Insurance

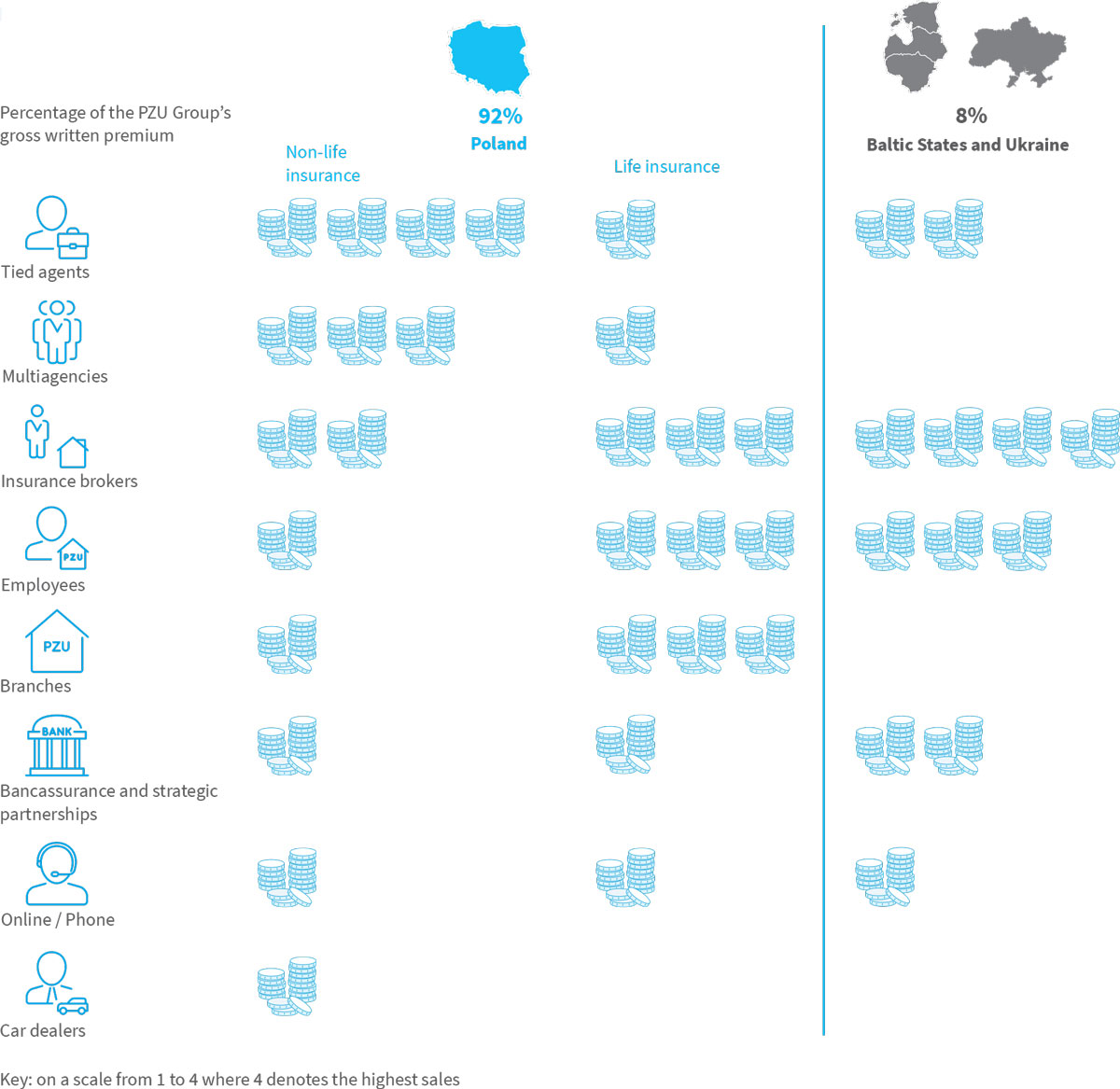

Insurance remains the core business of PZU Group’s activity. The business model utilizes effective sales channels and efficient claims handling functions in their midst. The PZU Group offers insurance in Poland, Lithuania and Ukraine (life and non-life insurance), as well as in Latvia and Estonia (non-life insurance).

