PZU Group’s policies [Accounting Act]

[GRI 103-2, GRI 103-3]

„Offering the best-in-class customer service standards at every stage when clients interact with our company establishes our competitive edge. We want to accompany clients in every moment of their lives and offer them the relevant financial and insurance support. Our actions will focus on effectively caring for clients’ future and satisfy their needs comprehensively when it comes to life, health and property insurance and their finances.”

„Offering the best-in-class customer service standards at every stage when clients interact with our company establishes our competitive edge. We want to accompany clients in every moment of their lives and offer them the relevant financial and insurance support. Our actions will focus on effectively caring for clients’ future and satisfy their needs comprehensively when it comes to life, health and property insurance and their finances.”

Michał Świderski, Managing Director for Retail Sales, PZU Group

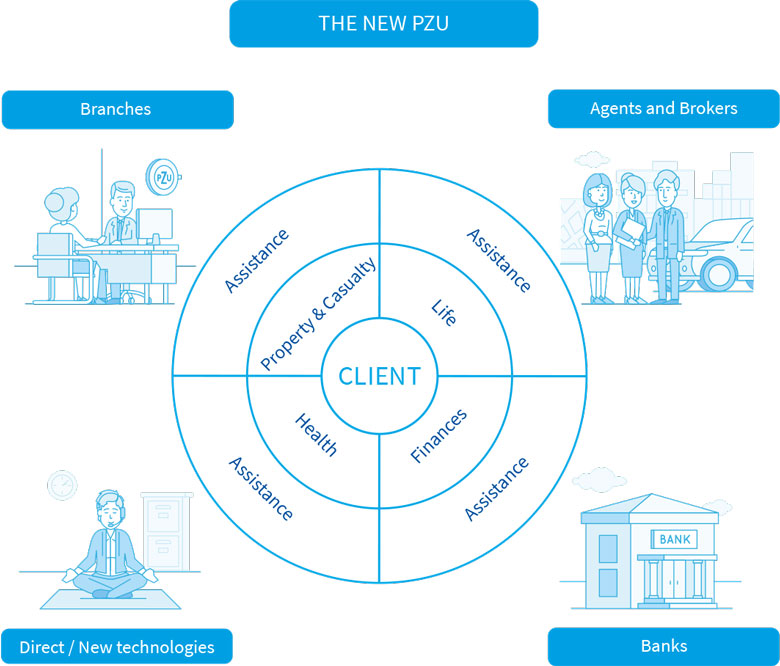

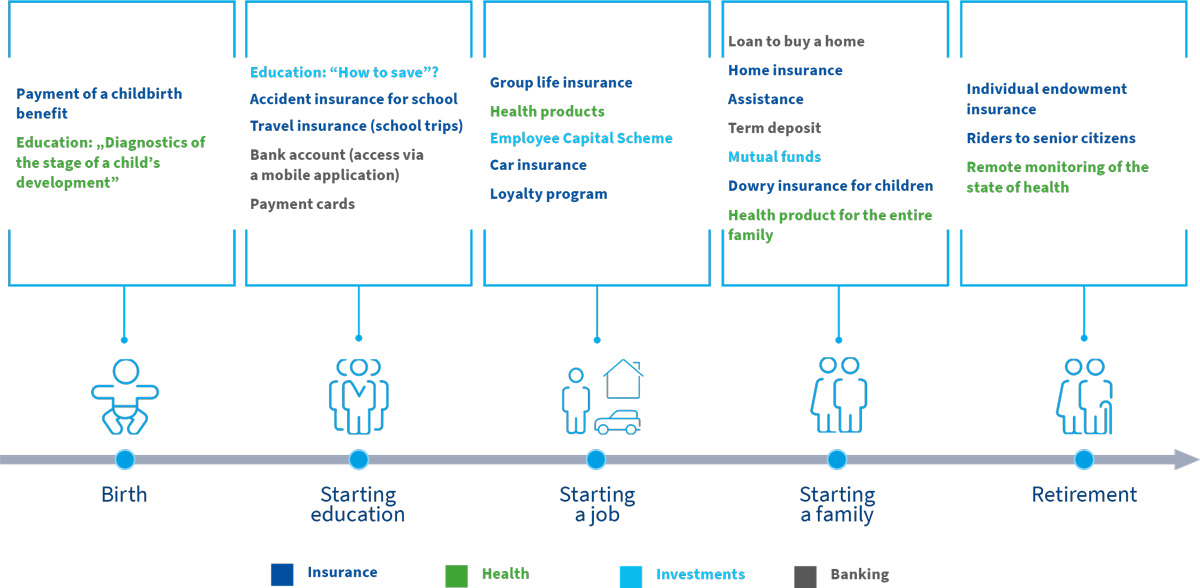

It is not the number of products that determines PZU’s competitive edge and its unrivaled position on the Polish market, but their quality and, above all, their alignment to client needs as they evolve over their lifetimes. PZU is always present where clients are in need of financial and insurance services, from birth to education and maturity until retirement.

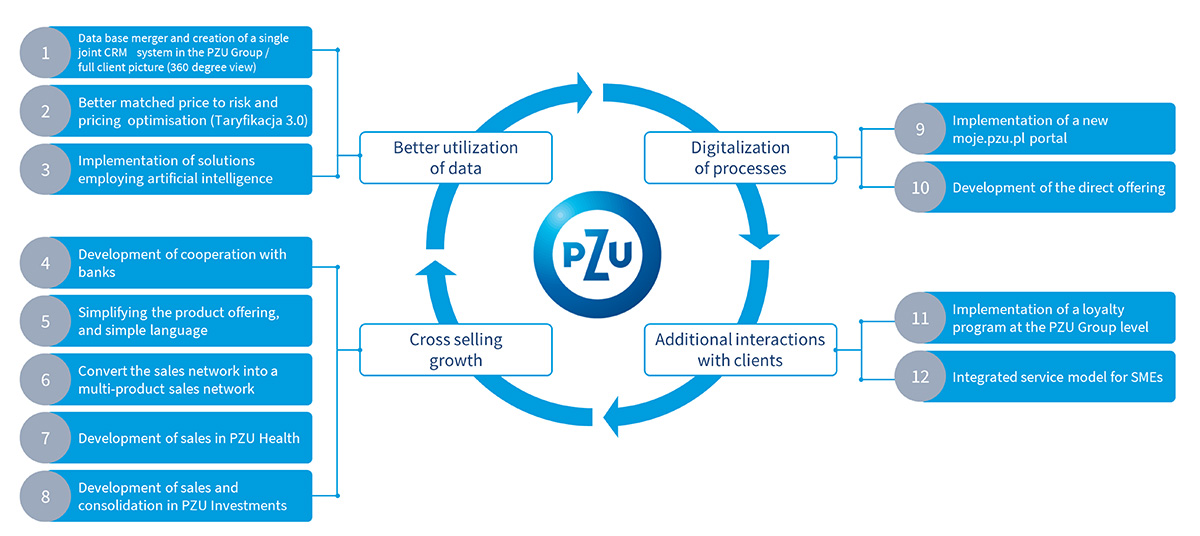

The strength of the #newPZU strategy was in technological support spanning the field of innovation and encompassing nearly all the Group’s operating areas. Multi-dimensional data analysis makes it possible to gain a better grasp of client needs, offer more efficient client service and provide for easier contacts with a greater amount of partnership. The means to reach these ambitious client-oriented goals involve the usage of tools based on artificial intelligence, Big Data and mobile solutions.

