Navigation Map

- strategy (insurance, health, investments, finances);

- sustainable development (sales, employees, social responsibility, natural environment and ethics).

PRACTICES

In the Chapter

GRIs

In the Chapter

GRIs

In the Chapter

List of GRIs

In the Chapter

GRIs

In the Chapter

GRIs

In the Chapter

GRIs

In the Chapter

GRIs

In the Chapter

GRIs

In the Chapter

GRIs

In the Chapter

GRIs

In the Chapter

Operating model

GRIs

- About the report

- Results

- Comment on the financial results for 2020

- Major factors contributing to the consolidated financial result

- PZU Group’s income

- PZU Group’s claims paid and technical provisions

- PZU Group’s acquisition and administrative expenses

- Drivers and atypical events affecting the results

- PZU Group’s asset and liability structure

- Contribution made by the market segments to the consolidated result

- Issuer’s financial results – PZU (PAS)

- Impact of the COVID-19 pandemic on the PZU Group’s results

- Business strategy (2017-2020)

- CSR strategy(2017-2020)

- Supplementary information and notes

- 1. Introduction

- 2. Composition of PZU Group

- 3. Shareholder structure

- 4. Composition of the Management Board, Supervisory Board and PZU Group Directors

- 5. Key accounting policies, key estimates and judgments

- 5.1 Impact of the COVID-19 pandemic on the estimates and assumptions

- 5.2 Changes in accounting policies and estimates, errors from previous years

- 5.3 Amendments to the applied IFRS

- 5.4 Explanation of differences between the 2019 annual consolidated financial statements and these consolidated financial statements

- 5.5 Consolidation principles

- 5.6 Measurement of transactions and balances denominated in foreign currencies and FX rates used

- 5.7 Purchase method

- 5.8 Classification of insurance contracts in accordance with IFRS 4

- 6. Segment reporting

- 7. Risk management

- 8. Equity management

- 9. Fair value

- 10. Gross written premium

- 11. Fee and commission income

- 12. Interest income calculated using the effective interest rate

- 13. Other net investment income

- 14. Result on derecognition of financial instruments and investments

- 15. Movement in allowances for expected credit losses and impairment losses on financial instruments

- 16. Net movement in fair value of assets and liabilities measured at fair value

- 17. Other operating income

- 18. Claims and movement in technical provisions

- 19. Fee and commission expense

- 20. Interest expenses

- 21. Acquisition costs

- 22. Administrative expenses

- 23. Employee expenses

- 24. Other operating expenses

- 25. Income tax

- 26. Earnings per share

- 27. Goodwill

- 28. Intangible assets

- 29. Other assets

- 30. Deferred acquisition cost

- 31. Property, plant and equipment

- 32. Investment property

- 33. Entities carried by the equity method

- 34. Loan receivables from clients

- 35. Financial derivatives

- 36. Investment financial assets

- 37. Receivables

- 38. Impairment of financial assets

- 39.Cash and cash equivalents

- 40. Equity attributable to equity holders of the parent

- 41. Technical provisions

- 42. Subordinated liabilities

- 43. Liabilities on the issue of own debt securities

- 44. Liabilities to banks

- 45. Liabilities to clients under deposits

- 46. Other liabilities

- 47. Provisions

- 48. Deferred income tax

- 49. Assets and liabilities held for sale

- 50. Lease

- 51. Assets securing receivables, liabilities and contingent liabilities

- 52. Contingent assets and liabilities

- 53. Offsetting financial assets and financial liabilities

- 54. Notes to the consolidated cash flow statement

- 55. Disputes

- 56. Transactions with related entities

- 57. Headcount

- 58. Other information

- Financial data (2019-2020)

- Financial data (2016-2020) Focus on: Results - check the highlights of the year!

- Comment on the financial results for 2020

- Market and business

- External environment

- Business model

- Structure of the Group

- Operating model

- Brand management

- Insurance

- Non-life insurance (PZU, LINK4 and TUW PZUW)

- Life insurance (PZU Życie)

- Insurance (international operations)

- Investments

- Investments (PZU TFI)

- Investments (PTE PZU)

- Health

- Health (health companies)

- Banking and strategic partnerships

- Banking (Bank Pekao, Alior Bank)

- Other operating areas

Focus on: Market and business - check the highlights of the year!