Clients and products

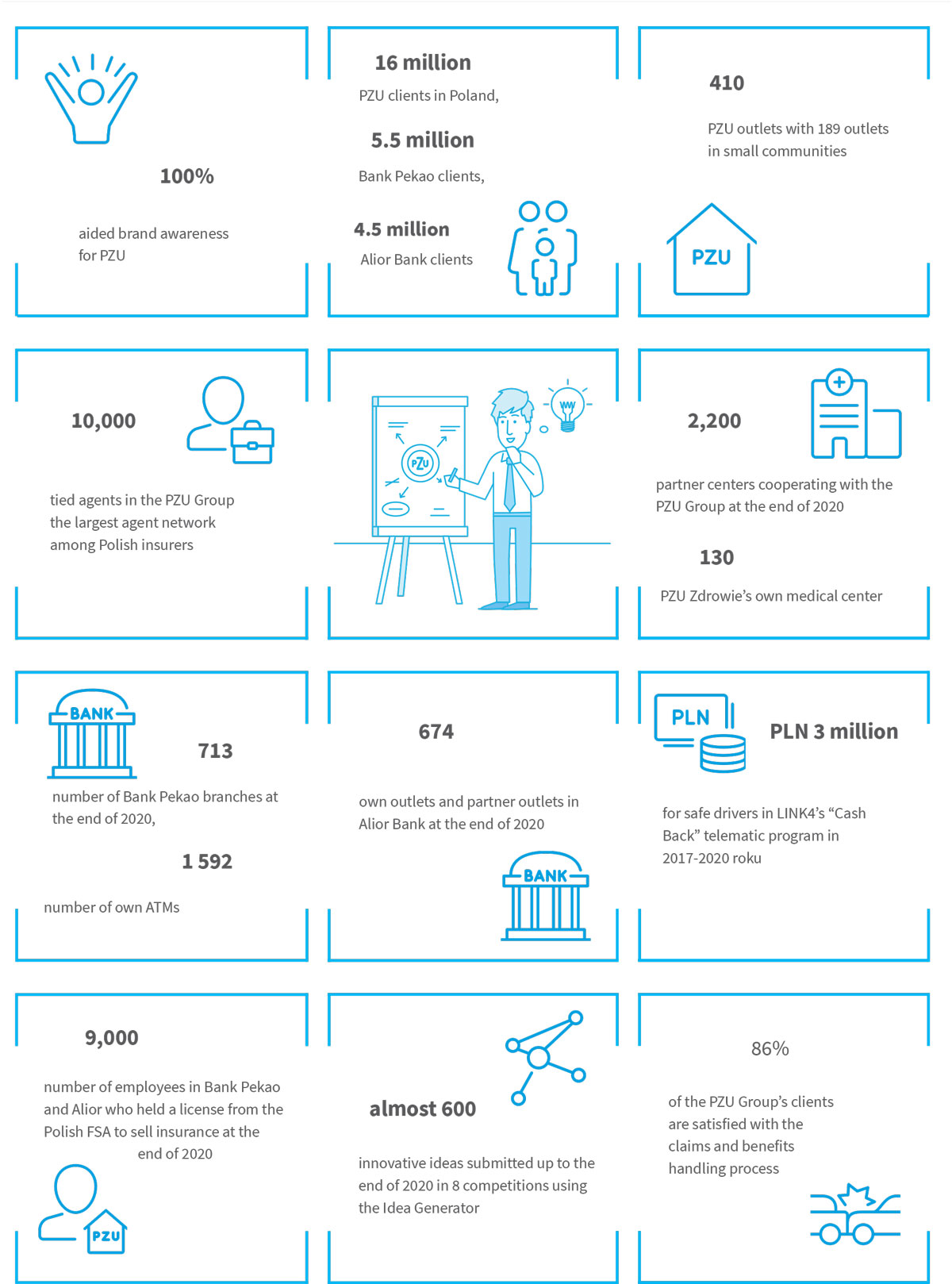

In Poland the PZU Group has a comprehensive product offer of life and non-life insurance for 16 million clients. They are retail clients, sole proprietors, small and medium enterprises and large corporates. The PZU Group enjoys the trust of 1.2 million clients in the Baltic States and Ukraine.

Non-life insurance is offered in Poland under three brands: PZU, the traditional and most well-known brand, Link4 associated with direct sales channels and TUW PZUW, i.e. the mutual insurance company.

Life insurance is sold in Poland under the PZU brand.

In the Baltic States the PZU Group conducts insurance activity under the brand of Lietuvos Draudimas in Lithuania, under the Balta brand in Latvia and under the PZU brand in Estonia. In the Ukrainian market insurance is sold under the PZU brand.

Distribution network

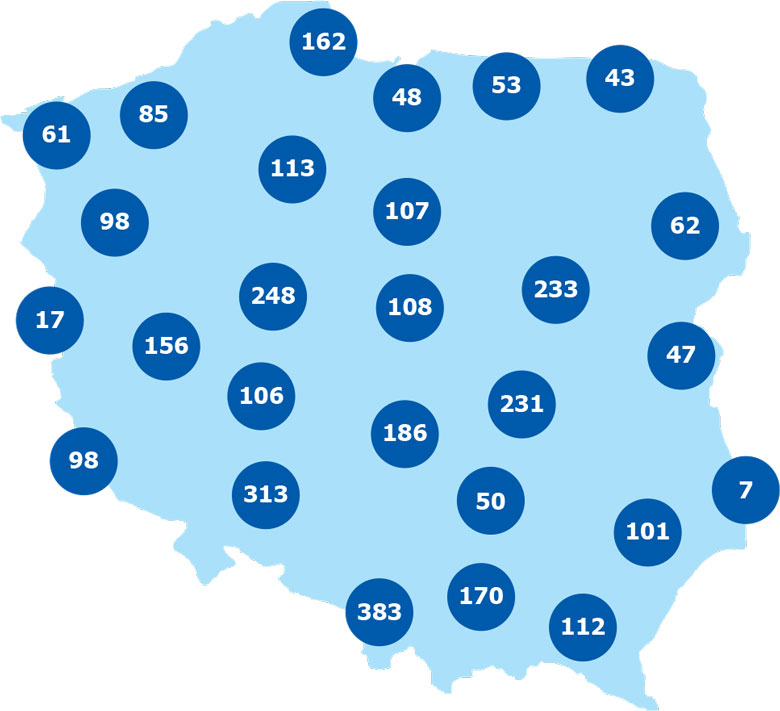

PZU's sales network is organized in a manner that ensures sales effectiveness along with high quality services. Among all the Polish insurers PZU offers its clients the largest sales and service network. It has 410 branches across the country with 189 in small communities and tied agents, multiagencies, insurance brokers and electronic distribution channels.

Distribution network

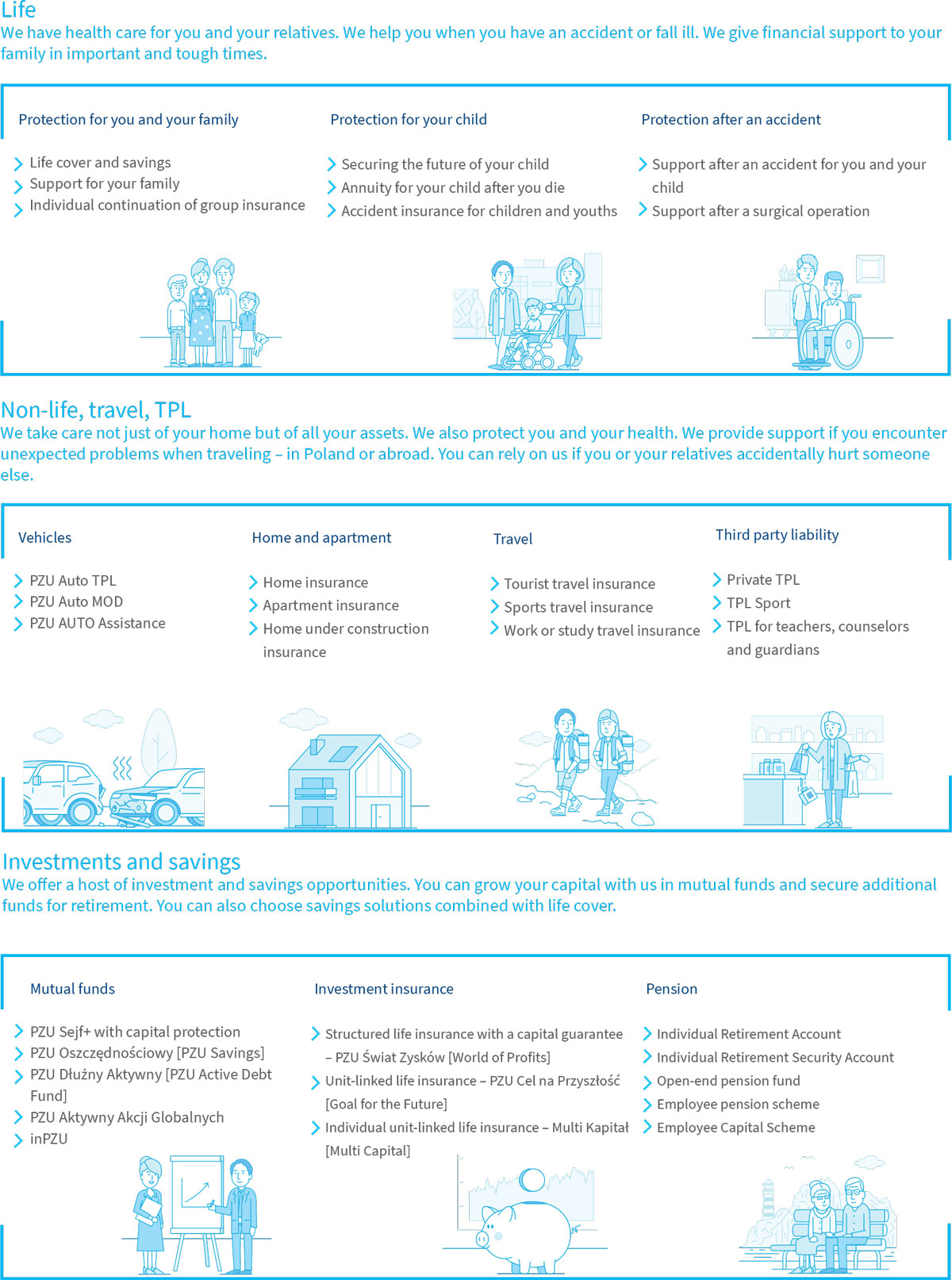

For you and your family

In 2020, the PZU Group’s distribution network included the following:

