Navigation Map

- strategy (insurance, health, investments, finances);

- sustainable development (sales, employees, social responsibility, natural environment and ethics).

PRACTICES

In the Chapter

GRIs

In the Chapter

GRIs

In the Chapter

List of GRIs

In the Chapter

GRIs

In the Chapter

GRIs

In the Chapter

GRIs

In the Chapter

GRIs

In the Chapter

GRIs

In the Chapter

GRIs

In the Chapter

GRIs

In the Chapter

Operating model

GRIs

- About the report

- Results

- Comment on the financial results for 2020

- Major factors contributing to the consolidated financial result

- PZU Group’s income

- PZU Group’s claims paid and technical provisions

- PZU Group’s acquisition and administrative expenses

- Drivers and atypical events affecting the results

- PZU Group’s asset and liability structure

- Contribution made by the market segments to the consolidated result

- Issuer’s financial results – PZU (PAS)

- Impact of the COVID-19 pandemic on the PZU Group’s results

- Business strategy (2017-2020)

- CSR strategy(2017-2020)

- Supplementary information and notes

- 1. Introduction

- 2. Composition of PZU Group

- 3. Shareholder structure

- 4. Composition of the Management Board, Supervisory Board and PZU Group Directors

- 5. Key accounting policies, key estimates and judgments

- 5.1 Impact of the COVID-19 pandemic on the estimates and assumptions

- 5.2 Changes in accounting policies and estimates, errors from previous years

- 5.3 Amendments to the applied IFRS

- 5.4 Explanation of differences between the 2019 annual consolidated financial statements and these consolidated financial statements

- 5.5 Consolidation principles

- 5.6 Measurement of transactions and balances denominated in foreign currencies and FX rates used

- 5.7 Purchase method

- 5.8 Classification of insurance contracts in accordance with IFRS 4

- 6. Segment reporting

- 7. Risk management

- 8. Equity management

- 9. Fair value

- 10. Gross written premium

- 11. Fee and commission income

- 12. Interest income calculated using the effective interest rate

- 13. Other net investment income

- 14. Result on derecognition of financial instruments and investments

- 15. Movement in allowances for expected credit losses and impairment losses on financial instruments

- 16. Net movement in fair value of assets and liabilities measured at fair value

- 17. Other operating income

- 18. Claims and movement in technical provisions

- 19. Fee and commission expense

- 20. Interest expenses

- 21. Acquisition costs

- 22. Administrative expenses

- 23. Employee expenses

- 24. Other operating expenses

- 25. Income tax

- 26. Earnings per share

- 27. Goodwill

- 28. Intangible assets

- 29. Other assets

- 30. Deferred acquisition cost

- 31. Property, plant and equipment

- 32. Investment property

- 33. Entities carried by the equity method

- 34. Loan receivables from clients

- 35. Financial derivatives

- 36. Investment financial assets

- 37. Receivables

- 38. Impairment of financial assets

- 39.Cash and cash equivalents

- 40. Equity attributable to equity holders of the parent

- 41. Technical provisions

- 42. Subordinated liabilities

- 43. Liabilities on the issue of own debt securities

- 44. Liabilities to banks

- 45. Liabilities to clients under deposits

- 46. Other liabilities

- 47. Provisions

- 48. Deferred income tax

- 49. Assets and liabilities held for sale

- 50. Lease

- 51. Assets securing receivables, liabilities and contingent liabilities

- 52. Contingent assets and liabilities

- 53. Offsetting financial assets and financial liabilities

- 54. Notes to the consolidated cash flow statement

- 55. Disputes

- 56. Transactions with related entities

- 57. Headcount

- 58. Other information

- Financial data (2019-2020)

- Financial data (2016-2020) Focus on: Results - check the highlights of the year!

- Comment on the financial results for 2020

- Market and business

- External environment

- Business model

- Structure of the Group

- Operating model

- Brand management

- Insurance

- Non-life insurance (PZU, LINK4 and TUW PZUW)

- Life insurance (PZU Życie)

- Insurance (international operations)

- Investments

- Investments (PZU TFI)

- Investments (PTE PZU)

- Health

- Health (health companies)

- Banking and strategic partnerships

- Banking (Bank Pekao, Alior Bank)

- Other operating areas

Focus on: Market and business - check the highlights of the year!

- Capitals (IIRC)

- Strategy and outlook 2021+

- Risk and ethics

- Objective of risk management

- Risk management system

- Risk appetite

- Risk management process

- PZU Group's risk profile

- ESG risks

- Risk vulnerability

- Reinsurance operations

- Capital management

- Ethical foundations of doing business

- Preventing corruption and conflicts of interest

- Whistleblowing System

- Transaction security

- Tax transparency

- Cooperation with suppliers Focus on: Risk and ethics - check the highlights of the year!

- Corporate governance

- Application of corporate governance rules

- System of control in the process of preparing financial statements

- Audit firm auditing the financial statements

- PZU's share capital and its shareholders

- Rules for amending the Company's Articles of Association

- Shareholder Meeting and shareholder rights

- Supervisory Board and Management Board

- Compensation paid to members of supervisory and management bodies

- Diversity policy Focus on: Corporate governance - check the highlights of the year!

- Shares and bonds

- Equity and bond market

- PZU's share price

- Banking sector on the Warsaw Stock Exchange

- PZU's investor relations

- Analysts' recommendations regarding PZU's shares

- PZU Group's Capital and Dividend Policy

- Debt financing of PZU, Bank Pekao and Alior Bank

- Rating

- Calendar of PZU's major corporate events in 2021 Focus on: Shares and bonds - check the highlights of the year!

