expenses related to the adaptation of the activity to work in the conditions of restrictions related to the COVID-19 pandemic.

Operating result in the Baltic States segment (in PLN m)

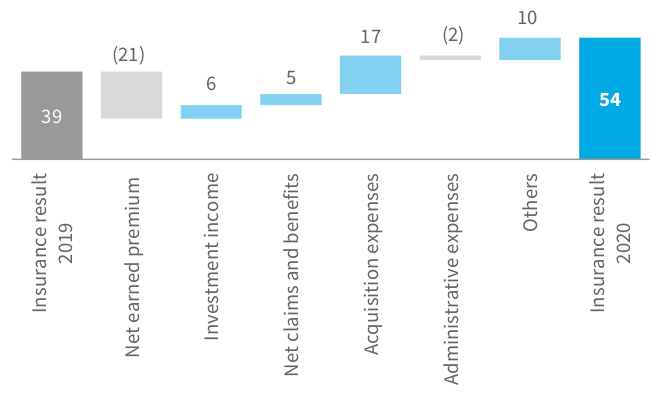

Ukraine

The Ukraine segment closed 2020 with an increase in the operating result by PLN 15 million (after eliminating the impact of change in the UAH exchange rate the increase would be PLN 17 million), reaching PLN 54 million compared to PLN 39 million in 2019.

Factors affecting this segment’s performance:

- decrease in net earned premium by PLN 21 million (-9.7% y/y) combined with a decrease in gross written premium. The gross written premium was PLN 291 million and decreased by PLN 44 million (-13.1% y/y, and in the functional currency: -9.4% y/y) relative to the previous year. Due to the restrictions in movement introduced during the COVID-19 pandemic, the largest drop, by 47.1%, was recorded in travel insurance and other TPL insurance jointly (which is obligatory when filing an application for a visa for entering Poland), and in Green Card insurance (-39.3% y/y). The premium in life insurance dropped by PLN 2 million, but in the functional currency an increase by 2.7% was recorded;

- investment income higher by PLN 6 million (+18.2% y/y), to PLN 39 million;

- decrease in net claims and benefits to PLN 76 million (-6.2% y/y, and in the functional currency: -2.6% y/y). The restrictions in movement introduced due to the COVID-19 pandemic considerably contributed to the lower frequency of losses in TPL and MOD motor insurance, and also the frequency of losses in health insurance decreased. In life insurance the value of benefits paid increased by PLN 8 million (+29.6% y/y, and in the functional currency: +34.8%) compared to the previous year. The loss ratio calculated on the basis of the net earned premium in non-life insurance was 33.6%, down 4.4 p.p. compared to 2019;

- decrease in acquisition expenses to PLN 101 million from PLN 118 million (-14.4% y/y) in the previous year. As a result, the acquisition expense ratio dropped by 2.8 p.p. and achieved the value of 51.5%;

- administrative expenses higher by PLN 2 million (+6.5% y/y and in the functional currency: +11.7%) – to PLN 33 million. The administrative expense ratio calculated on the basis of the net earned premium increased 2.6 p.p. and stood at 16.8%. The increase was caused, among others, by the higher personnel costs as a result of the payroll pressure and the increase in expenses related to the project activity.

Operating result in the Ukraine segment (in PLN m)

Investment contracts

In the consolidated financial statements investment contracts are recognized in accordance with the requirements of IFRS 9.

The results of this segment are presented according to the Polish Accounting Standards, which means that they include, among other things, gross written premium, claims paid and movements in technical provisions. These categories are eliminated at the consolidated level.

Gross written premium generated on investment contracts in 2020 decreased by PLN 2 million (-5.7% y/y) compared to 2019 and reached PLN 33 million. The changes resulted primarily from the decrease in the payments to IRSA accounts, after the product was withdrawn from the offering.

The investment result in the segment of investment contracts decreased by PLN 3 million (-18.8% y/y) relative to the previous year, chiefly due to the lower rate of return on IRSAs.