- Capitals (IIRC)

- Strategy and outlook 2021+

- Risk and ethics

- Objective of risk management

- Risk management system

- Risk appetite

- Risk management process

- PZU Group's risk profile

- ESG risks

- Risk vulnerability

- Reinsurance operations

- Capital management

- Ethical foundations of doing business

- Preventing corruption and conflicts of interest

- Whistleblowing System

- Transaction security

- Tax transparency

- Cooperation with suppliers Focus on: Risk and ethics - check the highlights of the year!

- Corporate governance

- Application of corporate governance rules

- System of control in the process of preparing financial statements

- Audit firm auditing the financial statements

- PZU's share capital and its shareholders

- Rules for amending the Company's Articles of Association

- Shareholder Meeting and shareholder rights

- Supervisory Board and Management Board

- Compensation paid to members of supervisory and management bodies

- Diversity policy Focus on: Corporate governance - check the highlights of the year!

- Shares and bonds

- Equity and bond market

- PZU's share price

- Banking sector on the Warsaw Stock Exchange

- PZU's investor relations

- Analysts' recommendations regarding PZU's shares

- PZU Group's Capital and Dividend Policy

- Debt financing of PZU, Bank Pekao and Alior Bank

- Rating

- Calendar of PZU's major corporate events in 2021 Focus on: Shares and bonds - check the highlights of the year!

Polish banking sector compared to Europe

Banking assets in Poland have recorded a significant increase since the transformation. Currently, the Polish banking sector, as measured by the value of assets, ranks around the European median. According to data of the European Central Bank (ECB), at the end of 20191 the Polish banking sector’s assets totaled EUR 474.3 billion. The largest banking sector in Europe is that of the United Kingdom (EUR 10.7 trillion at the end of 2019), with Latvia occupying the other end of the spectrum (EUR 22.1 billion at yearend 2019). At the end of 2019, the assets of European (EU-28) banks stood at approx. EUR 42.9 trillion (EUR 28.9 trillion in the euro area)2. Poland has a relatively low, compared to the European Union, ratio of banking assets to GDP, oscillating around 90%, while the average for the European Union and the countries of Central and Eastern Europe is approx. 260% and 92%3, respectively.

The Polish banking sector operates in accordance with the classic model of financial intermediation in which banks mainly provide loans to the non-financial sector using their customers’ deposits in the process. This is reflected in the high share of loans in the banking sector’s assets, which at the end of 2019 accounted for 68% of such assets and was higher than the average for the banking sectors of the European Union (66%)4.

