Navigation Map

- strategy (insurance, health, investments, finances);

- sustainable development (sales, employees, social responsibility, natural environment and ethics).

PRACTICES

In the Chapter

GRIs

In the Chapter

GRIs

In the Chapter

List of GRIs

In the Chapter

GRIs

In the Chapter

GRIs

In the Chapter

GRIs

In the Chapter

GRIs

In the Chapter

GRIs

In the Chapter

GRIs

In the Chapter

GRIs

In the Chapter

Operating model

GRIs

- About the report

- Results

- Comment on the financial results for 2020

- Major factors contributing to the consolidated financial result

- PZU Group’s income

- PZU Group’s claims paid and technical provisions

- PZU Group’s acquisition and administrative expenses

- Drivers and atypical events affecting the results

- PZU Group’s asset and liability structure

- Contribution made by the market segments to the consolidated result

- Issuer’s financial results – PZU (PAS)

- Impact of the COVID-19 pandemic on the PZU Group’s results

- Business strategy (2017-2020)

- CSR strategy(2017-2020)

- Supplementary information and notes

- 1. Introduction

- 2. Composition of PZU Group

- 3. Shareholder structure

- 4. Composition of the Management Board, Supervisory Board and PZU Group Directors

- 5. Key accounting policies, key estimates and judgments

- 5.1 Impact of the COVID-19 pandemic on the estimates and assumptions

- 5.2 Changes in accounting policies and estimates, errors from previous years

- 5.3 Amendments to the applied IFRS

- 5.4 Explanation of differences between the 2019 annual consolidated financial statements and these consolidated financial statements

- 5.5 Consolidation principles

- 5.6 Measurement of transactions and balances denominated in foreign currencies and FX rates used

- 5.7 Purchase method

- 5.8 Classification of insurance contracts in accordance with IFRS 4

- 6. Segment reporting

- 7. Risk management

- 8. Equity management

- 9. Fair value

- 10. Gross written premium

- 11. Fee and commission income

- 12. Interest income calculated using the effective interest rate

- 13. Other net investment income

- 14. Result on derecognition of financial instruments and investments

- 15. Movement in allowances for expected credit losses and impairment losses on financial instruments

- 16. Net movement in fair value of assets and liabilities measured at fair value

- 17. Other operating income

- 18. Claims and movement in technical provisions

- 19. Fee and commission expense

- 20. Interest expenses

- 21. Acquisition costs

- 22. Administrative expenses

- 23. Employee expenses

- 24. Other operating expenses

- 25. Income tax

- 26. Earnings per share

- 27. Goodwill

- 28. Intangible assets

- 29. Other assets

- 30. Deferred acquisition cost

- 31. Property, plant and equipment

- 32. Investment property

- 33. Entities carried by the equity method

- 34. Loan receivables from clients

- 35. Financial derivatives

- 36. Investment financial assets

- 37. Receivables

- 38. Impairment of financial assets

- 39.Cash and cash equivalents

- 40. Equity attributable to equity holders of the parent

- 41. Technical provisions

- 42. Subordinated liabilities

- 43. Liabilities on the issue of own debt securities

- 44. Liabilities to banks

- 45. Liabilities to clients under deposits

- 46. Other liabilities

- 47. Provisions

- 48. Deferred income tax

- 49. Assets and liabilities held for sale

- 50. Lease

- 51. Assets securing receivables, liabilities and contingent liabilities

- 52. Contingent assets and liabilities

- 53. Offsetting financial assets and financial liabilities

- 54. Notes to the consolidated cash flow statement

- 55. Disputes

- 56. Transactions with related entities

- 57. Headcount

- 58. Other information

- Financial data (2019-2020)

- Financial data (2016-2020) Focus on: Results - check the highlights of the year!

