Non-life insurance (PZU, LINK4 and TUW PZUW)

Market situation

Measured by gross written premium in the first three quarters of 2020, the non-life insurance market in Poland grew by a total of PLN 33 million (+0.1%) in comparison to the corresponding period of the previous year.

Gross written premium of non-life insurers in Poland (in PLN million)

Source: KNF (www.knf.gov.pl), Quarterly Bulletin. Rynek ubezpieczeń [Insurance market] 3/2020, Rynek ubezpieczeń 3/2019, Rynek ubezpieczeń 3/2018, Rynek ubezpieczeń 3/2017, Rynek ubezpieczeń 3/2016

The market growth was driven primarily by gross written premium increase in the non-motor insurance area by PLN 424 million (+3.4% y/y), while gross written premium in the motor insurance area was PLN 391 million lower (-2.1% y/y).

In motor insurance the gross written premium in motor TPL insurance, which is the most important category for the overall market, (PLN 11.8 billion representing 37.8% of the overall premium in non-life in the first three quarters of 2020) fell by PLN 384 million y/y (-3.2% y/y). The change in premium was negative again, both in direct (down by PLN 329 million, -2.9% y/y) and indirect business (down by PLN 55 million, -6.1% y/y). These trends were caused by active price-based competition initiated after a period of high profitability of the portfolio, supported by lower frequency of losses (the period of periodic social isolation as a result of the pandemic) and a slow-down on the leasing market. The sales of motor own damage insurance declined by PLN 6 million (-0.1% y/y) to PLN 6.4 billion, which accounted for 20.7% of the overall written premium in non-life insurance in the first three quarters of 2020.

In non-motor insurance, the increase in gross written premium growth was affected mostly by higher sales of insurance against fire and other damage to property (up PLN 559 million, or 10.0% y/y, of which PLN 361 million was for direct activity), liability insurance (up PLN 97 million, 5.3% y/y) and assistance (up PLN 50 million, 5.2% y/y). A decline occurred only in various financial risk insurance products (down PLN 157 million, -18.9% y/y) and accident and sickness insurance (down PLN 196 million, -8.9% y/y).

Non-life insurers – percentage of gross written premium in the first three quarters of 2020 (in %)

*PZU Group – PZU, LINK, TUW PZUW; 32.1% - PZU Group’s market share in non-life insurance on direct business.

Groups: Allianz – Allianz, Euler Hermes; Ergo Hestia – Ergo Hestia; Talanx – Warta, Europa; VIG – Compensa, Inter-Risk, TUW TUW, Wiener (Gothaer); Generali - Generali, Concordia

Source: Polish Insurance Chamber / KNF’s Quarterly Bulletin. Rynek ubezpieczeń [Insurance Market] 3/2020

In the first three quarters of 2020, the overall non-life insurance market generated a net result of PLN 3,038 million, which is PLN 893 million less in comparison with the corresponding period of 2019. Excluding the dividend from PZU Życie, net profit of the non-life insurance market decreased PLN 892 million (-34.3%).

After the first 3 quarters of 2020, the technical result of the nonlife insurance market rose PLN 243 million to PLN 2,362 million. The largest contributor was an increase of the technical result on motor own damage products by PLN 235 million (effect of an increase in earned premium with a simultaneous decline in claims and benefits paid) and by PLN 62 million in assistance products, while the result on insurance against fire and other damage to property fell by PLN 78 million and on loan and guarantee insurance products was PLN 31 million lower y/y.

The following entities in the PZU Group operate on the non-life insurance market in Poland: the Group’s parent company, i.e. PZU, LINK4 and TUW PZUW.

To address expectations voiced by clients, the PZU Group has been consistently extending its offering in recent years for both retail and corporate clients. As a result, it has been able to retain its high market share.