We are a long-term partner for our clients

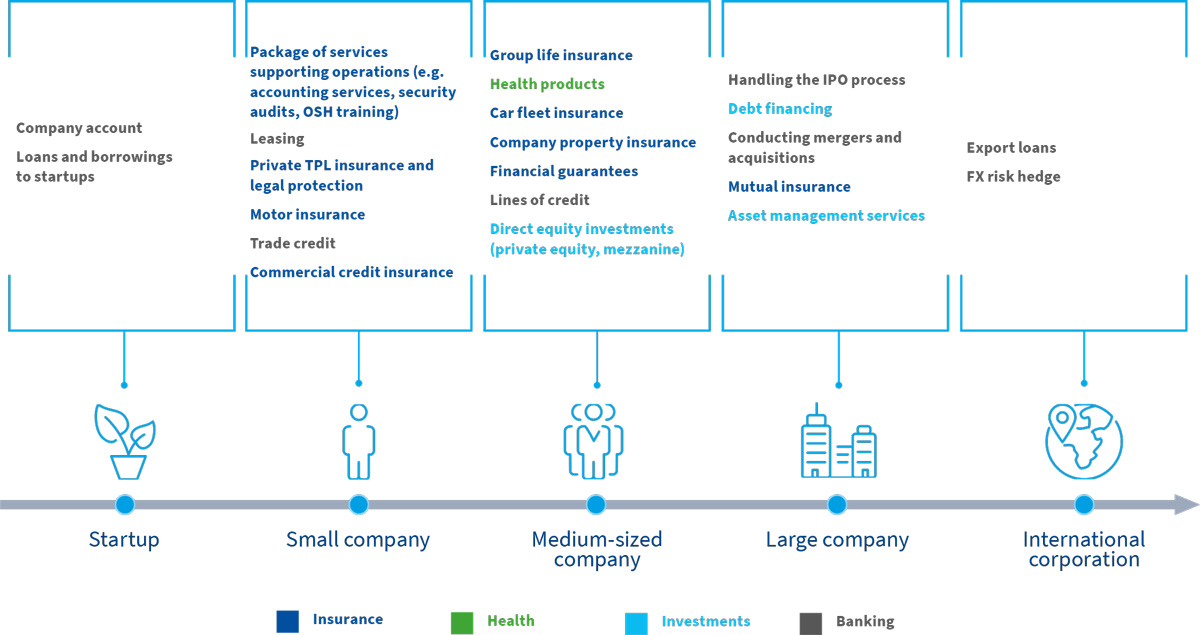

We help companies grow by offering them a wide array of products supporting their growth

12 initiatives (in four areas: data analysis, cross selling, digitalization of processes and client interactions) defined the path to achieving strategic objectives.

#newPZU 2020 strategic initiatives

Mindset toward client experience

A mindset focused on the client has long been a component of PZU’s DNA. The Group listens to the client’s voice, collects information about the client’s experience and emotions, examines complaints and recommends changes that will ensure the client maximum satisfaction. All these activities help us design a positive client experience.

Governance policies and systems in the PZU Group [Accounting Act]

PZU and PZU Życie have a „Client experience management policy” in force, with the program devoted to that subject matter being a strategic initiative for the overall Group. The Client Relations Management Department is in charge of its execution. The priority is to develop the best client experience during every contact with the company and its products and services. This program posits systematically proceeding through the various phases of the cycle, starting with a client expectation study and defining the optimum experience, to crafting measures to influence client experience, all the way to implementing changes and constantly measuring the outcomes. The guidelines for handling all complaints reported to PZU and PZU Życie have been compiled in the “Rules for handling client complaints”. Several hundred employees are involved in this process. Dedicated Complaint Handling Teams have been established to handle complaints and grievances. Some complaints may be dealt with by employees who handle claims and benefits. The complaint process in place is largely based on the Act on Complaints Handling by Financial Market Participants and on the Financial Ombudsman.

Also other PZU Group companies have implemented documents and procedures assisting in the management of client satisfaction.

PZU CO has in place the „Regulations for handling complaints/ grievances reported to PZU CO regarding the Company’s agency activities”. PTE PZU has adopted a set of rules and regulations for examining complaints, procedures for handling correspondence and rules and regulations for using external services.

At PZU Pomoc, the following documents are in place:

- „Customer service quality policy”;

- „Customer experience management policy”;

- Guidelines for accepting and examining complaints.

TFI PZU has a procedure in place for handling complaints submitted by its clients and clients of its mutual funds, which defines the principles and guidelines for dealing with complaints submitted by clients of the mutual fund management company or its mutual funds in connection with TFI PZU’s activities in the field of mutual fund establishment and management, in particular regarding brokerage in selling and redeeming participation units, accepting subscriptions for investment certificates, providing management services for portfolios which include one or more financial instruments and fulfilling obligations towards its clients. Moreover, a procedure for serving TFI PZU’s portfolio clients has been developed. It is an internal document that governs activities related to the establishment and termination of cooperation between TFI PZU and its client related to managing portfolios of financial instruments and activities related to client service. TFI PZU has also adopted the „Policy for acting in the best interests of clients and funds”, which defines TFI PZU’s principles and activities aimed at generating the best possible results for the funds and the clients through the provision of professional services.

LINK4 has in place the „LINK4 TU Complaint Procedure” and the „Rules and regulations for accepting and examining complaints and appeals”.