- Comment on the financial results for 2020

- Market and business

- External environment

- Business model

- Structure of the Group

- Operating model

- Brand management

- Insurance

- Non-life insurance (PZU, LINK4 and TUW PZUW)

- Life insurance (PZU Życie)

- Insurance (international operations)

- Investments

- Investments (PZU TFI)

- Investments (PTE PZU)

- Health

- Health (health companies)

- Banking and strategic partnerships

- Banking (Bank Pekao, Alior Bank)

- Other operating areas

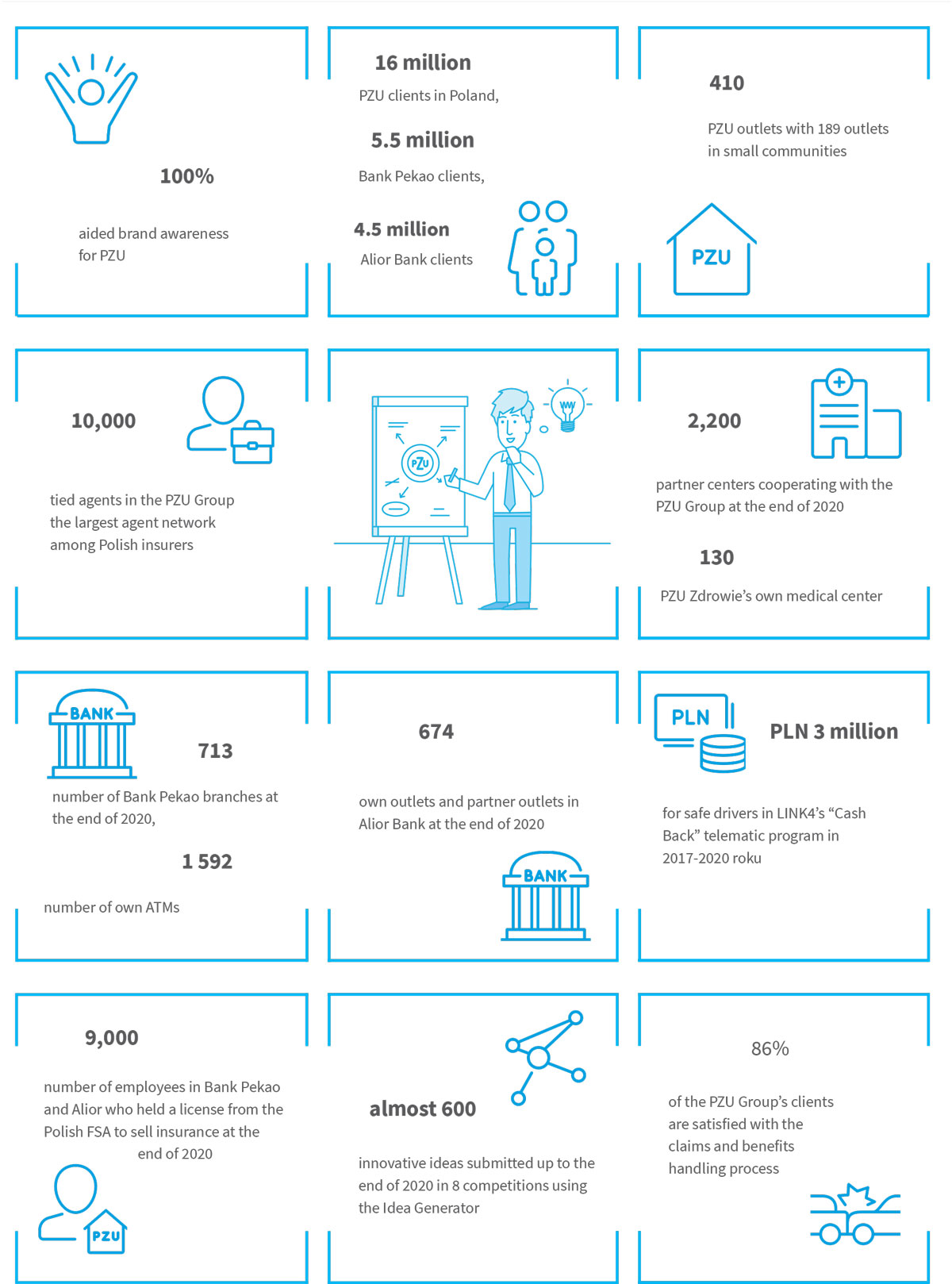

Focus on: Market and business - check the highlights of the year!