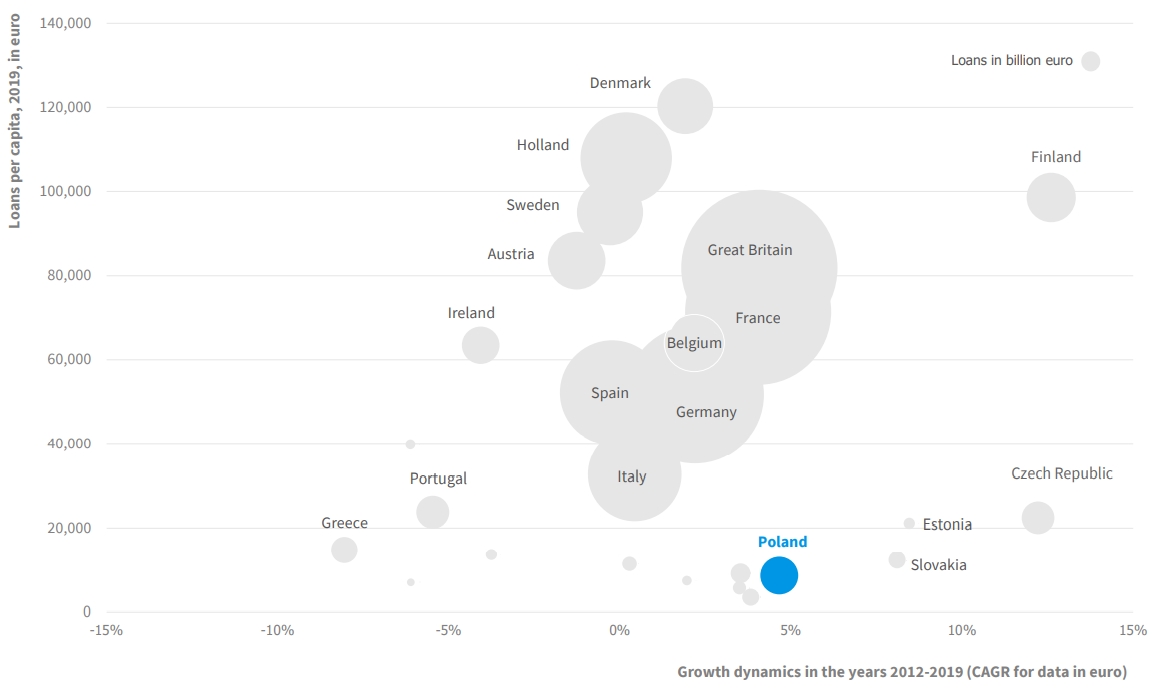

At yearend 2019, loans in the Polish banking sector totaled EUR 324 billion, which placed Poland in the middle of the pack among European countries.

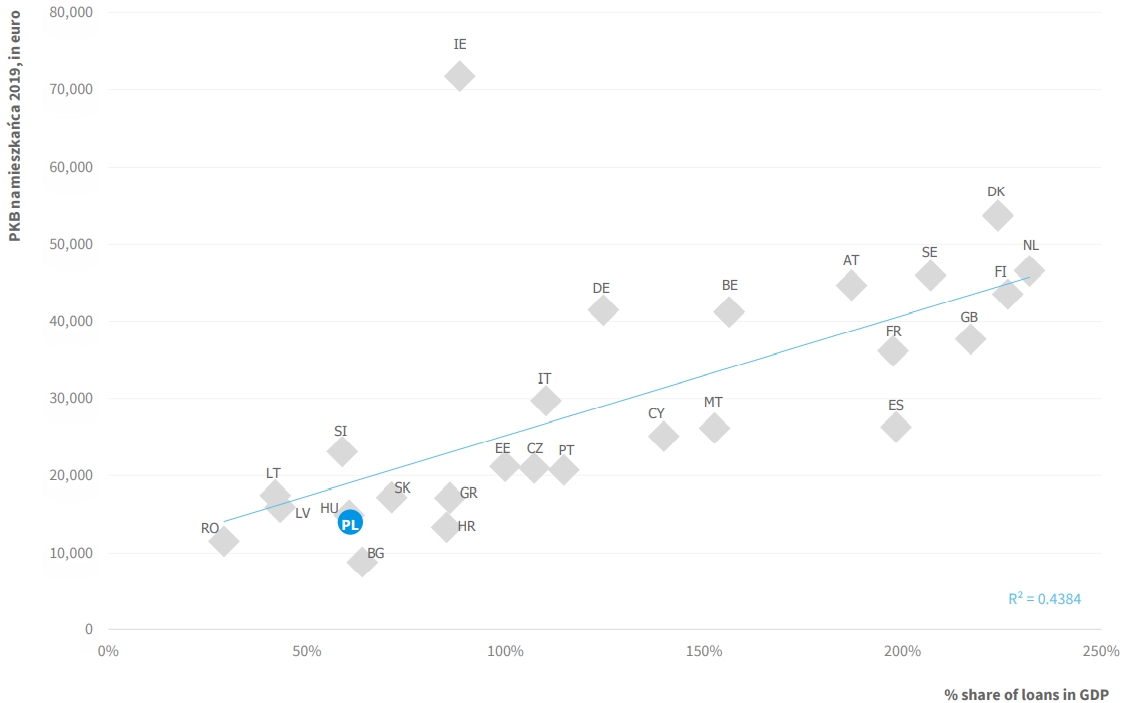

Compared to other European Union states, Poland’s banking sector is small in relation to the country’s GDP. Bank loans in the Polish banking system account for 61% of GDP while the European average is 125%. The Netherlands, Finland and Denmark have the highest ratios of loans to GDP.