A procedure has been rolled out in PZU Zdrowie describing the rules for the workflow, records and examination of complaints by the Client Relation Section and PZU Zdrowie branches. It also defines responsibility in this process and the method of reporting complaints. Also in place is the „Patient Handling Standards Book”, which contains nonmedical service standards dedicated to various professional groups in medical centers. Also adopted has been the „Medical safety regulation package”. It contains the rules governing the supervision of drugs, medical records, medical equipment, hygiene plans, etc.

Ratio or complaints handled within 30 days in 2019-2020

Closed Improvement Loop:

The Closed Improvement Loop is a model adopted by the PZU Management Board that depicts how PZU defines, implements and monitors proactive client initiatives that ensure positive client experience. The purpose of the closed improvement loop is to improve client experience and streamline existing products and processes, design client experience, ensure consistent and effective communication and create new products and services in line with client needs and expectations. The Closed Improvement Loop process also includes the promotion of appropriate attitudes and behaviors among PZU employees, in particular by involving them in active participation in the process of managing proactive client initiatives.

All PZU employees exert a tangible impact on the design of client experiences, which is why it is imperative that they look at things through the client’s eyes, in other words: by placing the client at the center of attention. For the purpose of supporting employees in building relationships with clients, a unique „Focus on the Client” training has been held in the form of microlearning. It includes attractive video materials, podcasts, a variety of graphics, exercises and quizzes with prizes. The training is aimed at educating employees in the areas of client experience and employee experience and, additionally, at boosting a client-focused organizational culture. The training explains the secrets to designing a positive client experience and, above all, teaches the participants how to use the acquired knowledge in their day-to-day work. During the training, experts demonstrate how important client experience is and how it affects business.

Every PZU employee, serving either external or internal clients, is eligible to take part in the training. After completing all modules and providing correct answers to quiz questions, the training participants also receive a PZU Client Experience (CX) Ambassador certificate.

In 2020, the CX Academy was established. Its members are 355 CX Ambassadors who have already completed the „Focus on the Client” training and received a Certificate. A special event was held under the auspices of the Academy, attended by over 100 participants who had the opportunity to expand their knowledge in the CX area, talk to experts and exchange their ideas with other Ambassadors. Moreover, three webinars on Client Experience and Employee Experience were held, attended by an average of over 320 participants.

The „Focus on the Client” training was also rolled out and adapted to the needs of PZU agents. It was completed by 230 agents, 72 of whom became CX Ambassadors.

In the future, we are planning to:

- deliver a new edition of the „Focus on the Client” training and supplement it with new topics

- make the „Focus on the Client” as a compulsory training course for all new PZU employees.

Client experience management plan

The client experience management plan is a long-term strategy aimed at developing the best possible client experience at all points of contact with PZU. The tool enabling effective management of the plan is the „Policy for managing proactive client initiatives in PZU – Closed Improvement Loop”.

Within the framework of the Employee Experience initiative, the „Recipe for good cooperation” program has been rolled out to promote cooperation and kindness in contacts between PZU employees. Also, proactive client initiatives are proposed and deployed for the purpose of improving client experience and satisfaction. These initiatives result from studies, market analyses, reviews of complaints and grievances, and observations of the operation of processes and products at PZU.

The initiatives pertain to:

- the area of communication with clients – such as recommendations to modify the wording of renewal letters and messages on mojePZU;

- the area of electronic channels – such as the deployment of the mojePZU evaluation tool targeted at users who have just visited the website;

- the customer service area – such as changes in the methods of disseminating information about the degree of coverage with medical insurance, simplification of the complaint form, etc.

In 2020, in the client experience area, we managed to roll out proactive client initiatives related to the wording of messages on mojePZU and in the complaints area.

Customer Journey and Emploee Experience Map in the complaints handling area

For PZU, the client’s perception of activities undertaken for the benefit of external and internal clients is of great significance. In an attempt to find out as much as possible about what is important to the client and what experience the client has with the PZU brand, a number of tests were conducted, in which one of the tools applied for analyzing processes from the client’s perspective was the Customer Journey. The Customer Journey is a tool that describes all events and experiences of the client in his or her interaction with the brand.