- Capitals (IIRC)

- Strategy and outlook 2021+

- Risk and ethics

- Objective of risk management

- Risk management system

- Risk appetite

- Risk management process

- PZU Group's risk profile

- ESG risks

- Risk vulnerability

- Reinsurance operations

- Capital management

- Ethical foundations of doing business

- Preventing corruption and conflicts of interest

- Whistleblowing System

- Transaction security

- Tax transparency

- Cooperation with suppliers Focus on: Risk and ethics - check the highlights of the year!

- Corporate governance

- Application of corporate governance rules

- System of control in the process of preparing financial statements

- Audit firm auditing the financial statements

- PZU's share capital and its shareholders

- Rules for amending the Company's Articles of Association

- Shareholder Meeting and shareholder rights

- Supervisory Board and Management Board

- Compensation paid to members of supervisory and management bodies

- Diversity policy Focus on: Corporate governance - check the highlights of the year!

- Shares and bonds

- Equity and bond market

- PZU's share price

- Banking sector on the Warsaw Stock Exchange

- PZU's investor relations

- Analysts' recommendations regarding PZU's shares

- PZU Group's Capital and Dividend Policy

- Debt financing of PZU, Bank Pekao and Alior Bank

- Rating

- Calendar of PZU's major corporate events in 2021 Focus on: Shares and bonds - check the highlights of the year!

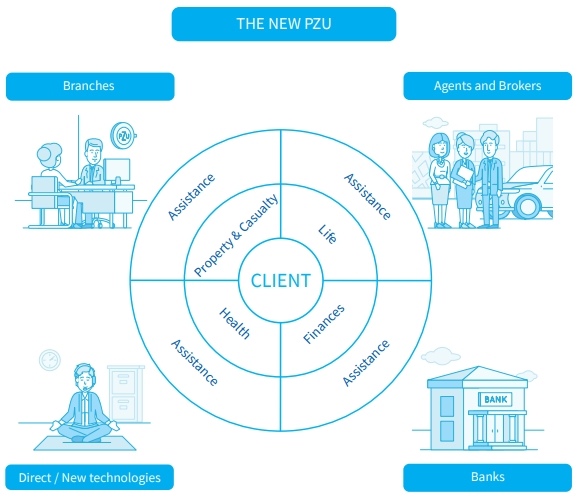

The PZU Group’s insurance and financial offer is the most extensive and most comprehensive offer on the Polish market. It consists of a broad array of insurance, pension and investment products addressed to all client segments. Group companies are active in health care, banking and additionally they render assistance services to retail clients and businesses through strategic partnerships.

The PZU Group Strategy is client-centered. Our mission is helping clients take care of their future. This means that our client relationships and our knowledge of our clients are becoming the Group’s overriding value, while our chief product is our acumen in addressing client need to build a stable future.

PZU wants to do something different from the classical client relation model in which the only contact clients have with their insurer after buying a policy is when a claim occurs. PZU effectively helps clients solve their problems in many areas and during every stage of their life. PZU’s philosophy of thinking about clients constitutes a departure from the classic model of an insurer’s client relations rooted solely in sales and aftersales service. PZU wants to establish and maintain long-term relations with clients and deliver products that best fit their needs. Everything in the right place and at the right time, adequate to their requirements and financial capabilities This approach has defined the philosophy of PZU Group’s operating model.

