Business in the face of climate change

GRIs

“We are apprehending increasingly better how our decisions affect the natural environment. There is no doubt that the future of subsequent generations depends on our decisions and choices. Investors, regulatory authorities, governments and public opinion expect companies to take actions consistent with the principles of sustainable development. We see the special role that financial and insurance industry companies play in this process. The products offered by us may contribute to a great degree to the green transition of the economy. And that is the goal we want to start with in the subsequent decades of the 21st century”.

“We are apprehending increasingly better how our decisions affect the natural environment. There is no doubt that the future of subsequent generations depends on our decisions and choices. Investors, regulatory authorities, governments and public opinion expect companies to take actions consistent with the principles of sustainable development. We see the special role that financial and insurance industry companies play in this process. The products offered by us may contribute to a great degree to the green transition of the economy. And that is the goal we want to start with in the subsequent decades of the 21st century”. The PZU Group is aware that both its direct operations and the insurance products it offers, as well as its banking and investment business, are areas through which companies may affect the behavior of their clients and, as a consequence, their approach to the natural environment and climate change.

[GRI 102-12]

PZU is a signatory of the United Nations Environment Programme Finance Initiative established between the United Nations Environment Program and the financial sector. The global partnership between the United Nations Environment Programme and the financial sector serves the purpose of mobilizing the financial and insurance sectors to act towards the achievement of sustainable development goals. By joining this initiative, the PZU Group has become one of more than 350 organizations committed to making their business decisions consciously with a view to contributing to a favorable impact on people’s lives and the quality of the natural environment.

The PZU Group participates in the dialogue on sustainable development and sustainable finance. A PZU representative chairs the Task Force on Sustainable Finance at the Polish Insurance Association (PIU). PZU also participates in the work of the Financial Market Development Council for Sustainable Finance. The PZU Group is also involved in the work of a task force established by PIU, the Polish Bank Association (ZBP) and the Polish Association of Listed Companies, striving to develop a uniform approach to the performance of obligations under the Sustainable Finance Disclosure Regulation (SFDR) on the disclosure of information related to sustainable development in the financial services sector. The task force endeavors to increase the transparency of reporting and ensure the comparability of data between companies and institutions providing financial products. The purpose of these efforts is to attain the primary objective of increasing the transparency of companies and providing end investors with information about the ways in which market participants approach risks to sustainable development.

The PZU Group keeps monitoring the activities and initiatives undertaken by financial institutions and international organizations, specifically the United Nations (UN), the Organization for Economic Cooperation and Development (OECD) and the European Commission (EC). In taking steps to disclose information and manage risks related to climate change in the financial sector, the PZU Group observes the provisions of the climate agreement entered into by 195 countries in Paris in 2015. A document of major significance as a guideline for action from the perspective of efforts aimed at reducing natural disasters is the “Action Plan on the Sendai Framework for Disaster Risk Reduction 2015-2030 – A disaster risk-informed approach for all EU policies”. While working on solutions aimed at tackling environmental and climate change challenges, the Group also takes heed of activities carried out by the Polish government and the objectives of “Poland’s Energy Policy until 2040”.

The PZU Group takes a number of actions in support of the energy transformation process. This is a response to the expectations that the financial sector will provide increasing support to various sectors of the economy, especially power generation, transport and industry, in reducing climate change caused by greenhouse gas emissions.

The PZU Group’s insurance business is aimed at offering insurance products tailored to the needs of both individual and corporate clients in various sectors of the economy. The Group’s highest priority is to properly respond to the current needs of the Polish market and economy in accordance with national and EU regulations (including those safeguarding the principles of fair competition and permitting cooperation only with those business clients whose activity, according to PZU’s knowledge, complies with the applicable laws). The complexity of needs and, consequently, of the offering has led PZU do provide insurance cover also to entities operating in the mining and power sectors. Besides traditional operations based on fossil fuels, clients from this group also develop their activities in the area of renewable energy sources. Moreover, the PZU Group is fully aware that the transformation process of the Polish economy towards carbon neutrality will require commitment and investment by commercial undertakings currently operating in the power sector. To enable a successful and orderly transformation, financial products, including loans and insurance policies, must be available to entities doing business in this sector.