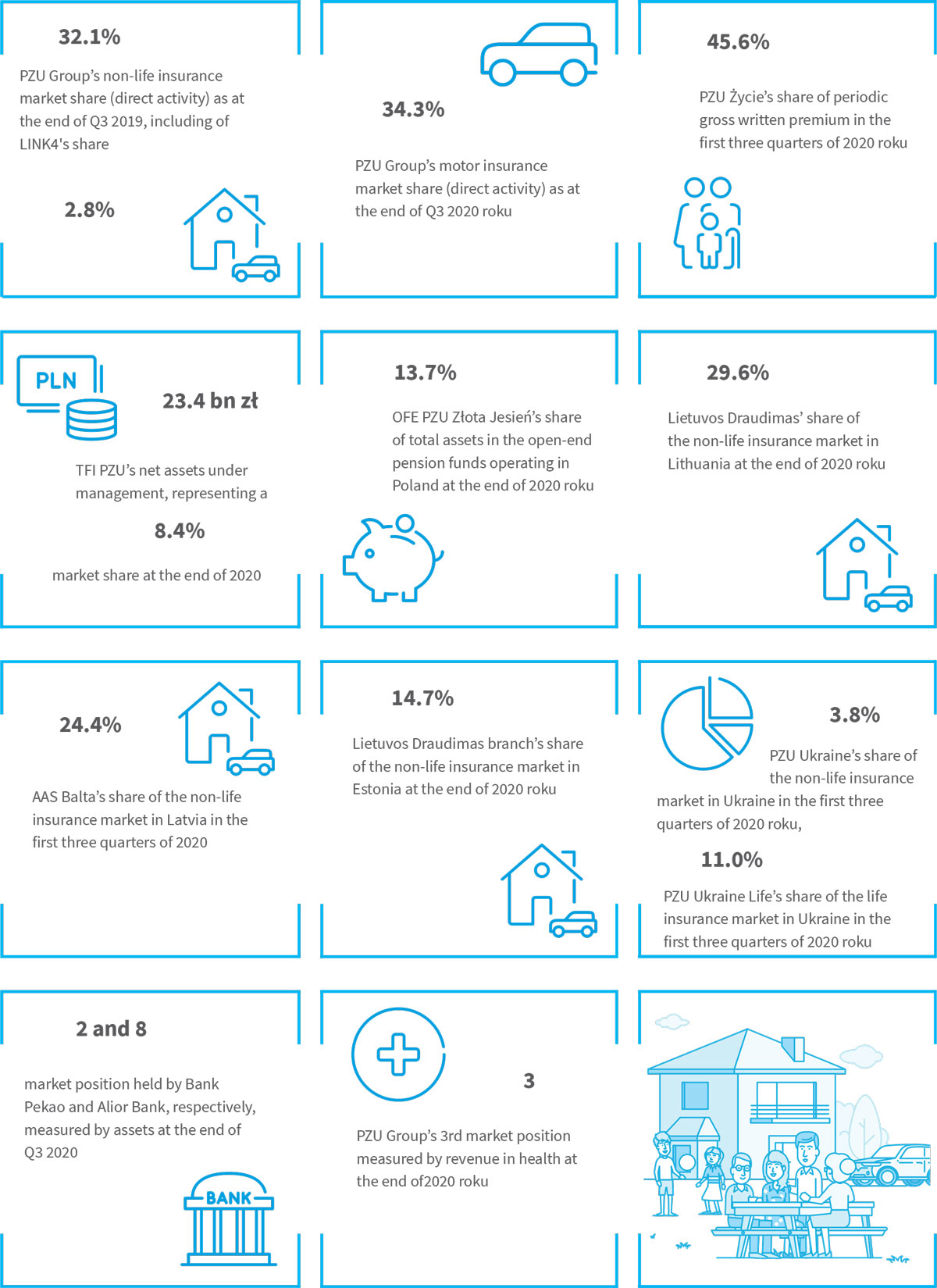

After three quarters of 2020, the PZU Group had a 32.6% share in the non-life insurance market (32.1% on direct activity) compared to 33.7% in the corresponding period of 2019 (33.2% on direct activity). It recorded a slight decline but maintained high profitability of the portfolio.

After the first three quarters of 2020, the PZU Group’s technical result (PZU together with LINK4 and TUW PZUW) stated as a percentage of the overall market’s technical result was 45.6% (the PZU Group’s technical result was PLN 1,077 million while the overall market’s technical result was PLN 2,362 million).

The total value of the investments made by non-life insurers at the end of Q3 2020 (net of the investments in subsidiaries) was PLN 66,630 million, up 9.1% compared to the end of 2019.

Non-life insurers estimated their net technical provisions at an aggregate amount of PLN 58,030 million, signifying 3.4% growth compared to the end of 2019.