The Customer Journey map depicts the client along with his or her objectives, fears, specific questions, doubts and emotions. The tool lets us know what the client feels and thinks and what choices he or she makes at each stage of contact with PZU. There are many such points of contact, including advertising, leaflets, employees, the website, the app, Contact Center consultants, the offering, agents, opinions of other people. Each action taken by the client and the accompanying emotions are depicted on the Customer Journey map.

The tool helps us eradicate the causes of negative experiences and design new ones that are better. To create the map, a 360 analysis is applied, looking at the aspects concerned through the eyes of the client, employee, agent and service providers. This in-depth analysis enables the deployment of a ‘quick wins’ solution that promptly brings the desired effect. It allows us to devise products that better meet client expectations, improve systems and applications used by the clients, introduce improvements in communication, process and documents, etc. The map helps us focus our employees’ attention on the clients and their feelings, understand the clients, their motivations, expectations and selection paths and engage employees to try harder while keeping the clients in mind.

The actions we take as part of the Customer Journey include:

- regulating activities and business responsibilities within in the firm;

- rollout of a data collection and initiative management tool;

- reporting the status of proposed initiatives (as part of the management information report for senior management);

- workshops with operational employees – in selected business areas (following a review of complaint volumes) and developing initiatives within the workshop formula;

- constant monitoring of proposed initiatives and keeping in contact with business units responsible for implementing the changes.

In December 2019, the Client Journey and Employee Experience Map projects were completed. During their execution, a number of recommendations and initiatives were developed. In 2020, they were forwarded for the conduct of detailed reviews. On this basis, specific solutions and methods of their deployment were developed. An exchange of communication within the organization was also carried out pertaining to recommendations resulting from the projects, developed and implemented initiatives and planned follow up activities. One of the objectives for 2021 is to change the complaints handling process to improve its perception by clients and to make it easier and friendlier for employees involved in handling client notifications.

Due to the COVID-19 pandemic, the PZU Group implemented solutions and processes to minimize the risk of infection and spread of the COVID-19. Insurance branches and agencies, bank outlets and medical centers remained open, adapting to all applicable legal limitations and sanitary restrictions. Above all, they were equipped with hand disinfectants, masks, sanitizers and protective plexiglass at direct service workstations. The sales, service and claims handling processes were adapted to the new requirements to ensure business continuity and, at the same time, safe customer service.

The tools enabling remote customer service, such as mojePZU, which were deployed in recent years, turned out to be of key significance. Out of concern for the health of our clients, the following new solutions were rolled out to help maintain social distance:

- remote identity authentication on the mojePZU platform and in online and mobile banking channels of the PZU Group banks;

- remote inspection of apartments and vehicles via a smartphone and video-inspections along with the calculation of damage based on photographs and telephone calls;

- Door to Door service, enabling the collection of a damaged vehicle from the client, its subsequent repair and delivery to the specified address, without the client having to contact the vehicle repair shop;

- process of opening a bank account for contactless payment of claims;

- payment of amounts due to business partners and contractors within a maximum of three days;

- greater use of remote contact channels and the mojePZU app.

PZU Remote – campaign promoting remote forms of contact with PZU during the pandemic

Our of concern for the health of our clients and their relatives, PZU launched a comprehensive campaign on television and the Internet to promote remote contact with the insurer without leaving home. A special website was set up with a description of all possible forms of remote contact, and nearly 3.5 million PZU clients received a text message with information about the availability of this form of contact. Under the campaign, we managed to reach 6.1 million individuals in the target group and approx. 25.5 million people across the population.

InPZU - an online platform for selling and handling investment funds and pension products

In October 2018, the online inPZU transaction service to sell mutual fund units s was launched. This service bypasses intermediaries and directly reaches retail clients with its new offer of index funds. Client service is done solely in the online channel without having to pay a visit to a branch while the platform is available on all network-enabled devices. InPZU has enabled the PZU Group to build the first offer of low cost index funds in Poland.

In 2020, the following work was completed on inPZU:

- the second stage of the employee portal for managing ECS accounts was launched;

- the product offering of index funds was extended by adding three new funds, including two in cooperation with Goldman Sachs Asset Management and one in cooperation with the Warsaw Stock Exchange;

- „500 for 500” investment promotion campaign was conducted (PLN 500 for regular transfers of savings to inPZU) and an investment promotion campaign for ECS participants was rolled out;

- the English version of the website was made available;

- two new pension products were launched for sales and handling: individual retirement accounts and individual pension security accounts based on index funds and five new lifecycle funds;

- a new MIFID survey was added to study the target market of investment funds with the presentation of the outcomes of the survey on the website;

- the main page of the website was modified to accommodate the sales of other TFI products and the new „Knowledge base” tab;

- a road map for the development of the inPZU portal for 2021-2023 was developed.