- tied agents – in Poland the PZU’s own agency network consisted of 10 thousand tied agents and agencies. We conduct sales through the agency channel predominantly in the mass client segment, particularly of motor and non-life insurance as well as individual insurance (life insurance). Link4 cooperated with 250 agents not tied to any aggregator. In the Baltic States the Group’s agency network comprised over 700 agents, while in Ukraine there were approx. 400 agents;

- multiagencies – on the Polish insurance market, the PZU Group cooperates with more than 3.2 thousand multiagencies. They perform sales operations targeted mainly at the mass market (insurance of all types is sold through this channel, especially motor insurance and nonlife insurance) as well as individual life insurance. Link4 cooperated with 50 multiagencies, while in the Baltic States Group companies cooperated with 18 multiagencies and in Ukraine with 20 multiagencies;

- insurance brokers – in Poland, the Group, in particular PZU’s Corporate Client Division, cooperated with almost 1.1 thousand insurance brokers. In the Baltic States where the brokerage channel is a major insurance distribution channel, the Group companies cooperated with over 400 brokers and in Ukraine with nearly 40 brokers;

- bancassurance and strategic partnership programs – in the area of protective insurance, in 2020 the PZU Group cooperated in Poland with 13 banks and 21 strategic partners. The PZU Group’s business partners are leaders in their industries with client bases offering enormous potential. In strategic partnership, cooperation applied mostly to companies operating in the telecom and power sectors through which insurance for electronic equipment and assistance services was offered. Link4 cooperated with 5 banks in different sales models – traditional, online and call center. In the Baltic States, PZU cooperated with 7 banks and 42 strategic partners, in Ukraine with 9 banks and 2 strategic partners; • the direct channel – non-life insurance sales through this channel is conducted in particular by LINK4 and comprises cooperation with price comparison engines, website and call center. This channel comprises also the mojePZU portal.

Bulk of PZU’s clients prefer direct service by the agent and in the agent’s office, therefore PZU focuses on developing a professional agency sales network.

Bulk of PZU’s clients prefer direct service by the agent and in the agent’s office, therefore PZU focuses on developing a professional agency sales network.

The tied agent network undergoes constant transformation in order to improve the professionalism and constantly improve the quality of client service. Most agents running offices offer advice regarding the clients’ property, life and health insurance. They provide clients with comprehensive service as part of the product offering of the entire PZU Group. The support constantly provided to agents by PZU (attractive equipment and marketing signage of the offices, agent onboarding and training on service quality standards, substantive support for the sales teams, financial support) increases their physical recognition in the field. Many of the efforts focus on locations where there are not many agent offices or their presence is not very strongly marked.

In 2020, due to the COVID-19 pandemic, agents received from PZU additional support which ensured safety both to agents and to their clients. PZU equipped their offices with Plexiglas screens, 7 thousand liters of disinfectant, 55 thousand facemasks and 168 thousand disposable gloves. Thanks to intensive promotion of the mojePZU portal, agents were well prepared for effective sales using this tool, which was particularly important in the initial phase of the pandemic.

Branches and agencies

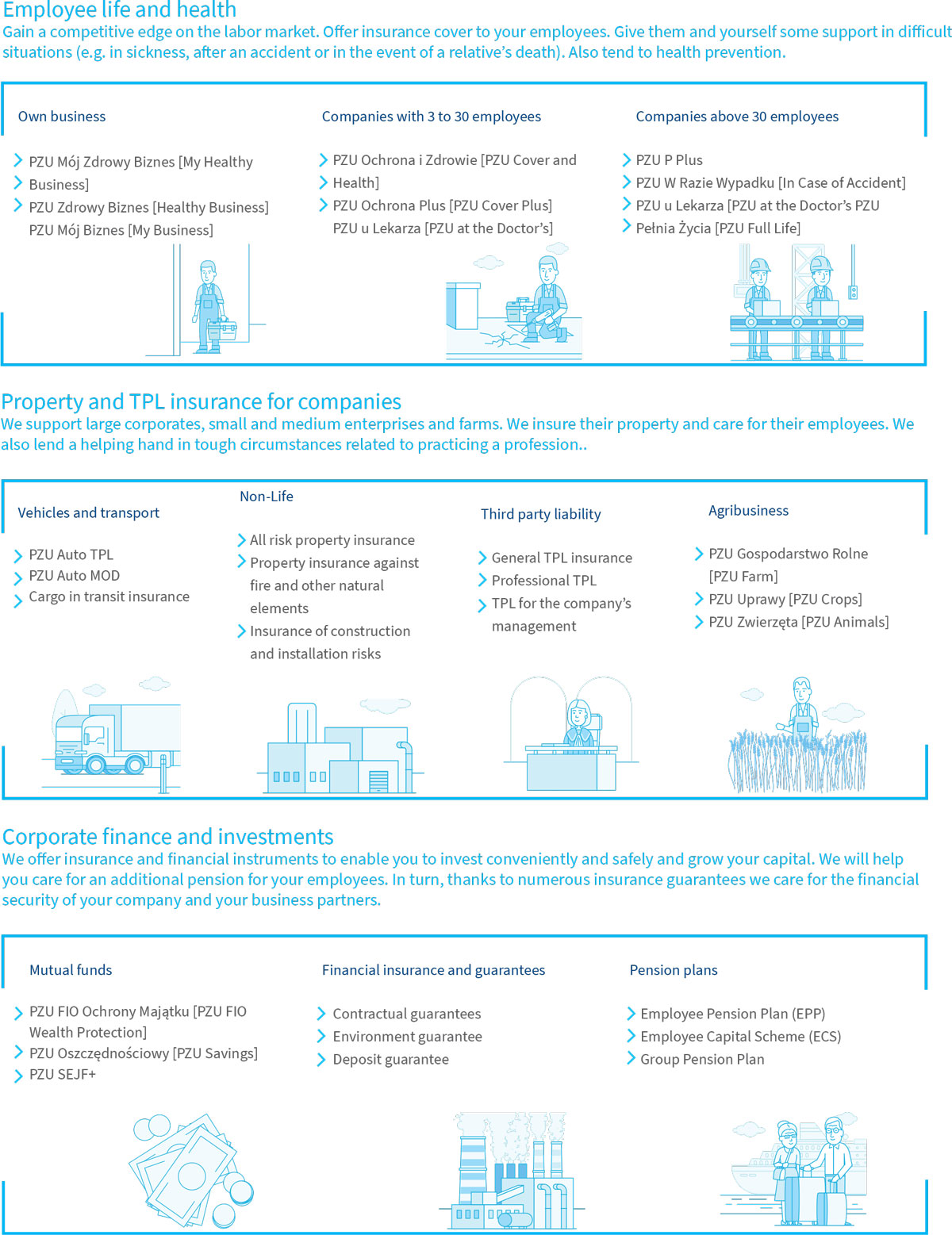

For companies and employees

PZU develops and promotes the agents' online presence. We set up their websites, which we then put up on the www.agentpzu.pl site and prepare their Google "business cards". From 2020, PZU has also been offering Facebook profiles, co-managed by PZU. The visit statistics and ifnormation from agents confirm that these efforts help them reach a broader group of clients.