Non-life insurance market – gross written premium vs. technical result (in PLN million)

| Gross written premium vs. technical result | 1 January – 30 September 2019 | 1 January – 30 September 2020 | ||||

| PZU* | Market | Market net of PZU | PZU* | Market | Market net of PZU | |

| Gross written premium | 10,482 | 31,079 | 20,597 | 10,131 | 31,112 | 20,981 |

| Technical result | 1,016 | 3,119 | 1,103 | 1,077 | 2,362 | 1,285 |

Source: KNF (www.knf.gov.pl), Quarterly Bulletin. Rynek ubezpieczeń [Insurance market] 3/2020, Rynek ubezpieczeń 3/2019, PZU’s data

PZU’s activity

As the PZU Group’s parent company, PZU offers an extensive array of non-life insurance products, including motor insurance, property insurance, casualty insurance, agricultural insurance and third party liability insurance. At yearend 2020, motor insurance was the most important group of products offered by PZU, both in terms of the number of insurance agreements and its premium stated as a percentage of total gross written premium.

Faced with changing market conditions, PZU realigned its offering in 2020 to clients’ interests and needs by rolling out new products and innovative solutions.

PZU’s activities in the mass insurance segment:

- in PZU Home insurance, it extended the scope of the assistance product to include the new personal data protection service, Alerty BIK. The service offers protection against unauthorized use of personal data by third parties, for example to take out a loan. Additionally, a Service Option clause was added to the private property insurance and the insurance cover of the Health Assistant product was modified. The Service Option is a new claims handling standard, in which the company organizes and pays for repairs following a water damage loss, instead of paying out a claim. The new Health Assistant product offers rehabilitation procedures to clients suffering from an orthopedic injury. Also, a new pricing tool Radar Live was introduced, which will enable an even better alignment of the offering with the client’s expectations and risks;

- in the PZU Crops product, an additional limit of 10% was introduced to supplement the existing limits of 17% and 25% – in the risk of adverse effects of ground frost for grain and rape. Additionally, the limit of claims paid for total losses occurring after May 31st was increased from 85% to 90% to adapt it to market regulations;

- expanded the scope of PZU Firma by adding the following:

- the PZU Cyber clause providing insurance cover, among others, against the consequences of cyberattacks and breaches of privacy regulations (including the GDPR and the Polish Personal Data Protection Act). In the event of a cyberattack, PZU will arrange for and cover the costs of assistance by incident management specialists, IT investigators, law firms and a PR agency,

- changes to make the offer more attractive for businesses, which included definitions, a catalog of liability inclusions and a catalog of additional clauses, which was extended; simplifications were introduced in the area of data collection to speed up the offering process, as well as system prompts pertaining to the insurance cover recommended by PZU depending on the business profile;

- increased the appeal of General TPL insurance (independent product) and PZU Advisor for businesses, forwarders and IT service providers, by making changes to certain definitions and liability exclusions. The wording of some clauses, including forwarder’s third party liability, was modified;

- rolled out the PZU against Cancer product for clients under the age of 65 who have not been diagnosed with cancer prior to enrolling in the insurance. The insurance offers funds needed for treatment in the event that a malignant neoplasm is diagnosed, including pre-invasive or non-malignant brain tumor. It also offers the possibility of obtaining an additional medical opinion from an international specialist;

- changed the pricing of the PZU ADD insurance for athletes and in short-term contracts;

- launched the UTO TPL insurance of personal transport devices to accompany the TPL insurance for owners of motor vehicles. The insurance covers losses caused by the use of a personal transport device, such as e.g. a bicycle, electric scooter or a segway transporter. A new rider to the TPL insurance for motor vehicle owners who are natural persons increases its appeal and differentiates the product on the competitive motor insurance market;

- supplemented the PZU AUTO Assistance insurance with doctor consultations in the event of an accident of a bodily injury suffered in connection with the use of a vehicle. The additional benefit is an element of the medical insurance growth strategy in the PZU Group. Its purpose is to encourage clients to use medical care in PZU;

- extended the coverage in the PZU AUTO Legal Protection insurance for businesses and their car fleets, mainly for corporate and fleet clients, to also include:

- assistance abroad provided over the phone for an owner or a driver of a vehicle insured with PZU; this product assistance in determining liability for a loss, protecting the client from being falsely attributed fault,

- legal consultation in Poland or abroad after an accident involving a vehicle insured with PZU,

- increased the sums insured to PLN 2,000 in the Komfort option and to PLN 50,000 in the Super option. Modification of the legal protection insurance cover ensures comprehensive protection of a fleet and a corporate client and reduces its operating costs. PZU benefits by reducing the frequency and value of foreign losses in TPL insurance of motor vehicle owners;

- added the PZU Motor Tires insurance to its offering, providing assistance and funding for clients with PZU Auto TPL or PZU Auto MOD for the repair or replacement of a damaged tire in a vehicle. This insurance stands out due to its very broad available cover, adjustable in accordance with the client’s needs. Another advantage is the largest assistance network on the market comprising over 700 PZU partners providing road assistance services.