The PZU Group gradually expands its range of products designed to help reduce the adverse environmental impact, while taking into account the specific features of the Polish economy. The Group’s product offering includes solutions for retail, corporate and institutional clients. In respect of large clients, engineering underwriting is performed to enable the insurer to calculate the premiums. A detailed outcome of the underwriting exercise along with full risk assessment and scenarios are presented to the client. The underwriting covers business risks, which are often combined with environmental risks. For this reason, the actions taken by the client to eliminate or reduce certain elements of its risks, even if induced solely by an attempt to suppress insurance costs, contribute to diminishing the risks to the environment or humans.

Banks also take action to minimize environmental risks. Bank Pekao, along with the assessment of creditworthiness and credit risk, carefully examines all transaction-specific risks, including environmental and climate risks and the risk of the client’s failure to comply with the rules of corporate social responsibility. In its lending policy, Bank Pekao takes into consideration climate, environmental and social risks arising from the transition to a low-carbon economy that will be resilient to climate change and the threats stemming from the physical risk of climate change, among other factors. The issues of financing the power sector are included in Bank Pekao current credit risk policy. According to the provisions of this policy, Bank Pekao supports a gradual and orderly transition to a low-carbon economy, curtailing the funding of coal mining and energy generation from fossil fuels (oil and coal) and increasing the funding of energy generation from renewable sources (water, wind and the sun). The Bank supports clients and projects aiming to slow down climate change, reduce the emission of pollutants and support sustainable social development. Infrastructural investments characterized by low CO2 emissions and resistant to climate change and disasters are considered desirable by the Bank.

TUW PZUW, a company operating in the insurance segment for corporate clients, medical operators and public institutions, takes climate issues into account in its offering in a comprehensive manner. The specific nature of business insurance provided by a mutual insurance company involves the execution of insurance contracts by way of negotiation based on an individual risk assessment, with insurance programs attuned to the individual needs and expectations of its members.

- supports the decarbonization process of the Polish economy – by providing insurance cover to entities operating in the broadly construed power and coal sectors that have initiated or are in the process of changing their energy mix, with particular emphasis on those business areas that seek to develop generation capacity from renewable energy sources, such as wind farms, photovoltaic farms and a network of hydroelectric power plants and biogas-fired plants;

- supports enterprises operating in the segment that uses low-carbon energy sources based on natural gas (including Gaz System, PLNG and new Baltic Pipe investment projects). According to materials published by the Ministry of Energy, as early as in 2040 the volume of electricity generated in Poland from natural gas will exceed the volume generated from coal;

- supports new environmentally friendly investment projects in the power sector that satisfy stringent environmental requirements imposed by the EU and replace less environmentally efficient assets;

- creates and promotes its own fire safety standards in an attempt at reducing the number of fires in business entities, thus contributing to a decrease in the emission of toxic pollutants into the atmosphere and surface and ground waters;

- carries out regular risk analyses and issues recommendations for improving safety – recommendations issued by PZUW’s risk engineers for enterprises classified as Large Risk Establishments (ZDRs) and Increased Risk Establishments (ZZWs) to reduce the risk of industrial failures and minimize their impact on humans and the natural environment.

TUW PZUW prepared and disseminated an offering to waste management firms, designed in particular to promote environmentally friendly waste management methods, including the construction of highly efficient waste processing plants, such as those that turn waste into fertilizers, recover heat from thermal treatment or produce alternative fuels.

BEST PRACTICE

Environmental guarantee

Offers a form of protection to companies whose activities may exert an adverse impact on the environment, e.g.:

- chemical plants;

- companies dealing in trans-border movement of waste;

- municipal services plants.