At the end of 2020, the number of the PZU’s tied agent offices throughout Poland was 1,500, i.e. the same as the year before.

Cooperation with the banks within the PZU Group (Alior Bank and Bank Pekao) opened an additional platform for PZU to build lasting client relations. At the end of 2020, more than 9 thousand banking advisors (5.3 thousand in Bank Pekao and 4.1 thousand in Alior Bank) received the KNF license and became qualified to sell PZU’s insurance products.

Claims and benefits handling

Claims handling is for the client the moment when they check the quality of their product.

Satisfying client expectations during the claim handling or case handling process is the key to building PZU’s client relationships.

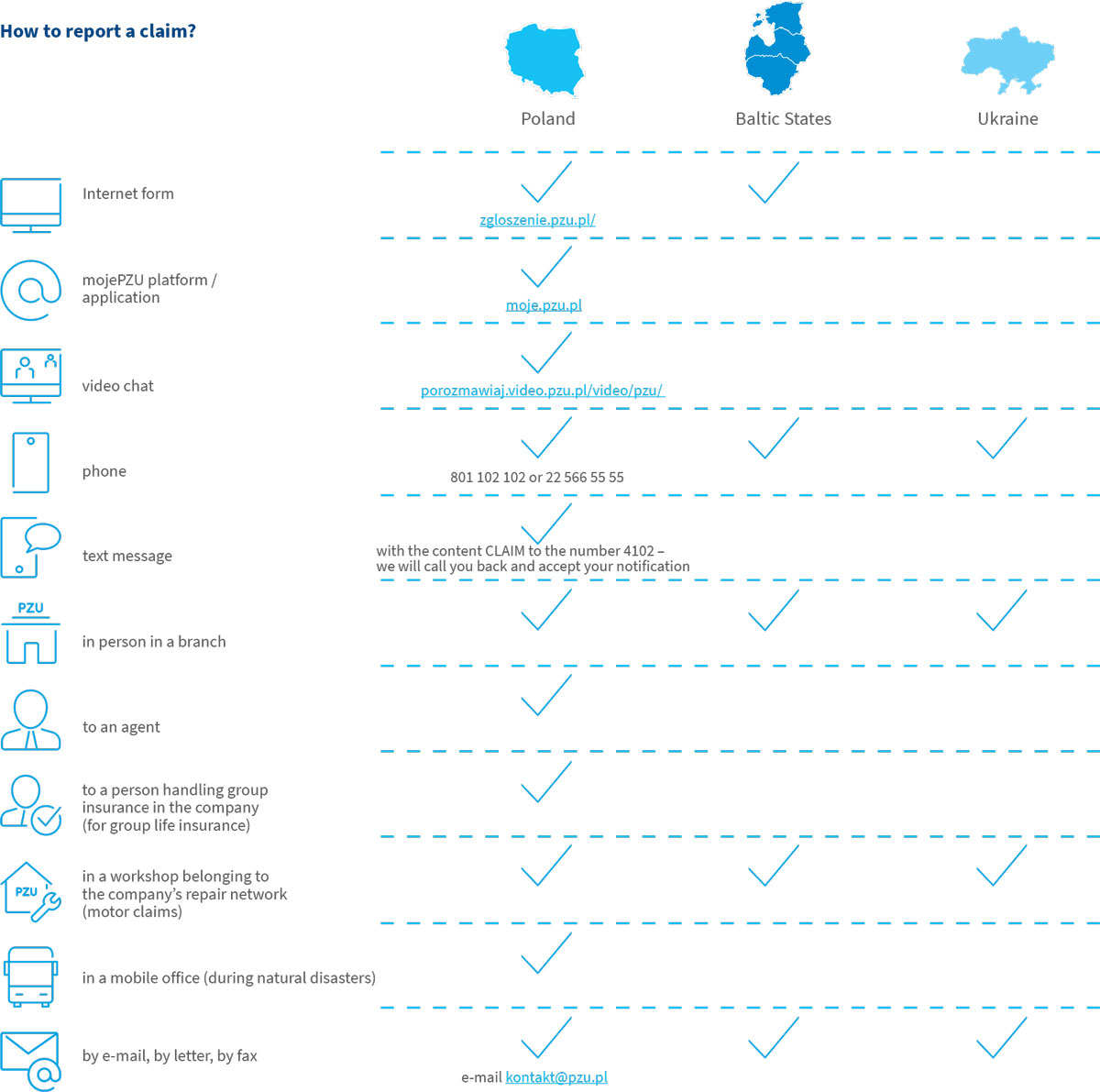

The online service for reporting claims and benefits zgloszenie. pzu.pl/ makes it possible to automatically calculate the claim amount and report a claim for foreign partners.

The service upholds its emphasis on simple communication language and was awarded the “Simple Polish Language Certificate” by the Institute of Simple Polish at the University of Wroclaw.

In Poland, claims and benefits handling is carried out in competence centers operating across the country. It is founded predominantly on electronic information and is not tied to the insured’s place of residence or the place of the event. The competence centers handle specific types of damage, which is conducive to stricter specialization and boosts client satisfaction. These units specialize, among others, in handling claims arising from property, motor or personal damage, claims reported by corporate clients, benefits, damage involving in the theft of personal vehicles or claims handled as part of the direct claims handling (DCH) service. A separate unit deals with technical issues related to claims arising from motor or property damage.

A similar claims handling model is in place at PZU Estonia where there are 3 competence centers. Centralized among them is the handling of certain types of damage, such as personal injuries, large property damages and marine damages. In other Group companies operating in the Baltic States and Ukraine, the claims and benefits handling process is entirely centralized.

In connection with the COVID-19 pandemic, in 2020 we launched remote work for most claims handling staff, which secured the continuity of the claims and benefits handling.

PZU develops methods for determining the extent of the loss to expedite the calculation of the indemnity amount. In non-life insurance, on top of conducting a vehicle inspection in a fixed inspection point, through a Mobile Motor Expert in a venue chosen by a client or in a Repair Network workshop, the quantum of the loss may be determined under:

- a simplified service procedure (without conducting a vehicle inspection),

- self-service (calculation of the amount of the loss on your own),

- video inspection (using an app to determine the amount of the loss).

PZU supports handling the entire claims handling process with the use of a smartphone. Using a smartphone, the injured party may:

- report a claim,

- summon assistance on the roadside or from home,

- initiate the repair process in a Repair Network workshop,

- conduct a video inspection and determine the amount of the loss.

PZU deals only with the final stage in the claims handling process, i.e. determining the amount of the indemnity and disbursement.