#newPZU – we are becoming a lifetime partner

PZU Group’s operating model brings together all of the Group’s activities and integrates them in a client-focused manner: life insurance, non-life insurance, health insurance, investments, pensions, health care, banking and assistance services. This drives the gradual transformation of insurers from focusing primarily on valuation and transfer of risk toward being an advisory and service company (utilizing the technological know-how). We have created an operating model in which the core is client knowledge and the skill of building long-term relations. Thanks to that we will achieve high quality and large volume of interactions with the client. The transformation in the direction of an advisory and service company will makes it possible to care for the clients’ future and satisfy their needs comprehensively when it comes to life, health and property insurance and savings and finance.

The PZU Group proposes abandoning “product centricity” in favor of an ecosystem whose overriding objective is to manage client relations skillfully. This means offering solutions in all available places. Accurately anticipating the future, understanding client needs and (inventing) creating ever better reasons for becoming part of their daily lives are the key assumptions of PZU’s new strategy. These initiatives contribute to transforming the Group’s operating model in the direction of an ecosystem spanning not just insurance, but also banking, health protection and payments.

We use new risk assessment methods and simplify processes, including client processers, thanks to:

- utilizing our Big Data files better,

- digitalizing processes,

- using artificial intelligence and new technologies associated with the development of fintechs and insurtechs.

The beneficiaries of the change include the sales, claims handling and medical diagnostics areas.