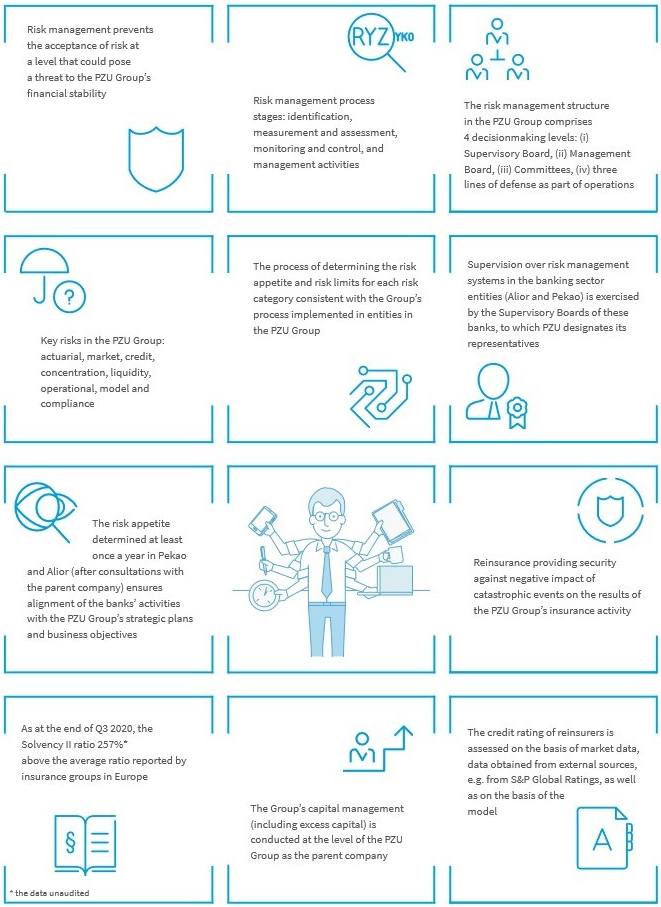

The risk appetite in the PZU Group – the magnitude of risk undertaken to attain its business objectives, where its measure is the level of potential financial losses, the decline in asset value or the growth in the amount of liabilities within one year.

Risk appetite defines the maximum permissible risk level while setting limits and restrictions for the various partial risks and the level above which remedial actions are taken to curtail further risk expansion.

The process of determining the risk appetite and risk limits for each risk category consistent with the Group’s process has been implemented in all the insurance entities in the PZU Group. The management board of each entity determines the risk appetite, risk profile and risk tolerance reflecting its financial plans, business strategy and the objectives of the entire PZU Group. This approach ensures the adequacy and effectiveness of the risk management system in the PZU Group and prevents the acceptance of risk levels that could jeopardize the financial stability of individual entities or the entire PZU Group. The determination of the appropriate level of risk in each entity is the Management Board’s responsibility, whereas a review of the risk appetite values is conducted once a year by the unit responsible for risk. All these measures are coordinated at the PZU Group level.

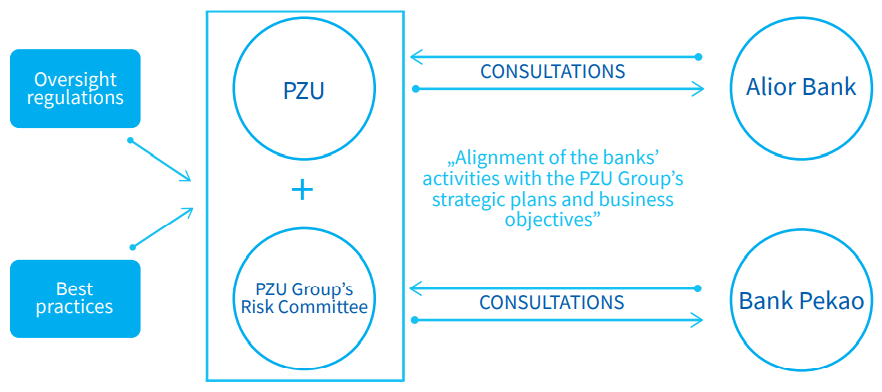

The risk appetite is set at least once a year also by the two banks from the PZU Group. They do it in accordance with the supervisory regulations (including those following from recovery plans) and the best practices. However this process is personalized to reflect the business strategy and capital structure of each entity. Risk appetite in these companies is consulted with the PZU Group’s parent company and the subject matter of opinions issued by the PZU Group Risk Committee. The aim is to ensure consistency between the activities carried out by the banks and the strategic plans and business objectives of the PZU Group as a whole and maintain an acceptable level of risk at the entire Group level. Once agreed, the level of risk appetite is then approved by the banks’ Supervisory Boards.

Process of determining the risk appetite in the PZU Group

- About the report

- Results

- Market and business

- Capitals (IIRC)

- Strategy and outlook 2021+

- Risk and ethics

- Objective of risk management

- Risk management system

- Risk appetite

- Risk management process

- PZU Group's risk profile

- ESG risks

- Risk vulnerability

- Reinsurance operations

- Capital management

- Ethical foundations of doing business

- Preventing corruption and conflicts of interest

- Whistleblowing System

- Transaction security

- Tax transparency

- Cooperation with suppliers Focus on: Risk and ethics - check the highlights of the year!

- Corporate governance

- Shares and bonds

Investor Relations Team

e-mail: IR@pzu.pl

Magdalena Komaracka, IR Director, tel. +48 (22) 582 22 93

Piotr Wiśniewski, IR Manager, tel. +48 (22) 582 26 23

Aleksandra Jakima-Moskwa, tel. +48 (22) 582 26 17

Aleksandra Dachowska, tel. +48 (22) 582 43 92

Piotr Wąsiewicz, tel. +48 (22) 582 41 95