In addition, PZU has a self-service claims handling solution. In the case of ADD claims and benefits, the client personally marks the nature of their injuries on an intuitive human figure, which makes it possible to calculate the benefit amount. The client may accept or reject the proposed amount. This is the only solution of this type on the market for handling ADD claims and benefits.

In motor and property damage and in centers repairing devices damaged by a power surge, the client may also assess on his or her own the amount of indemnification payable. This information is then forwarded online to the Relationship Manager who executes the payment. This service allows clients to participate in the payout decision in a simple and convenient manner and reduces the waiting time for the disbursement of the benefit. Satisfaction surveys carried out among PZU clients reveal the fact that insureds are of a very favorable opinion about this service. PZU companies in the Baltic States are rolling out similar improvements. Since 2019, automatic death benefits payments are made. The payments are approved by automated processes, which considerably speeds up the handling process of those cases.

In first half of 2020, PZU implemented the ADD video assessment, in which medical examinations are carried out using a video call. The organization of the process if based fully on PZU Group’s resources. The examination takes place in the place where the client stays, without having to leave home. The service is intuitive and very convenient – all the client needs is a device with Internet access. The solution worked perfectly well especially when outpatient clinics were closed due to the COVID-19 pandemic. Despite closed clinics, clients had access to medical examinations. In addition, PZU limited the scope of documents required from clients. This is another initiative which made it possible to continue our services during the pandemic and, additionally, had positive impact on client satisfaction.

In connection with the COVID-19 pandemic, remote inspections were the preferred form of determining the indemnification amount. If the client could not use the video inspection service the claim was handled on the basis of photographs sent by the client.

In addition, PZU introduced robotics elements at the stage of summarizing the claims notification, sending out correspondence, making the claims decision and downloading police memos in order to speed up the indemnification payout. We also use robotics in specific claim types, e.g.: motor claims, mass claims caused by weather phenomena, and handling of medical claims.

The Repair Network workshops apply an innovative technology using artificial intelligence algorithms and allows for analyzing the photographs documenting the loss. It can also determine the scope of the damage and classify the given part for repair or replacement. The algorithms can detect more anomalies more quickly and accurately, and confirm that all repairs are carried out in compliance with the procedures and standards adopted by PZU. In 2020, artificial intelligence analyzed over 160 thousand claims worth over PLN 1.5 billion.

In Q4 2020, PZU Życie introduced robotic handling of medical benefits. The optical character recognition (OCR) tool reads the data from the medical documentation and transmits it to a resource operated by a robot. Then, on the basis of a learnt script, the robot automatically transfers the read data to the product system (hospitalization period and diagnosed conditions), and verifies whether the data on the information sheet from the hospital pertain to the insured. The automation of the process supports Relationship Managers in their daily work, limiting the manual operations in the system. It also facilitates retrieval of data from unstructured documents, which shortens the benefit processing time and eliminates mistakes which could occur during manual data input.

In 2020, LINK4 implemented an analytical claim segmentation engine. Using machine learning algorithms, the engine chooses the claims handling path which will be optimal for the client. During a discussion, the relationship manager enters data in the system and then obtains the proposed claims handling path, which is communicated to the client during the same visit. In the claims handling process, the customer experience depends also largely on the loss adjusters, whose work in Link4 is supported by technology. A specially-designed application allows them to calculate the claims amount more precisely based on the customer data. The solution enables the analysis of information obtained in conversations with the clients, which allows it to propose the most suitable cooperation scenarios. Analytical claim segmentation also enables early detection of total losses, which can speed up the claims handling process significantly in such cases.

LINK4 has increasing numbers of robots, whose functionalities have significant influence on work efficiency. This reduces the claims handling time and supports introduction of additional activities satisfying the client. Robots support, among others:

- automatic registration of motor, property and casualty claims,

- update of the provision amount and entry of costs of inspections carried out by third party suppliers,

- verification of a vehicle’s loss ratio,

- collection of loss documentation,

- handling of memos from the Insurance Guarantee Fund,

- handling of medical opinions,

- review of vehicles with MOD insurance,

- availability of loss files.

Advanced data analysis is used also in the anti-fraud tool implemented in LINK4. Combination of the scoring engine and the prediction model business rules allows for quick detection and analysis of suspicious cases and identification of links between loss participants.

PZU was the pioneer in DCH (Direct Claims Handling) on the Polish insurance market. Currently, DCH is executed in two forms: at an individual level or under the agreement worked out by PIU. DCH is offered by entities accounting for nearly 70% of the motor TPL insurance market, as measured by gross written premium. The said agreement, which is based on a lump-sum approach, has dramatically simplified the settlement of claim payments between insurers. Thanks to DCH the claim handling following an accident is carried out by the insurer from whom the TPL policy has been purchased. It subsequently makes a settlement with the perpetrator’s insurer, without the client’s participation. PZU also maintained its own DCH solution previously introduced for clients injured by insureds in establishments that did not sign the agreement. In Estonia, direct claims handling has been regulated by the provisions of the TPL Insurance Act since the beginning of 2015. In turn, clients in Latvia who wish to take advantage of DCH must purchase a rider on their insurance. In 2020, Link4 joined the Direct Claims Handling system.

PZU has built the largest network of centers in Poland that arrange replacement vehicle rental services and roadside assistance services. A network of centers offering these services is also being developed in the Baltic States. Currently, clients of Lietuvos Draudimas in Lithuania and the Lietuvos Draudimas branch in Estonia may benefit from replacement vehicle rental and roadside assistance. Moreover, since 2015, Lietuvos Draudimas as the only insurer in Lithuania has been arranging such services for clients who have purchased its TPL insurance.

The year 2020 with its pandemic has forced us to adapt our service processes and partner cooperation rules in such a way as to ensure safety of both the clients and the service providers. We made sure that vehicles, including replacement cars, are properly disinfected (and ozonized). On-site services were performed in such a way as to limit the direct contact and risk of coronavirus contagion.

The automation efforts initiated in 2019 were continued in 2020. The average roadside assistance arrival time was reduced by a few minutes. Work on changing the supplier of the dynamic map was started – new GPS transmitters were installed for a larger group of service providers, and the processes were planned in such a way as to reduce the impact of the changes in the transition periods. Launch of new products made it possible to develop services associated with tire failure – a network of tire repair workshops and towers with a comprehensive service was expanded. Cooperation with caresharing providers developed and brought an increased number of orders, as well as launch of new caresharing points in new cities, including in Szczecin, Rzeszów and Opole. A client entitled to a replacement vehicle may use a voucher to use a vehicle from these operators. As a result, the client has access to a replacement vehicle only when it is really needed. There were changes not only in roadside assistance, but also in medical products – the service of a new rider Treatment Abroad was launched. The product ensures comprehensive organization of foreign medical services using cooperation with the Spanish provider – Further.