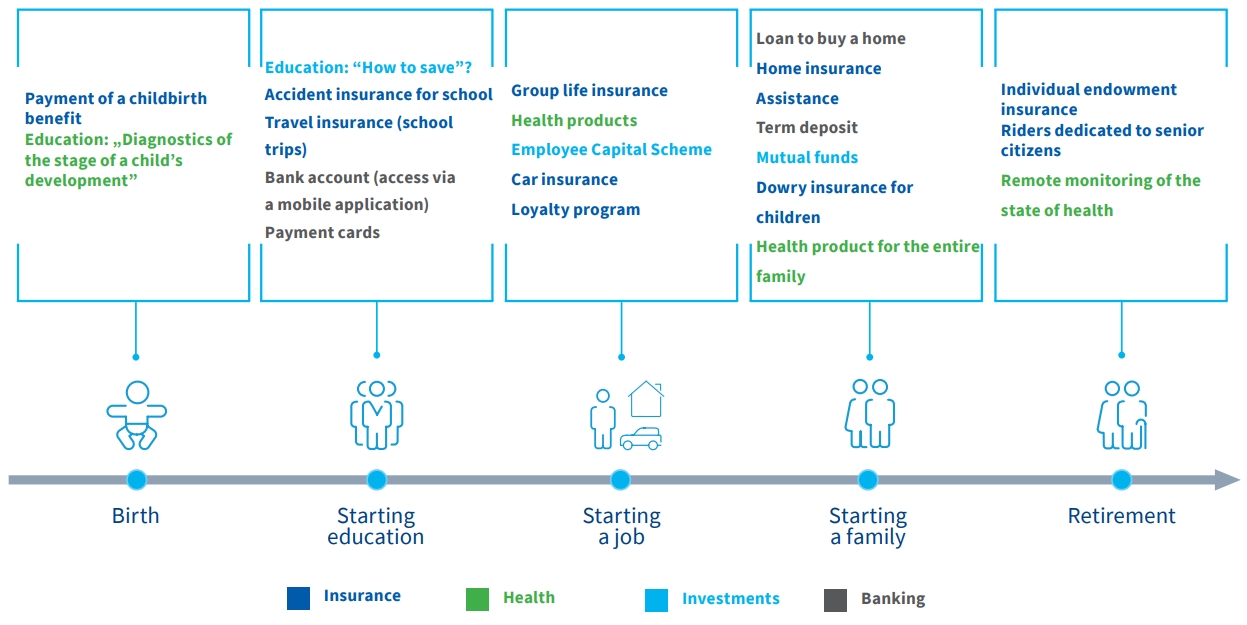

We are a long-term partner for our clients

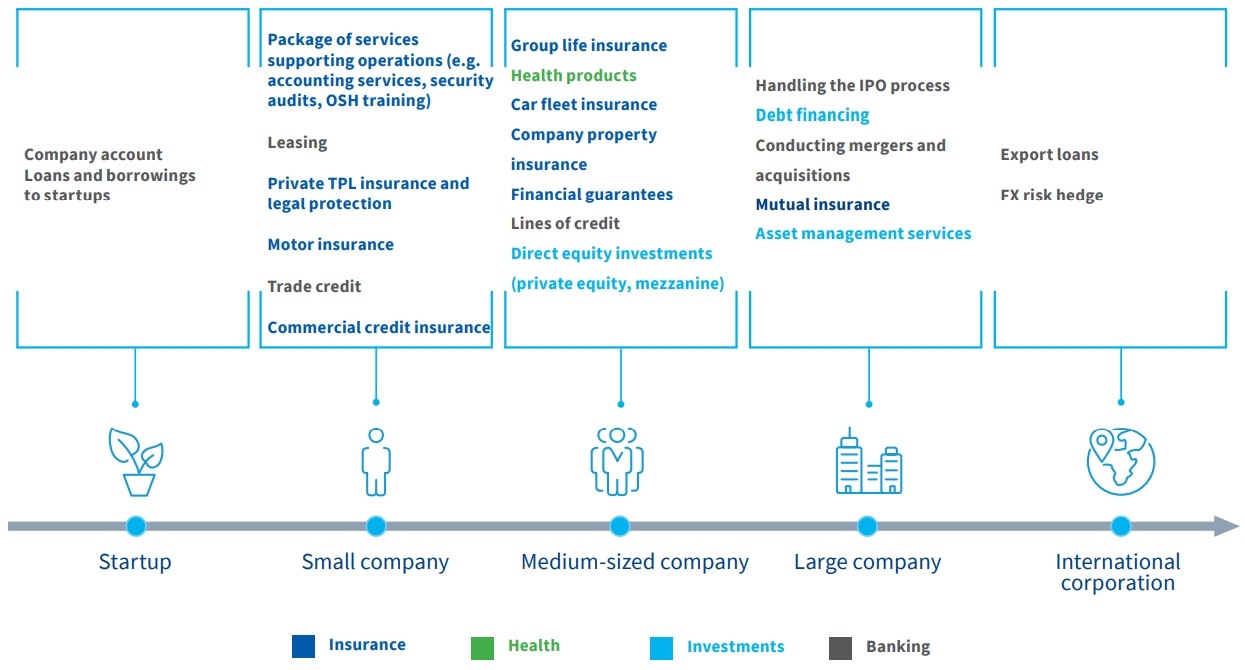

We help companies grow by offering them products supporting their growth

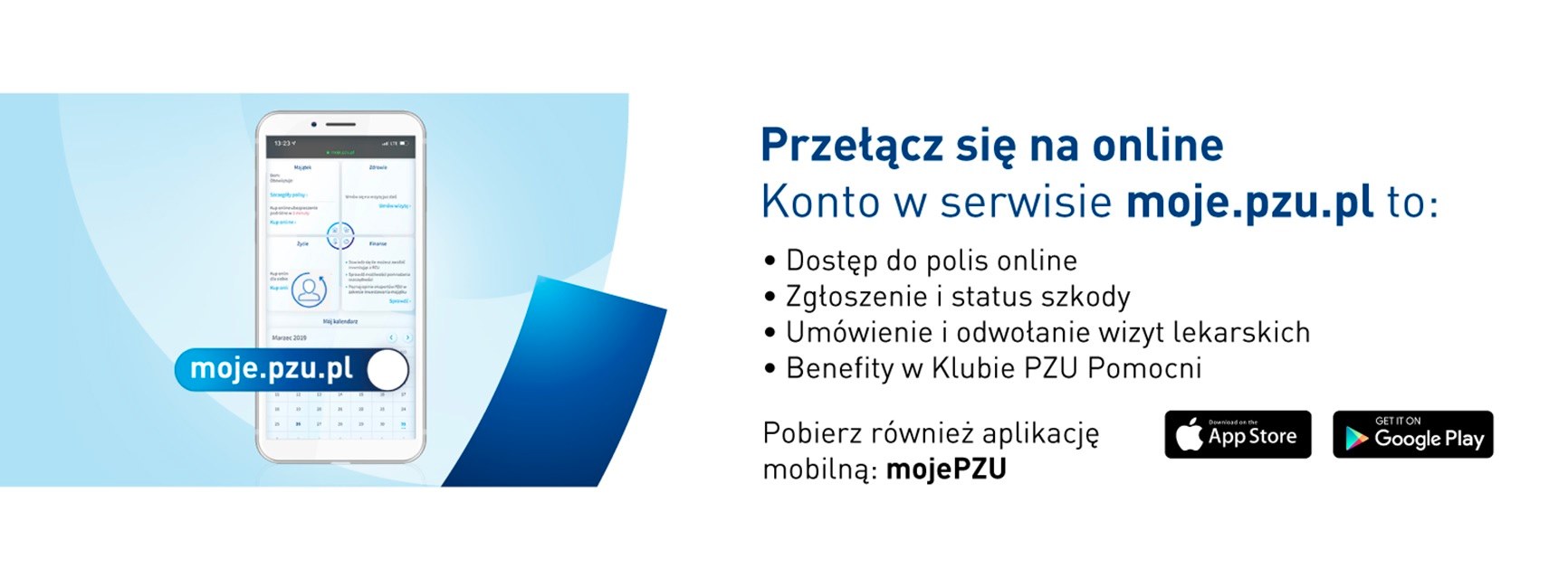

All services in one place

Our clients can handle numerous matters under the same roof. At the mojePZU portal they can:

- buy a home or travel policy,

- make an appointment with a physician,

- collect a referral for examination or an e-prescription,

- check their medical records,

- invest savings,

- report a claim.

Launching the mojePZU portal is not just the outcome of developing digitalization and mobility in PZU but also a way of radically modifying client interactions. This is a one-of-a-kind dashboard enabling clients to check their policy coverage at any time, manage their medical coverage and appointments and their investments.

Modern self-service offers a single location to access PZU Group’s products and services and helps in the handling of numerous matters without the need to visit a branch or call a hotline. It is accessible from any location and at any time on personal computers and through the mobile app. At the end of 2020, the mojePZU portal was used by 1.6million users.

MojePZU is the most comprehensible platform available on the insurance, financial and health markets. It is continuously developed and upgraded with new functions. In 2020, we expanded it by, among others, the possibility of verifying