The guarantee is a commitment to pay a specified compensation if the company to which the guarantee has been granted fails to remove adverse environmental effects of its business operations. The beneficiary of this guarantee is the environmental protection authority issuing the relevant administrative instrument giving a permit to use natural resources, e.g. the marshal, provincial governor (voivod) or county governor (starost).

Most of companies operating in Poland belong to the category of small and medium-sized enterprises (SMEs). The PZU Group is aware that involving these firms in environmental protection efforts has the potential of generating significant benefits. For this reason, the offering of PZU Advisor targeted at the SME segment is focused on protecting the assets of these companies. The insurance cover protects the following installations and devices:

- photovoltaic installations, including photovoltaic farms;

- wind farms (windmills);

- biogas-fired plants – devices for generating gas energy from biomass;

- sewage treatment plants.

Moreover, the insurance cover protects third party property used by the insured company to render services and may be purchased by firms that install photovoltaic panels for retail customers. Such cooperation supports rapid sales of photovoltaic installations, but above all protects users against any damage to their equipment. The offering targeted at SMEs also includes third party liability insurance for damage to the natural environment (e.g. covering the costs of removing leaked substances from soil).

Alior Bank has prepared a loan offering called EKOFIRMA, intended for the purchase and installation of photovoltaic panels by SMEs. It is addressed specifically to prosumers of renewable energy, that is commercial undertakings willing to generate electricity from the sun in a micro installation with a capacity of up to 50 kW to satisfy their own demand for energy.

The PZU Group also offers a broad range of environmental products for retail clients. Even the most basic scope of PZU Dom property insurance offers comprehensive protection of equipment used in and around the home to save energy or protect the environment.

This insurance covers:

- photovoltaic installations;

- solar installations;

- “smart home” installations (designed to save electricity);

- heating installations: electric, gas, heat pump (air heat pump, ground-water heat pump);

- recuperation unit (to minimize energy losses);

- home sewage treatment plant;

- rainwater recovery installation.

TUW PZUW has taken another step towards supporting environmentally friendly initiatives of its members, offering an insurance product that promotes the repair of a broken device instead of purchasing a new one. It is designed to generate financial savings for the client and helps to protect the environment by reducing waste. These benefits are provided through assistance insurance at TUW PZUW. Owing to their cooperation with TUW PZUW, power companies support their clients in emergency situations, offering them the tradesman product, ensuring assistance in arranging and performing repairs of home equipment and devices.

It is a response to the changing trends, growing awareness among consumers, the need to protect the environment and demand for comprehensive professional home assistance services. Under this offering, customers of power companies may take advantage of professional support in the event of a failure of their:

- electrical devices (electronics, household appliances, computers), heating and air conditioning systems;

- internal electricity, gas, water and sewage installations, doors, locks, etc.

BEST PRACTICE

The PZU Group endeavors to reduce the environmental impact of its products not only in the process of their creation and offering, but also throughout their lifecycle, in particular during the claims handling process. Within the framework of the claims handling process under third party liability and motor own damage insurance, an innovative process called Green Parts has been launched to handle the management of waste generated during the repair of damaged vehicles. It adheres to the following three universal values:

-

Responsibility

PZU covers the manufacturing costs of approximately four million vehicle spare parts per year. It assumes responsibility for managing the remains of damaged vehicles (parts replaced with new ones) in accordance with the requirements of generally applicable laws.

-

Care for the natural environment

Improper disposal of damaged vehicle parts creates an environmental hazard. That is why partners of the Green Parts program who collect the remains of damaged vehicles after the repair are firms with experience in the disposal of motor vehicles and their replacement parts. They hold all the required permits. Their professional approach and reputation for integrity guarantee that each part collected by them is handled in compliance with the applicable legal requirements and the best environmental standards.

-

Safety

The technical condition of damaged vehicle parts may pose a threat to human health and lives. In collaboration with a network of qualified partners, we make efforts to ensure that all parts (qualified for replacement due to damage) are replaced rather than refurbished. Our actions in this area are also aimed at reducing the volume of trade on the secondary market for salvage that has lost its safety features.