2020 was another year of cooperation with repair shops in the area of post-accident vehicle repairs in countries covered by the PZU Group’s insurance business. PZU has created Poland’s largest network of cooperating repair shops enabling the Company to control the quality and speed of service already at the claim handling stage. Every client who orders a repair in the PZU Repair Network receives a quality certificate guaranteeing that the repair has been performed in accordance with the highest standards. PZU is refining its proposal to assist clients in managing damage remains by selling them on the Online Assistance platform. Clients are presented with a proposal to sell their damage remains for the highest purchase offer obtained from reliable entities that cooperate regularly with the platform administrator. A similar solution is also available to clients of the Estonian Lietuvos Draudimas branch. In connection with the COVID-19 pandemic PZU launched a new service standard in the Repair Network – “door to door” service, i.e. collection and delivery of the vehicle to the client. Also Link4 provided the “door to door” service to its clients. Thanks to this solution the client could have their vehicle repaired without leaving home. Additionally, PZU introduced an obligation to disinfect the vehicle after the repair by the Repair Network shops.

Caring for the financial liquidity of the business partners, service providers and repair shop network, PZU implemented a solution which provides for reimbursement of the repair costs specified in the invoice up to three days.

PZU constantly improves its communication with clients. Traditional communication is being replaced with electronic communication and telephone contacts. To make sure the information is clear and comprehensible, letters, e-mails and text messages for clients are adapted to the principles of a simple language.

Visualizing distinct case handling stages in the mojePZU portal is a great convenience to clients. Logging into moje.pzu.pl and quoting the claim or case number, the client may find out about the case status and the steps that have already been completed.

Also available on www.pzu.pl are video tips on how to handle the claim online. Short videos featuring PZU employees explain to clients how to report a case in a few simple steps and how to check the status of the case or how to take advantage of the ADD policy in case of an accident.

Since 2014, the Assistance Organization Team (PZU Client Relationship Managers) has been operating in PZU, a solution that is unique on the insurance market. These are mobile experts who visit injured persons in their homes. The relationship managers determine the actual standard of living of the victim and in consultation with the victim assess his/her needs arising from the accident for which PZU is liable under TPL insurance. For severely injured accident victims, PZU Client Relationship Managers arrange a broad array of medical and social rehabilitation and psychological support. Injured parties have the option of obtaining treatment and rehabilitation in modern medical centers cooperating with PZU. Persons who have become disabled as a result of an accident are given advice on how to adapt the closest environment to their needs and select properly devices that compensate for dysfunctions and disability. Injured children are covered by a program of comprehensive, long-term psychological support featuring, as one of its elements, therapeutic/leisure camps run by counselors experienced in treating post-accident trauma. In 2019, this PZU program was extended to also cover the children who experience trauma after a parent dies as a result of oncological disease. This way PZU addresses the social effects of this increasingly common civilization disease.

Since 2018 PZU has been developing the pre-claims handling process. The process involves PZU making initial contact with an injured party, even before that party reports a claim. After the occurrence of random event (such as fire, gas explosion, whirlwind), we attempt to identify the client based on information obtained from publicly available sources (including the Internet, radio, e-mail and emergency phone number). If the identification is successful, we establish contact with them to provide help in the difficult situation. PZU proves the required support, starts the claim handling process and arranges for assistance, including rental of a replacement home, clearing up of the property.

PZU has had the PZU GO solution in place for two years. The main aim of this modern solution is to help on life threatening situations and monitoring driver and passenger safety when driving. The PZU GO mobile app is connected to a small beacon device, installed on the car windshield. The device collects data and sends them to the PZU GO app via Bluetooth. When it detects a situation which may suggest an accident it sends information on the client’s location to PZU’s Remote Client Service Center. Then a Center employee contacts the client to check if they need help. If it is not possible to establish telephone contact, emergency services are called to the scene (ambulance, fire brigade, police). The PZU hotline may be also contacted by pressing a button (SOS) on the app’s main screen. PZU GO is not only emergency help – it is also professional assistance in arranging for towing, replacement car rental, claim registration or help in quick disbursement of the claim. After the event PZU employees remain in constant contact with the client at each stage of recovery and repair of material damages. Remote Client Service Center consultants support clients and agents in operating the app, installation or replacement of the device. They can also order a device on the client’s or agent’s request or following a sale in the direct channel, and register the PZU GO device following a sale in the direct channel.

PZU uses the remote sensing method during crop claims handling following poor overwintering. Remote sensing makes it possible to remotely obtain information concerning facilities or areas from a distance, most frequently by using sensors installed on aircraft or satellites facilitating the measurement of reflected and emitted radiation. In the autumn of 2019 PZU carried out the tests of the use of satellite remote sensing in risk underwriting in conclusion of winter crops insurance. Satellite remote sensing also worked in elimination of frauds involving reporting damages in fields where the crops have already been collected. The remote sensor method is objective and makes it possible to source the data required to calculate the indemnity quickly for a large geographical area. As PZU can see a broad application of remote sensing in claims handling the method is subject to constant improvements.

An invariably significant area of operation in claims and benefits handling is the prevention of insurance fraud. PZU keeps improving the solutions that curtail the payment of undue benefits, prevent clients from counterfeiting documentation filed during the submission of a claim or statements regarding their health status. In 2018 we extended support to identify undue payments of claims and benefits by incorporating a Fraud Management System (FMS) when examining non-life insurance claims. In the crime prevention division (covering insurance crime) there are three teams whose employees perform clarification activities and prepare recommendations for the decision issued in the case, and participate in preparation and issuing opinions on business decisions for individual product groups and procedures. PZU signed contracts to procure services involving the audit of electronic registers of post-accident vehicle traction and sourcing documents and information from international entities.

PZU also tries to build the processes and improve client service based on the employees’ experience. By the end of 2018 we appointed an Inspiration Council comprised of employees with outstanding knowledge, competences, creativity and engagement. The Council has over 400 members. The Council is a place where employees put forward solutions facilitating their daily work and improving client service processes. Ideas are analyzed, improved and, to the extent possible, implemented.

Innovations in insurance

Innovations, digitalization and development of new technologies have been in progress for years in all the sectors of the economy. By rolling out many new solutions companies are gaining an ability to transform their strategy, business model and client, partner and employee experience. PZU understands how much new technologies are changing the insurance industry therefore it implements innovative solutions. Activities in this area are supported by the Innovation Laboratory – a unit created with a view to verifying the latest technological trends and testing new solutions across the organization. We are creating modern solutions both internally and in cooperation with the best start-up companies in the respective fields. Annually, over 1,000 solutions are analyzed and 10-15 pilot projects are run. Projects implemented with the support of the Innovation Laboratory are awarded in local and international competitions (in 2020 the awards included, the Celent Model Insurer award for AI in claims handling, the ICAN Institute and MIT Sloan Management Review Polska award – AI Innovation Transformation Champion in claims handling, the Innovation Eagle award for the COVID-19 Band of Life).

In November 2020, the third year passed since the time when the PZU Management Board adopted the Innovation Strategy developed by the Innovation Laboratory. Its purpose is to help pursue the PZU Group’s mission and strategy and maintain the high level of competitiveness in the new technological environment. The Strategy points to three specific areas in which PZU should be especially active while seeking innovation:

- utilizing Big Data,

- digitalization,

- new client interactions.