Highlights in 2020:

- the platform had over 22.5 thousand active users handling their ECS accounts, investment portfolios, individual retirement accounts and individual pension security accounts;

- over 1.7 million views were logged, and over 3.2 million since the launch of the platform

- TFI PZU’s clients executed over 62 thousand purchase transactions of inPZU SFIO fund participation units;

- building the image of TFI PZU as an innovative, modern and low-cost brand was solidified;

- the effectiveness reaching clients through a new sales channel (online) was enhanced.

It is important for PZU that the tools provided to our clients are simple and intuitive. To this end, in Q4 2020, a study was launched using a UX (re-design sprint) methodology, the purpose of which was to have users evaluate the mojePZU portal and develop directions for its growth on the path related to medical care in line with the expectations of our clients.

As part of the work in this area:

- 23 in-depth interviews with mojePZU users were conducted;

- over 20 people involved in designing changes in the portal were engaged in the review of client needs;

- 6 workshops were conducted over the course of 3 days;

- 70 screen proposals (for desktop computers and mobile devices) were prepared for the path of making medical and check-up appointments.

The study resulted in the preparation of specific recommendations for changes and directions of growth for the mojePZU portal along the path of making a medical appointment, e.g. ready-to-deploy models of specific screens.

In the future, a gradual rollout of these changes is planned in the app and in the portal.

Claims handling done with greater customization and more quickly

In this time of automation and digitalization of processes, clients expect to an even greater degree a customized approach. PZU has a Relationship manager, who stays in contact with the injured party for the duration of the claims/benefits handling process.

While handling the claim, the relationship manager keeps the client informed about the progress of the case. Depending on the needs, the relationship manager may also provide support to clients, act as their advisor offering specific solutions in a difficult situation. The relationship manager can also efficiently organize and manage all the services PZU offers in the framework of handling a notification. That person’s task is to walk clients through the entire process in the least cumbersome manner, including by ascertaining their preferences regarding, for instance, channels of communication or methods of rectifying the loss. Relationship managers acquire competences for various substantive lines of business, making them versatile. This ensures that different cases of the same client may be handled by the same relationship manager, even though the cases may concern different lines of business (separate competences) or even other companies.

The new claims handling model under a formula based on client support provided by the relationship manager enables the injured party to avoid many formalities related to claims handling. The relationship manager’s role is to prepare the best solutions for clients and provide advisory services to select the most optimal choice involving, among other things, the method of calculating a claim or the selection of a workshop.

When dealing with simple claims, 85% of decisions are made at PZU on the day of notification. For more complicated claims, clients receive a decision on almost 62% of notified claims within seven days. Owing to the deployment of the Relationship manager role, 96% of decisions in simple cases may be made based on the first contact with the client, and in more complex cases – almost 75%.

Crisis management procedure in claims handling

The procedure describes a number of mechanisms applied to catastrophic claims. These processes are focused predominantly on how to:

- effectively reach the client, provide assistance and comprehensive services in the shortest possible time following the occurrence of the damage;

- shorten the claim handling time;

- adjust the claims handling process to client expectations;

- improve the quality of service and client satisfaction.

The following steps are most frequently taken within the framework of this procedure:

- launch of a mobile office and four mobile mini offices;

- simplification of the processes of receiving reports and handling claims;

- relocation of resources to areas affected by the disaster and substantive claims handling;

- provision of items of key significance to the persons in need, such as tarpaulins, cleaning products, foils, foodstuffs and potable water.

Catastrophic events, which occurred in 2020, caused damage of significant scale. From 7 June to 31 July, 52,737 property claims and agricultural claims were reported. The steps that were taken and the improvements that were made allowed to quickly handle those claims. The implemented simplifications allowed to determine the amount of claims paid without the need to draft a detailed cost estimate. The implementation of robots allowed to automatically disburse the advance payment or the claim already on the first business day following the date of reporting the claim. In voivodships most affected by disasters, we operated mobile offices which handled a total of almost 800 cases. A team of experts was appointed, which followed weather reports and media publications on potential hazards. In addition, as part of pre-claims handling process, PZU consultants were calling the insureds who lived in areas at risk of inundations to check whether they needed any help.