the identity using mojeID (myID) and mObywatel (mCitizen), which significantly expedited the portal registration process. In addition, we made it possible to set up a portal account through an activation link. Since 2020 an account can be opened also by persons who report a claim from the perpetrator’s TPL policy but are not PZU Group’s clients. Other functionalities introduced in 2020 included, among others, proposals of automatic renewals for clients who have a PZU Auto TPL policy 15 days before the end of the insurance, handling of reimbursement of incurred costs in PZU Zdrowie.

MojePZU also includes initiatives aimed at improving safety. From November 2020 the users of the mojePZU mobile app receive information about the launch in Poland of the lost child search procedure under the international Child Alert system.

MojePZU comprises also the PZU Pomocni Club. It is a loyalty program through which clients obtain attractive discounts and rebates. The club gives them bonuses, for example for leading a healthy lifestyle.

In 2020, the mojePZU portal was awarded the “Simple Polish Language Certificate” by the Institute of Simple Polish at the University of Wrocław.

Investor Relations Team

e-mail: IR@pzu.pl

Magdalena Komaracka, IR Director, tel. +48 (22) 582 22 93

Piotr Wiśniewski, IR Manager, tel. +48 (22) 582 26 23

Aleksandra Jakima-Moskwa, tel. +48 (22) 582 26 17

Aleksandra Dachowska, tel. +48 (22) 582 43 92

Piotr Wąsiewicz, tel. +48 (22) 582 41 95