The designated areas ascribed the direction to be taken by the pilot projects organized in cooperation with the Innovation Laboratory, the relevant business departments and IT. In 2020 they made it possible to vet the ideas and prepare the following implementations:

- COVID-19 Band of Life. PZU adapated the Bands of Life to the needs that appeared in the healthcare system in the times of the COVID-19 pandemic. The COVID-19 Band of Life reduces the risk of infecting the medical staff in hospitals because it remotely measures the patient's oxygen saturation of blood, pulse and body temperature in real time. The device alarms when the measured parameters are significantly exceeded and when the patient's fall is detected. The unique application of this medically certified solution enables doctors to supervise the patients' health with physical contact. In addition, the solution offers high accuracy of measurements and easy reconfiguration to adapt the device to the conditions and needs in different hospital wards. The band works for three days on a single charge and is easy to disinfect;

- AI in claims handling. PZU handles over 500 thousand motor claims per year. Bulk of them are handled by repair shops. Most claims comprise mass photographic and tehcnical documentation which often requires additional in-depth analysis. Analyses may be carried out only by trained and highly-qualified experts. The implemented artificial intelligence (AI) solution has improved their daily work. Before using AI most cases handled by repair shops had to be analyzed manually. Thanks to the implementation of a solution using artificial intelligence algorithms, experts recieve for analysis only selected cases while the remaning ones, which do not raise any doubts, are approved automatically or semi-automatically. The implementation translates into significant financial savings and improvement of client satisfaction. Work is under way to implement artificial intelligence in the remaining motor claims handling processes;

- Cyber SME. It is an online platform which automatically scans the websites of small and medium-sized companies and verifies their cyber attack safeguards. A company using this service receives a free report on cyber threats, assessment of the susceptibility of their website to cyber attacks and recommendations allowing it to mitigate the risk and prevent losses;

- Car Expert. The service supports clients in purchase of a car and is an element of a comprehensive ecosystem of services for drivers in PZU. The offer comprises: verification of car sale commercials, verification of the technical condition of the car, insurance product “Mobility cover” ensuring support in case of failure of the verified vehicle for 90 days from the purchase, and a loan for the purchase of the car. Non Stop Assistance brand experts verify the technical condition of the car before the purchase.

In 2020, PZU continued collaboration with two startup accelerators: MIT Enterprise Forum CEE and RBL_Start (Alior Bank’s accelerator). In the first one, solutions were searched associated with three key areas: big data, digitalization, and new client interactions. In the second one, PZU together with Alior Bank undertook a Special Initiative #COVID-19, which dealt with innovative solutions aimed at combating the coronavirus pandemic and its effects. The initiative attracted huge interest. From among several hundred submissions, experts decided to implement one of them as a pilot project. The solutions put forward under these programs enjoyed interest from selected business areas – in both programs five pilot projects were launched in the two programs.

LINK4 is known for its innovative approach to insurance. On the Polish market the Company is running a number of innovative projects to distinguish the brand and position it among the top modern and digital insurers. The challenges associated with the COVID-19 pandemic pointed to the weight and importance of these technological solutions.

One of the technologies which gained importance in 2020 is RPA (Robotic Process Automation). Robots imitating human work can perform simple activities and take over comprehensive processes. In the times when replaceability of employees and their presence can be strongly limited due to COVID-19, this technology makes it possible ensure the company’s business continuity. In 2020, robots operated over 50 processes in LINK4. Additionally, where automation of the entire process was not possible, they supported employees in preparation of parts of the process. Thanks to RPA it was also possible to create document repositories, which significantly facilitated documentation access and management, especially in the remote work formula.

In 2020, LINK4 also implemented the Voice Bot. The tests of the technology have shown that the bot is often more efficient that a consultant, and at the same time scores positive opinions from clients. In the first place the Voice Bot was introduced in the Premium Handling area, where during the conversation with the client the bot reminds them about the necessity and method of notification of the sale of the car, delay in payment of the insurance premium, or a prepared offer in connection with expiry of the policy. Work is under way on analyzing the potential of the technology in other areas.

To facilitate the insurance purchase process for clients, LINK4 introduced a new tool which supports inspection of the car by the client during purchasing the MOD insurance. The solution makes it possible to save the time required for the inspector’s visit and reduces the risk of coronavirus infection thanks to limiting physical contact. To use it, one needs a smartphone with Internet access. The process is simple and intuitive. The client receives a personalized link to a browser app in which, after accepting the rules and regulations, he/she is required to take 8 pictures. What is important, the photos need to be done in real time, which reduces the risk of fraud. They are also verified by artificial intelligence for correctness, among others, against the policy data.

LINK4 as the first insurance company in the Polish market created a repository of public documents secured with the blockchain technology. Thanks to that, it satisfies the requirements of the so-called “durable media” and LINK4 may provide its clients with documents in the electronic version with a guarantee that they cannot be modified and removed over time. All document modifications are visible, because the unique document number, the so-called hash, changes; it is stored and may be verified also on the website of a “Trusted Third Party” (KIR), which guarantees the authenticity of the document. This significantly streamlines the communication and reduces the necessity to send hardcopy documentation.

In 2020, LINK4 continued the transformation program in Data Driven Company started the year before. The Data and Advanced Analyses Center executed a number of innovative projects which made it possible to generate measurable business benefits. The Company made a milestone in terms of using the data processing and analysis capabilities. A modern Data Lake was built, which allows for efficient creation of Machine Learning models and business analysis. In addition, technologies were implemented to make it possible to process huge volumes of unstructured data which so far were not available for broader analyses. The data were used to better understand the client needs and address them in the form of an appropriate scope of insurance and price.

In the second half of 2020 the company implemented the Microsoft PowerBI tool which changed the way in which data are analyzed in Link4. Simple tables were replaced by manager dashboards, which support multidimensional analysis. At the end of 2020 there were 20 dashboards which were daily used to analyze and monitor business processes.

The Data Driven Transformation also involved strengthening employee competences. In 2020, LINK4 continued the Analyst Academy program (2nd semester) started in 2019 to improve the analytical skills of the persons employed on three advancement levels. In addition employee knowledge in the technical and business area was developed.

Other initiatives and tools implemented by LINK4 in 2020 in the IT area comprised:

- modern online premium rate calculator, which allows for advanced analytics and Machine Learning to optimize the price. Price optimization made it possible to execute the company’s business objectives and maintain portfolio profitability;

- the new, simplified and intuitive calculator in the direct channel, which significantly reduces the offer calculation time;

- completely remote sales process in the agency channel, which turned out indispensable during the COVID-19 pandemic and was very well received by agents;

- the Omnichannel program, aimed at ensuring a consistent offer for the client in all communication channels, was launched. Thanks to using new online rate calculation solutions and identification algorithms it will be possible to present a personalized offer to the client in real time;

- a hybrid architecture was prepared, combining Microsoft Azure with Link4’s ICT environment, on which the first cloud services will operate in 2021: the new TPL/MOD calculator and an app for processing and analyzing the data from the calculation.