Before-You-Call Service

The PZU Group is deeply convinced that insurers should instill a sense of security and conviction that someone will always be there for the client in times of trouble. Accordingly, the PZU Group wishes to be there for its clients when they need support the most, often even before they formally report their claim.

The Before-You-Call Service is a solution within the framework of which the insurer initiates contact with the client and offers the client actual assistance before the formal notification of the claim, putting both the client and the client’s needs first. The Before-You-Call Service is dedicated to clients who have experienced an unpleasant random event in which their property was damaged.

After the occurrence of an insurable event, such as a fire, gas explosion or tornado, an attempt is made to identify the client based on information obtained from publicly available sources, including the Internet or radio. In cases where the injured person is positively identified as a PZU client, contact with the client is established to provide actual assistance in the unfortunate situation (for instance, if the policy cover provides for a substitute apartment, it will be offered to the client during the first contact). Registration of the claim may be performed on a different day, at a time convenient for the client.

Data for 2020:

- 54 registered events;

- 36 events in which PZU clients were injured;

- 283 injured PZU clients;

- 152 persons we managed to contact

- 283 registered assistance cases, including:

- 4 registered claims.

Alior Bank has in place the „Rules of Individual Client Service Quality Standards” and „Business Client Service Quality Standards”.

Professional service and sales handling indicator

The customer service standards in the PZU sales networks among tied agents, field agents, life agents of the Agency Sales Department and multiagents, as well as in branches and office agencies are permanently verified by Mystery Shopping audits.

These audits are an important operating tool for the departments that are managing the sales networks, and allow them to monitor the quality and standards of services offered to clients by sellers. Thanks to quarterly Mystery Shopping audits, we can diagnose a systemic problem that may occur in a particular area of the agent’s or the center’s operations, and then rectify this problem with appropriate communication and training.

Already in 2018, the audits were bolstered through implementation of the professional service and sales handling indicator (PRO) which simplified the Mystery Shopping measurement method in PZU branches.

Prior to its rollout, the quality of client service was measured using several (up to four) indicators, which was not easy to grasp. They were thoroughly reviewed and served as the basis for the creation of a single, much simpler indicator, which was then augmented to include the guidelines stipulated in the General Data Protection Regulation (GDPR) and the Insurance Distribution Directive (IDD).

By assumption, the audits are carried out on-site, however, due to the COVID-19 pandemic, an online form of audits was also launched, which includes tied agents, field agents and interns. On the other hand, Mystery Shopping audits in branches, office agencies and multiagencies were put on hold several times.

The average PRO for 2020 was 97%.

Client satisfaction survey in PZU

Client satisfaction with quality of obtained services and products is a key factor for building a long-term relationship with the client. The information on what clients need enables PZU to develop and set new goals. PZU has been carrying out client satisfaction surveys for many years. Each year, it broadens their scope, deploys new methods and improves the reporting process, thanks to which we are able to better respond to the clients’ needs.

The results of client satisfaction surveys are distributed to the business units responsible for customer service on the given stage and discussed during the results presentations.

They allow us to, on an ongoing basis:

- identify the sources of client dissatisfaction with a product or service;

- compare the level of client satisfaction across products or areas;

- take action in case of declines in client satisfaction;

- introduce remedies in the customer service process to improve client satisfaction.

PZU reports key Customer Experience indicators such as:

- Customer Satisfaction Score (CSS);

- Customer Effort Score (CES);

- Net Promoter Score (NPS).

PZU has also deployed a permanent benchmark audit to compare client satisfaction with products, services and customer service provided by PZU and insurance industry competitors.

Client satisfaction indicators are also included in the goals prescribed for the employees at various levels. These indicators are directly connected with the employees’ responsibilities, and the employees have a real impact on them through the quality of their work.

In a quarter, PZU carries out more than 20 audits and conducts on average 20 thousand client interviews. We conduct regular meetings with business units responsible for the product and the service process – to present the audit results and discuss the areas that need improvement.

In 2020, we managed to:

- introduce, in the area of claims handling and benefits, three new permanent audits in the text message form, which gave us a faster feedback on the level of client satisfaction and ability to respond more quickly;

- introduce new sales goals on the basis of client satisfaction indicators;

- popularize the client’s perspective in the organization through publication of the „Client Pulse”,i.e. a one-page dashboard summary of key client satisfaction audit indicators.