Most of the changes in the corporate insurance segment increased the effectiveness of collaboration with intermediaries and the appeal of the dedicated offering for fleet clients and leasing companies. Major new products included:

- deployment of a new offering in the property insurance in international transport, aimed at increasing PZU’s competitiveness and standardizing the offering, in particular for clients in the business of both domestic and international transport;

- development of the PZU D&Oskonała Ochrona [PZU D&O Perfect Protection] sub-product for small and medium-sized enterprises, which covers third party liability insurance for members of governing bodies of such companies.

In financial insurance, PZU was unswerving in its support for the Polish economy by providing insurance guarantees and securing the performance of contracts in such key areas as the power sector, the construction industry and the science and innovation sector. The most important activities related to the product offering were as follows

- modified the Environmental guarantee product to secure claims by owners of waste, who are obligated to obtain a permit for collecting and processing waste;

- introduced a financial loss insurance GAP in the dealer channel;

- changed the risk assessment process for offering insurance guarantees, insurance of bank loans and GAP financial loss insurance.

In 2020, PZU cooperated with 8 banks and 10 strategic partners. PZU’s business partners are leaders in their respective industries and they have client bases offering the possibility of extending the PZU’s offering with additional innovative products geared towards those clients. By actively cooperating with PZU Group’s banks, i.e. Bank Pekao and Alior Bank, PZU continues the implementation of a comprehensive offering using the banks’ distribution networks. This cooperation has allowed PZU to steadily expand the offering and scale of sales of insurance products linked to bank products, including insurance coverage for cash loans and mortgage loans.

In strategic partnerships, cooperation was based mostly on companies operating in the power sector through which PZU offers assistance services, e.g. the assistance of an electrician or a plumber as well as the newly introduced health assistance. PZU’s insurance offering is also present on the e-commerce market through cooperation with PLL LOT, iSpot and Allegro.

LINK4's activity

LINK4, the first insurance company in Poland offering products by phone continues to be one of the leaders on the direct insurance market, extending its cooperation with multi-agencies, banks and strategic partners. It offers an extensive array of non-life insurance products, including motor, home, travel and third party liability insurance.

Given the changing market situation, the company has focused on the development of innovative solutions providing added value to both its clients and business partners. By using new technologies in internal processes and in relations with clients, the company continues to challenge the way of thinking about insurance. At the end of 2020, LINK4 had 47 fully-robotized processes and 9 applications, which support daily tasks of employees.

As the first insurance company on the Polish market, LINK4 started to provide public documents to clients in 2020 on a durable medium using the blockchain technology. Thanks to that, they have access to electronic versions of documents with a guarantee that they cannot be modified and removed over time. By doing this, the company satisfies legal requirements by using cutting-edge technology, making communication much easier, while reducing the need for mailing hard copy documents.

LINK4 was one of the first insurers in Poland to established the function of the Client Ombudsman in 2020 in cases that go beyond the available complaint paths.

In connection with the COVID-19 pandemic, the company introduced a number of solutions to facilitate the work of intermediaries. Just one week after the state of epidemic was announced, it introduced the option of executing insurance contracts remotely, without the client having to sign the documents. It also introduced the option of carrying out inspections without the participation of an agent.

It also launched a special claims hotline for clients who are employees of medical services, the police, city guards or other public service institutions that are directly involved in combating the pandemic, as well as volunteers assisting the infected and the elderly. Their notifications are processed first.

The recognition enjoyed by LINK4 on the market and among its employees is confirmed by the title of the Best Quality Employer 2020. The award granted by Centralne Biuro Certyfikacji Krajowej places LINK4 among the best employers in Poland.