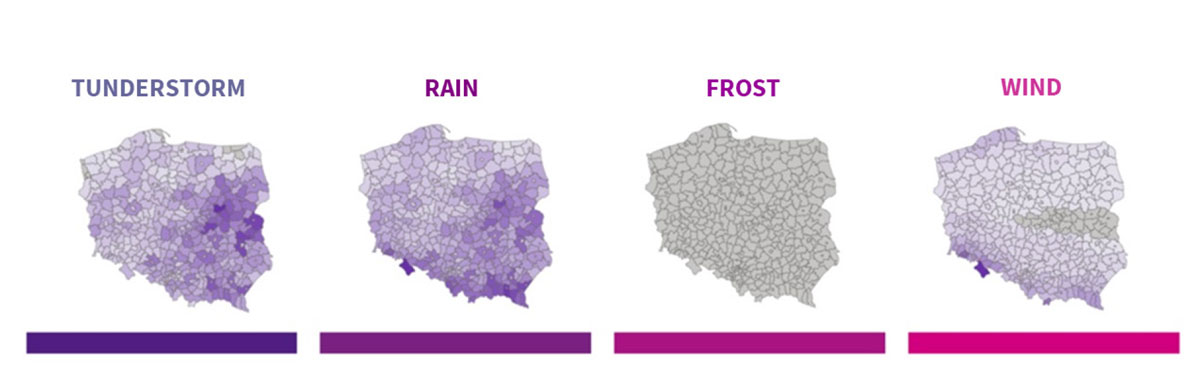

Weather alerts, i.e. text messages with information about extreme weather conditions (such as gales, tornadoes, torrential rains, storms, snow storms) are very popular among Link4’s clients. LINK4 sends them to clients who have real property insurance or motor insurance. In the event of expected sudden and severe weather phenomena clients receive a text message containing a warning and a website link where they can read about how to protect themselves against the adverse consequences of such events. In 2020, LINK4’s clients received over 1.6 million such alerts, three times more than the year before. In the case of mass phenomena, the tool makes it possible to identify groups of clients who might have suffered a potential loss. As a result, it is possible to establish contact with the client, assess his/her situation and needs, and accept the claim report still before the client contacts LINK4.

Areas to which alerts were most frequently directed in 2020 broken down by weather phenomena

The PZU Group has the potential of creating innovations also for the industry. The activities in this respect are conducted under the PZU LAB brand. The Company delivers innovative solutions and supports corporate clients in optimizing risk in their business.

PZU LAB engineers cooperate with clients at all stages of operations of their enterprises and offer a broad range of solutions and consulting and training services and services using innovative technologies. The Company supports clients in the area of safe enterprise management, reduction of financial losses associated with contingencies and stoppages, and building the reputation of a trusted partner in the local and international market.

From the beginning of the company’s operations, PZU LAB experts have helped over 400 clients to mitigate risks associated with their business. They implemented, among others, solutions using artificial intelligence and such projects as Self-learning Company, Enterprise Safety Tool (ESTools) and PZU LAB Academy.

The ESTools system, developed by PZU LAB together with its technological partner F@BE (FABE Safety Factory) under an acceleration program, serves to increase and maintain safety in industrial plants. The system supports ongoing control of insurance audit orders.

In 2020, as part of PZU’s prevention fund, PZU LAB launched the proprietary ESTools RyzykoPro program in 20 Polish businesses and provided the support of PZU LAB’s risk engineers in the daily conduct of their operations.

Artificial intelligence solutions implemented by PZU LAB used for failure prediction are another example of risk management innovations. They make it possible to detect irregularities in the operation of machines, going back as much as tens of hours earlier than the existing systems. This has paramount importance especially for complicated industrial installations (for example, turbines) because it makes it possible to avoid damages and losses in the range of tens of millions of zlotys.

PZU LAB has highly qualified engineering staff in the area of thermovisual measurements, holding the international ITC Level 1 (Infrared Training Center) certificate. Thermovisual measurements are performed by practitioner engineers with established theoretical background in infrared measurement techniques. PZU LAB engineers also have industry-specific expertise regarding operation and measurement of power facilities and mechanical systems. Based on the audit, the client receives a thermovisual report constituting a tool for managing risk in the enterprise. PZU LAB conducts training regarding thermovisual measurements for clients and business partners, thus increasing the competences of the safety services in the daily risk management in the enterprise.

PZU LAB cooperates with university centers, state institutions and engineering offices within the framework of partner groups and research councils.

One of PZU LAB’s initiatives in the Academy is a study program entitled “Risk management in the enterprise in the insurance aspect” launched in September 2018 together with the Business School of the Warsaw University of Technology. In the 2020/2021 semester, the second online edition of the studies was launched with the Kozminski University in Warsaw. During studies, risk managers in a business, agents, brokers and students have an opportunity to absorb a huge amount of practical knowledge on risk management, the role of insurance and deployment of state-of-the-art technologies improving industrial safety. Lectures and case studies are presented by experts combining theory with practice, who on a daily basis work on the point of contact of the world science, business, institutions and engineering offices. During the classes, also PZU LAB experts share their expertise on risk assessment and optimization in industry.

In 2020, PZU LAB developed an innovative system for safety certification of the Polish industry and preparation of guidelines for industries of strategic importance for the PZU Group, including the timber, power, municipal waste, chemical and petrochemical industries. PZU LAB engineers developed a consistent system for assessment of the level of safety and efficiency of devices that are key to safeguarding against emergencies. The system combines many years of experience of the engineers with the latest research and technological solutions. Satisfaction of the criteria by installation producers and users is confirmed by the PZU LAB Approved certificate. The “PZU LAB Approved” logo, as a sign of quality and safety of the solutions used, will be visible on sensors, fire doors, extinguishers and other fire system elements subject to certification. The PZU LAB SA system stands out with its comprehensive certification procedure. Certification covers the entire installation with the full life cycle, i.e. production, distribution, design, installation and maintenance. This approach is key as engineers observe the irregular mandatory servicing of the systems and equipment, aggressive price competition and cost cutting at different stages, which adversely affects the quality and effectiveness of operation of the safety systems.

PZU LAB organizes regular safety forums. This way it continues the initiative of sharing knowledge and promoting “best practices” with industrial clients in cooperation with the institutions responsible for security and with academic partners. Due to the COVID-19 pandemic, in 2020 only one safety forum for the maritime industry was organized, attended by approx. 250 representatives of entities and institutions from the maritime sector.

PZU LAB also organizes industry training in the form of workshops. In 2020 training was delivered on claims under third party liability, motor claims and machinery property claims in the power industry for Polskie Sieci Energetyczne. Due to the pandemic, the training courses were organized online.

PZU LAB took part in the Scale-Up acceleration program funded by the Polish Agency for Enterprise Development (PARP). Its aim is to get together young technological companies with big firms which need innovative solutions for business. As a result of the work under the project and acceleration, in 2020 the BlueMind start-up was established; it developed a tool for parameterization of the risk of corporate clients. Another company, 3DV Risk, which was commissioned by PZU LAB to develop the first in Poland prevention portal, is preparing realistic 3D animations presenting loss events from the initial cause to the final outcome. The aim of the animation is to show the causes of loss events in order to avoid similar events in the future. The animation is a training element for the company’s employees. After watching it the employee takes a test on the knowledge of safety rules associated with the presented event. The animations are aimed at attracting attention to the errors made in the production process.