The cost of insurance claims and benefits together with the movement in other net technical provisions decreased by PLN 5 million (-11.9% y/y) to PLN 37 million, mostly due to the aforementioned difference in investment income in unit-linked products and the resulting lower payments to the accounts.

In the investment contract segment, no active acquisition of contracts is currently underway.

Administrative expenses decreased to PLN 3 million (-25.0% y/y) as a consequence of the decreasing portfolio of contracts in this segment.

The segment’s operating result grew to PLN 6 million (+20% y/y), which resulted from a decrease in costs as a consequence of the shrinking size of business in this segment.

Operating result in the investment contracts segment (in PLN m)

Alternative Performance Measures

Selected Alternative Performance Measures (APM) within the meaning of European Securities and Markets Authority Guidelines (ESMA) no. 2015/1415 are presented below.

The presented profitability and operational efficiency indicators, being standard measures applied generally in financial analysis, provide, in the opinion of the Management Board, significant additional information about the financial performance of PZU Group’s activity. Their usefulness was analyzed in terms of the information, delivered to the investors, as to the financial standing and the financial performance of the Group.

Profitability indicators

To facilitate the analysis of PZU Group’s profitability, such indicators were selected that best describe this profitability in the opinion of the Management Board.

The return on equity (ROE) and the return on assets (ROA) indicate the degree to which the Company is capable of generating profit when using its resources, i.e. equity or assets. They belong to the most frequently applied indicators in the analysis of profitability of companies and groups regardless of the sector in which they operate.

Return on equity (ROE) is a measure of profitability. It permits an assessment of the degree to which the company multiplies the funds entrusted to it by the owners (investors). This is a ratio of the generated profit to the held equity, i.e. financial resources at the Group’s disposal for an indefinite term which were contributed to the enterprise by its owners. In the case of the PZU Group, the value of net profit and equity differ considerably depending on whether they are provided excluding or including the profit/equity of minority shareholders. Therefore, both return on equity (ROE) – attributable to equity holders of the parent, and return on equity (ROE) – consolidated, without excluding profit and equity attributable to non-controlling shareholders, are presented.

Return on assets (ROA) reflects their capability of generating profit. This indicator specifies the amount of net profit attributable to a unit of financing sources engaged in company’s assets.

Return on equity attributable to equity holders of the parent (PZU) for 2020 was 10.9%. At the same time, it was 10.3 p.p. lower than that achieved in the previous year, which resulted from non-recurring events, i.e. the impairment loss on goodwill arising from the acquisition of Alior Bank (PLN 746 million) and Bank Pekao (PLN 555 million) and the impairment loss on assets arising from the acquisition of Alior Bank (i.e. trademark and relations with clients) in the amount of PLN 161 million (after adjustment for the impact exerted by deferred income tax and minority shareholdings the impact exerted on the net result attributable to the parent company’s shareholders was PLN 42 million). The lower return on equity in 2020 resulted also from the retention of the whole profit for 2019 in the Company, hence from the lack of payment of dividends. Such a profit distribution was consistent with the standpoint expressed by the Polish Financial Supervision Authority on 26 March 2020 in the letter to insurance and reinsurance companies.

Return on assets (ROA) of the PZU Group for 2020 was 0.7%, i.e. 0.8 p.p. lower than in 2019. The primary cause was the decrease in the result on banking activity, including:

- non-recurring effect of the impairment loss on goodwill arising from the acquisition of Alior Bank and Bank Pekao;

- impairment loss on assets arising from the acquisition of Alior Bank (i.e. trademark and relations with clients), higher costs of risk stemming from the establishment of additional loan provisions due to the COVID-19 pandemic;

- increase in provisions for legal risk in Q4 pertaining to the portfolio of FX mortgage loans in Swiss francs in Bank Pekao.

| Basic performance indicators of the PZU Group | 2016 | 2017 | 2018 | 2019 | 2020 |

| ROE (Return on Equity) attributable to equity holders of the parent (annualized net profit/average equity) x 100% | 14,9% | 21,0% | 22,1% | 21,2% | 10,9% |

| ROE (Return on Equity) consolidated (annualized net profit/ average equity) x 100% | 14,7% | 15,3% | 14,6% | 13,5% | 6,1% |

| ROA (Return on Assets) (annualized net profit/average assets) x 100% | 2,1% | 1,9% | 1,7% | 1,5% | 0,7% |