Segmentation of claims

LINK4 puts the client in the center of interest at every stage of the product. This is made possible thanks to, among other things, introduced innovations. One of them is an advanced analytical model that utilizes machine learning algorithms to send claims down the proper handling path already at the registration stage.

The applied solution adapts the claim handling process as efficiently as possible to the severity of the loss, taking into account the solution that is the most optimal to the client, shortens the claim handling time and reduces the client’s involvement in the whole process.

PZU’s client ombudsman

PZU clients can count on the assistance of the Client Ombudsman in difficult, multi-faceted cases that require a tailormade approach, who acts as a liaison between a client and a PZU employee should an ambiguous situation occur.

Clients directly contact the Ombudsman through a web form, e-mail or by phone. It is also possible to have a visit in person in PZU’s Head Office in Warsaw. Every notification is recorded in the system while the Ombudsman intervenes in cases that, in his or her opinion, require a non-standard approach. The ombudsman also acts as an educator, since many questions forwarded to him/her pertain to the insurance product’s functioning. More than 1.5 thousand notifications were filed with the Ombudsman in 2020. Due to COVID-19 pandemic, no in-person visits were available. The accepted standard calls for closing a case within five business days.

Scope of notifications forwarded to the Client Ombudsman in 2020:

PZU’s Client Ombudsman also verifies the cases forwarded to the Management Board of PZU and PZU Życie, and mediates before the Financial Ombudsman and in the Polish Financial Supervision Authority.

The Client Ombudsman has established cooperation with the National Association of the Deaf (PZG) to best align insurance products with the needs of deaf and mute clients. In collaboration with PZG, we managed to make a film showing how deaf and mute persons can use PZU road assistance service. The film has been posted on PZG’s website.

Going forward, the activities of the Client Ombudsman are intended to be continued, with greater emphasis placed on its educational function and continued collaboration with the National Association of the Deaf through educating and assisting deaf people in using insurance products.

BEST PRACTICE

LINK4 Client Ombudsman

LINK4 Client Ombudsman was appointed on 28 May 2020. His/her tasks include supporting the clients who completed the complaint procedure in LINK4 and are still disagreeing with how their case was resolved. He/she handles difficult and complex cases that require additional attention, analysis and broad perspective. The client may use the Client Ombudsman’s support before forwarding the case to the court or filing a complaint with a state institution such as e.g. the Financial Ombudsman or the Office of Competition and Consumer Protection.

In 2020, the Client Ombudsman received more than 100 requests for intervention. It considered 23 client cases. Nine cases were resolved in client’s favor.

Client satisfaction survey using the NPS (Net Promoter Score) method

Alior Bank monitors the level of client satisfaction on quarterly basis. These surveys concern the score on overall satisfaction with cooperation with the bank as well as on various products and distribution channels (the surveys cover branches and partner centers). The surveys plus remarks make it possible to determine the overall level of client satisfaction and their willingness to recommend the bank to other clients. This means that Alior Bank can do more comprehensive research forming the starting point to implement improvements. The NPS for 2020 was at 32 (29 a year earlier).

Health Ombudsman

To better understand the patients’ needs and strengthen relationships with them, in December 2020, PZU became the first insurer in Poland to appoint the Health Ombudsman.

The Health Ombudsman’s primary responsibilities include listening to patients, assisting them in finding the best solutions and supporting them on every stage of interaction with health care operators – from the moment of purchase to visits or examinations in a medical center. The Health Ombudsman’s duties also include educating clients and promoting healthy lifestyle, preventive medical testing and physical activity. Close contact with patients will allow to have real impact on the development of new solutions and health products.

The clients may contact the Health Ombudsman through the online form or e-mail.

In the near future, the Health Ombudsman will continue the activities that have been undertaken and commence new prophylactic initiatives.

“PZU Zdrowie is one of the key operators on the medical services market. I believe that we have achieved that position through building positive relationships with patients, which is a priority to us. Appointment of the Health Ombudsman confirms the strategic importance of healthcare in our Group’s operations. Especially now, when all of us are paying particular attention to health, we want to provide our patients with an additional form of contact and support”

Anna Janiczek, President of the Management Board of PZU Zdrowie