Loans per capita (2019, EUR) in relation to the insurance market growth rate (2012-2019)

Source: Own calculations based on ECB data

Share of loans in GDP (2018, %) in relation to GDP per capita (2018, EUR)

Source: Own calculations based on ECB data

The Polish banking market features a relatively low percentage of business loans in the total value of loans extended to the non-financial sector (33.9% at yearend 2019)5. In turn, the lending activity of banks in Poland, like in most other European Union countries, focuses on granting loans to households. Poland ranks third among the EU states in terms of the share of household loans in total financing provided to the nonfinancial sector by banks and financial markets6.

The research conducted by the National Bank of Poland indicates that households in Poland are significantly less indebted than in the euro area. The average household has total liabilities of 5.5% of gross assets, while in the euro area the average debt is 26% of assets in total7.

Mortgage loans account for the highest percentage of household loans – roughly 58%. In the European Union, this proportion is higher and stands at approx. 74% on average, while in the countries of Central and Eastern Europe it is roughly 65%. The lesser significance of mortgage loans in the assets of Polish banks results from the fact that such loans are a relatively new product. For comparison, in 2005 their share in household loans in Poland was approx. 30%, compared to more than 80% in some West European countries8. Mortgage loans in Poland represent a mere 20% of GDP, while the average in the European Union is 42% of GDP. Meanwhile, Poland is among the countries with the highest share of consumer loans in total loans. The value of extended consumer loans versus GDP at the end of 2019 was 9.1% of GDP, or more than the average in the European Union (6.1%) and less only than in comparison with Bulgaria and Portugal9.

Banks in Poland, to a greater extent than the average for the European Union, finance their business with deposits from the non-financial sector (66% of which are deposits by private individuals). At the end of 2019, they accounted for 63% of the total balance sheet value of the banking sector2210. The surplus of deposits over loans granted to the non-financial sector in Poland has been growing steadily since 2015. This has been caused, among other factors, be declining demand for financing housing loan portfolios with foreign currencies. The value of the loan-to-deposit ratio in Polish banks is 91%, which is lower than the EU average of 102%11.

At the end of 2019, the relatively freely disposable financial assets of households increased by 10.4% compared to 2018. At the end of December 2019, they totaled PLN 1,422.9 billion, and their relation to GDP increased to 62.2%. Deposits are the most popular form of accumulation of financial assets by households. At yearend 2019, deposits in banks and credit unions accounted for 63.7% of the financial assets of households, 79.1% if counted together with the cash kept by these households. Financial assets of households in the form of life insurance assets (including policies with unit-linked funds) totaled PLN 60.8 billion in 2019, which accounted for 4.3% of total financial assets of these households. Less frequently, households invest their savings in shares listed on the Warsaw Stock Exchange (4.0% of financial assets), treasury securities (1.9%) and non-treasury securities (0.4%)12.

1 As at the date of the report, the most up-to-date data for Europe’s banking market are available for 2019

2 European Central Bank, https://sdw.ecb.europa.eu/

3 National Bank of Poland, „Development of the financial system in Poland in 2019

4 European Central Bank, https://sdw.ecb.europa.eu/

5 National Bank of Poland, “Financial data of the banking sector”

6 National Bank of Poland, ”Development of the financial system in Poland in 2019”

7 BZGD research is conducted in the international research network called Household Finance and Consumption Network (HFCN). Central banks and statistical offices representing euro area countries, Poland and Hungary participate in this undertaking initiated in 2006 and coordinated by the European Central Bank (ECB), https://www.nbp.pl/home.aspx?f=/aktualnosci/ wiadomosci_2018/ZGDwP_20180109.html

8 National Bank of Poland, ”Development of the financial system in Poland in 2019”

9 European Central Bank, https://sdw.ecb.europa.eu/

10 National Bank of Poland, “Financial data of the banking sector”

11 12 National Bank of Poland, ”Development of the financial system in Poland in 2019”

Investor Relations Team

e-mail: IR@pzu.pl

Magdalena Komaracka, IR Director, tel. +48 (22) 582 22 93

Piotr Wiśniewski, IR Manager, tel. +48 (22) 582 26 23

Aleksandra Jakima-Moskwa, tel. +48 (22) 582 26 17

Aleksandra Dachowska, tel. +48 (22) 582 43 92

Piotr Wąsiewicz, tel. +48 (22) 582 41 95