In 2020, LINK4 focused on expanding further its product offering, adapting it to the changing expectations of its clients and business partners. Its key activities included:

- extending the offer to clients holding a TPL motor policy by adding the Assistance after an Accident product. It guarantees fast handling of a loss if the event has occurred in the territory of Poland at the fault of another driver holding a TPL insurance with an insurer other than LINK4. In such a situation, LINK4 will pay indemnification to the client and will have recourse to the perpetrator’s insurer. This is very convenient for clients, who do not have to pursue a claim with a company with which they have signed no contract;

- introducing the All Risks MOD insurance, which extends the insurance cover by replacing the existing named events;

- extending the LINK4 Child offering with the disbursement of a benefit for sickness and hospitalization related to COVID-19;

- extending the cover in motor ADD insurance to include less severe, rather than just permanent dismemberment. Such injury will be classified in a new dismemberment table, which describes both the diagnosis and the consequences of an accident. LINK4 does not wait until the end of treatment with the disbursement of the benefit. Rather, it pays out the benefit on the basis of medical documentation;

- supplementing the LINK4 Travel offering to include treatment costs and assistance services related to COVID-19;

- editing the GTCI of other motor insurance products to ensure that the wording is as accessible and understandable for clients and meet the standards of a simple language.

TUW PZUW’s activity

Towarzystwo Ubezpieczeń Wzajemnych Polski Zakład Ubezpieczeń Wzajemnych (TUW PZUW) offers flexible insurance programs customized to the needs of the insured in terms of insurance cover and costs of the cover. Since 2016, it has been selling and handling commercial insurance products for various industries, focusing predominantly on cooperation with large enterprises, medical centers (hospitals and clinics), church entities and local government units.

At the end of 2020, the TUW PZUW had 432 members, which is 50 more than the year before. They are grouped by specific criteria (industry, corporate, risk types) in 52 mutual benefit societies (their number grew by two as compared to the previous year).

TUW PZUW is consistently attuning its operating model to the growing scale of business by expanding its team of professionals, who provide comprehensive service of its members’ insurance and tailor the offering to the members’ individual preferences.

In 2020, TUW PZUW continued its dynamic growth in terms of sales. It implemented new products and innovative service solutions, responding to the needs of the changing market and client expectations.

The most significant change in the offering was the launch of the Machinery Loss of Profit (MLoP) product for both large and smaller businesses. In the strategic partnership (affinity) area, an insurance offer was developed for renewable energy sources and assistance for clients with photovoltaic installations.

On the „500 List”, which is the list of largest Polish companies prepared by the Rzeczpospolita daily, TUW PZUW increased its ranking in 2020 from 460th (in 2018) to 407th. As a result it ranked 12th in the “Top Movements” category. It was also ranked 30th in the list of companies with the highest income growth (53rd in last year’s edition).

Factors, including threats and risks, that may affect the operations of the non-life insurance sector in 2021

In addition to chance events, such as flood, drought and spring ground frosts, the following risks are possible:

- slower growth of new car sales, mainly in the dealership channel and financed by leasing companies, which may result in lower sales of motor insurance;

- slowdown in the growth rate of gross written premium, mostly as a consequence of the motor insurance portfolio’s profitability generated in recent years, and thereby a rivalry to attract clients through an active pricing policy applied by competitors;

- slowdown in the economic growth in Poland – the more challenging financial standing of companies may result in elevated credit risk, a higher loss ratio on the financial insurance portfolio and deceleration in the pace of gross written premium growth in both motor insurance (predominantly leases) and property non-life insurance;

- the prospect of lower interest rates and their impact on the insurance industry;

- increase in the prices of spare parts due to the depreciation of Polish zloty against the euro and limited production and interrupted deliveries as a result of COVID-19, affect claims handling expenses;

- increase in the loss ratio may be expected to appear in the area of insurance guarantees, job loss insurance and low own contribution insurance for mortgage loans as a result of the continuing pandemic;

- reduced demand for voluntary insurance (due to a higher unemployment rate and a decline in employment) which may result from the persisting COVID-19 pandemic;

- changes in trends and behavior of client seeking customized proposals and an electronic, swift conclusion of agreements and handling insurance, forcing insurers to adapt to these new expectations rapidly;

- increase of insurance fraud as a result of the more difficult situation in numerous industries, increasing unemployment and lower employment rates;

- introduction of additional regulations or financial burdens on insurance undertakings.