Operational efficiency ratios

To facilitate the analysis of PZU Group’s performance, such indicators were selected that best describe performance in the case of insurance companies and those pursuing banking activity in the opinion of the Management Board. Some indicators refer the costs of pursuit of insurance activity to premiums, hence reflect which portion of the premium was allocated to costs and which portion – to margin. For the banking activity, the Cost/Income (C/I) ratio was selected as the relation which best reflects the performance of this area of the activity in the opinion of the Management Board. All indicators are widely applied by other companies from the corresponding sectors and by investors and serve an analysis of efficiency and profitability of these companies. Detailed information to better understand the functionality and value in use of the applied Alternative Performance Measures can be found in Glossary and APMs.

One of the fundamental measures of operational efficiency and performance of an insurance company is COR (Combined Ratio) calculated, due to its specific nature, for the non-life insurance sector (Section II). This is the ratio of insurance expenses related to insurance administration and payment of claims (e.g. claims paid, acquisition and administrative expenses) to the net earned premium for a given period.

In recent years, the combined ratio (for non-life insurance) of the PZU Group’s has been maintained at a level ensuring high profitability of business.

In 2020, COR was 88.2% and was 0.3 p.p. lower than in 2019, due primarily to a lower loss ratio in motor insurance. It was an outcome of a lower frequency of claims due to the traffic restrictions introduced at the time of the COVID-19 pandemic, and an increase of the average disbursement.

Operating profit margin in life insurance is also an important indicator, i.e. the profitability of life insurance segments calculated as the ratio of the result on operating activity to gross written premium. In 2020, the indicator reached 18.6%, and its fall by 1.9 p.p. in comparison to 2019 was in particular due to a higher loss ratio in the group and individually continued insurance. It was attributable to higher mortality resulting from the COVID-19 pandemic.

As regards banking activities, efficiency is measured by the cost to income ratio, i.e. the quotient of administrative expenses and the sum of operating income, excluding: the BFG charge, the levy on other financial institutions and the net result on realization and impairment losses on investments. In 2020, the cost to income ratio for banking activity in the PZU Group reached 43.2%, and was higher than in 2019 by 2.4 p.p. It is attributable to lower income, including net interest income, resulting from the fall of interest rates in Q2 2020.

The operational efficiency ratios, by segment, are given in Glossary and APMs.

| Operational efficiency ratios | 2016 | 2017 | 2018 | 2019 | 2020 | |

| 1. | Gross claims and benefits ratio (simple)(gross claims and benefits/gross written premium) x 100% | 63,7% | 67,3% | 63,8% | 66,5% | 67,5% |

| 2. | Claims and benefits ratio on own share (net claims and benefits / earned premium on own share) x 100% | 68,4% | 70,0% | 65,2% | 68,0% | 67,7% |

| 3. | Insurance activity expense ratio (insurance activity expenses/earned premium on own share) x 100% | 22,5% | 21,1% | 21,4% | 22,3% | 22,6% |

| 4. | Insurance acquisition expense ratio (acquisition expenses/premium earned on own share) x 100% | 14,3% | 14,0% | 14,5% | 15,1% | 15,3% |

| 5. | Administrative expense ratio in the insurance segments (administrative expenses/premium earned on own share) x 100% | 8,3% | 7,2% | 6,9% | 7,2% | 7,4% |

| 6. | Combined ratio (COR) in non-life insurance (net claims and benefits + insurance activity expenses) / net premium earned on own share x 100% | 94,9% | 89,6% | 87,1% | 88,5% | 88,2% |

| 7. | Operating margin in life insurance (operating profit /gross written premium) x 100% | 25,3% | 19,3% | 21,3% | 20,5% | 18,6% |

| 8. | Cost / Income ratio - banking operations | 44,4% | 48,0% | 42,3% | 40,8% | 43,2% |