Bank Pekao offers an express loan for environmental purposes under its “Care for a good climate” campaign on preferential terms (APR of 8.3% and 0% fee, for between PLN 5,000 and PLN 50,000, repayable over a 10-year term). 80% of the loan value must be spent on the purchase or installation of one of the following environmental purposes:

- renewable energy sources: solar collectors, photovoltaic panels/cells;

- central heating boilers (except for coal-fired boilers);

- heat pumps;

- windows, doors and home insulation materials;

- electric or hybrid cars, electric motorcycles and electric scooters.

The PZU Group is fully aware of the fact that the need to prevent climate change and adapt to the changing climate requires coordinated efforts by decision-makers, businesses and the financial sector. The PZU Group conducts a scenario analysis of climate change in accordance with the structure proposed by The Network of Central Banks and Supervisors for Greening the Financial System (NGFS). In the PZU Group’s opinion, the probability that the risk related to the global economy transformation will materialize is much higher than the probability that the most extreme physical risk related to the climate change will materialize. In accordance with the scenario analysis the Group’s impact would be greater if the ‘greenhouse effect world’ scenario materialized, under which greenhouse gas emissions would continue to increase and no actions aimed at avoiding physical risks would be taken. However, the range of the PZU Group’s product offering and activities is twofold: the offering includes products that are designed to help reduce greenhouse gas emissions, including those that diminish the likelihood of materialization of risks related to transformation through investments in a low-emission economy and those that increase the ability of clients and the environment to adapt to the changing climate.

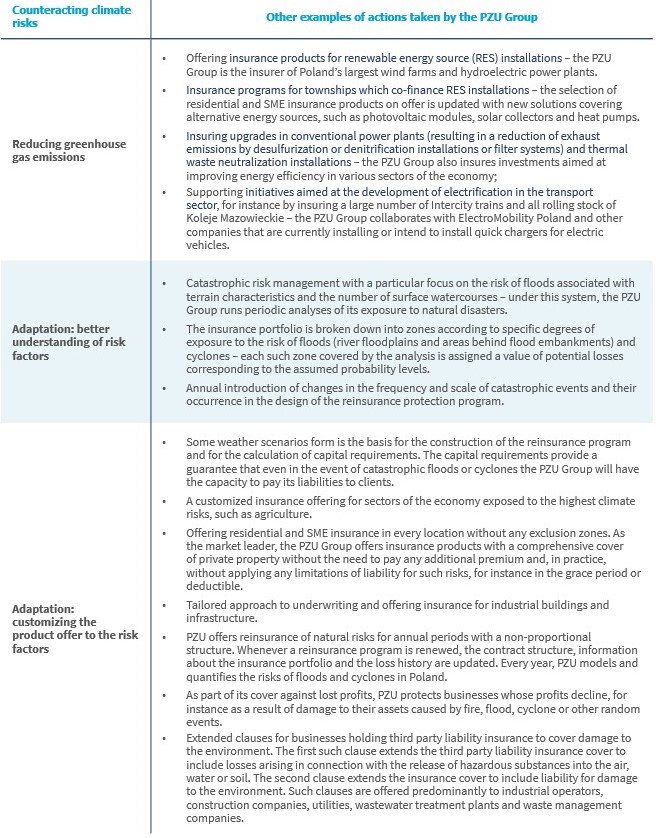

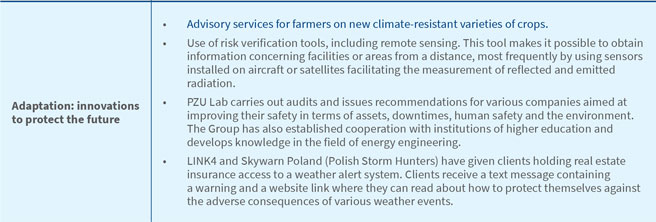

Additional activities aimed at counteracting climate risks and boosting adaptation capacity