Navigation Map

- strategy (insurance, health, investments, finances);

- sustainable development (sales, employees, social responsibility, natural environment and ethics).

PRACTICES

In the Chapter

GRIs

In the Chapter

GRIs

In the Chapter

List of GRIs

In the Chapter

GRIs

In the Chapter

GRIs

In the Chapter

GRIs

In the Chapter

GRIs

In the Chapter

GRIs

In the Chapter

GRIs

In the Chapter

GRIs

In the Chapter

Operating model

GRIs

- About the report

- Results

- Comment on the financial results for 2020

- Major factors contributing to the consolidated financial result

- PZU Group’s income

- PZU Group’s claims paid and technical provisions

- PZU Group’s acquisition and administrative expenses

- Drivers and atypical events affecting the results

- PZU Group’s asset and liability structure

- Contribution made by the market segments to the consolidated result

- Issuer’s financial results – PZU (PAS)

- Impact of the COVID-19 pandemic on the PZU Group’s results

- Business strategy (2017-2020)

- CSR strategy(2017-2020)

- Supplementary information and notes

- 1. Introduction

- 2. Composition of PZU Group

- 3. Shareholder structure

- 4. Composition of the Management Board, Supervisory Board and PZU Group Directors

- 5. Key accounting policies, key estimates and judgments

- 5.1 Impact of the COVID-19 pandemic on the estimates and assumptions

- 5.2 Changes in accounting policies and estimates, errors from previous years

- 5.3 Amendments to the applied IFRS

- 5.4 Explanation of differences between the 2019 annual consolidated financial statements and these consolidated financial statements

- 5.5 Consolidation principles

- 5.6 Measurement of transactions and balances denominated in foreign currencies and FX rates used

- 5.7 Purchase method

- 5.8 Classification of insurance contracts in accordance with IFRS 4

- 6. Segment reporting

- 7. Risk management

- 8. Equity management

- 9. Fair value

- 10. Gross written premium

- 11. Fee and commission income

- 12. Interest income calculated using the effective interest rate

- 13. Other net investment income

- 14. Result on derecognition of financial instruments and investments

- 15. Movement in allowances for expected credit losses and impairment losses on financial instruments

- 16. Net movement in fair value of assets and liabilities measured at fair value

- 17. Other operating income

- 18. Claims and movement in technical provisions

- 19. Fee and commission expense

- 20. Interest expenses

- 21. Acquisition costs

- 22. Administrative expenses

- 23. Employee expenses

- 24. Other operating expenses

- 25. Income tax

- 26. Earnings per share

- 27. Goodwill

- 28. Intangible assets

- 29. Other assets

- 30. Deferred acquisition cost

- 31. Property, plant and equipment

- 32. Investment property

- 33. Entities carried by the equity method

- 34. Loan receivables from clients

- 35. Financial derivatives

- 36. Investment financial assets

- 37. Receivables

- 38. Impairment of financial assets

- 39.Cash and cash equivalents

- 40. Equity attributable to equity holders of the parent

- 41. Technical provisions

- 42. Subordinated liabilities

- 43. Liabilities on the issue of own debt securities

- 44. Liabilities to banks

- 45. Liabilities to clients under deposits

- 46. Other liabilities

- 47. Provisions

- 48. Deferred income tax

- 49. Assets and liabilities held for sale

- 50. Lease

- 51. Assets securing receivables, liabilities and contingent liabilities

- 52. Contingent assets and liabilities

- 53. Offsetting financial assets and financial liabilities

- 54. Notes to the consolidated cash flow statement

- 55. Disputes

- 56. Transactions with related entities

- 57. Headcount

- 58. Other information

- Financial data (2019-2020)

- Financial data (2016-2020) Focus on: Results - check the highlights of the year!

- Comment on the financial results for 2020

- Market and business

- External environment

- Business model

- Structure of the Group

- Operating model

- Brand management

- Insurance

- Non-life insurance (PZU, LINK4 and TUW PZUW)

- Life insurance (PZU Życie)

- Insurance (international operations)

- Investments

- Investments (PZU TFI)

- Investments (PTE PZU)

- Health

- Health (health companies)

- Banking and strategic partnerships

- Banking (Bank Pekao, Alior Bank)

- Other operating areas

Focus on: Market and business - check the highlights of the year!

- Capitals (IIRC)

- Strategy and outlook 2021+

- Risk and ethics

- Objective of risk management

- Risk management system

- Risk appetite

- Risk management process

- PZU Group's risk profile

- ESG risks

- Risk vulnerability

- Reinsurance operations

- Capital management

- Ethical foundations of doing business

- Preventing corruption and conflicts of interest

- Whistleblowing System

- Transaction security

- Tax transparency

- Cooperation with suppliers Focus on: Risk and ethics - check the highlights of the year!

- Corporate governance

- Application of corporate governance rules

- System of control in the process of preparing financial statements

- Audit firm auditing the financial statements

- PZU's share capital and its shareholders

- Rules for amending the Company's Articles of Association

- Shareholder Meeting and shareholder rights

- Supervisory Board and Management Board

- Compensation paid to members of supervisory and management bodies

- Diversity policy Focus on: Corporate governance - check the highlights of the year!

- Shares and bonds

- Equity and bond market

- PZU's share price

- Banking sector on the Warsaw Stock Exchange

- PZU's investor relations

- Analysts' recommendations regarding PZU's shares

- PZU Group's Capital and Dividend Policy

- Debt financing of PZU, Bank Pekao and Alior Bank

- Rating

- Calendar of PZU's major corporate events in 2021 Focus on: Shares and bonds - check the highlights of the year!

Analysts' recommendations regarding PZU's shares

In 2020, fundamental valuations in global and local equity markets differed significantly from market valuations. The hard-to-estimate consequences of the COVID-19 pandemic prompted a significant group of investors to downsize their positions or exit the market completely. The situation normalized only in the last quarter of 2020, as more reports on the efficacy of vaccines were published.

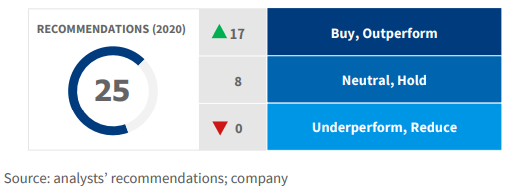

In 2020, PZU stock recommendations were issued by 11 domestic and international financial institutions. In total, sell side analysts published 25 recommendations.

Statistics related to the recommendations published in 2020

Source: analysts’ recommendations; company

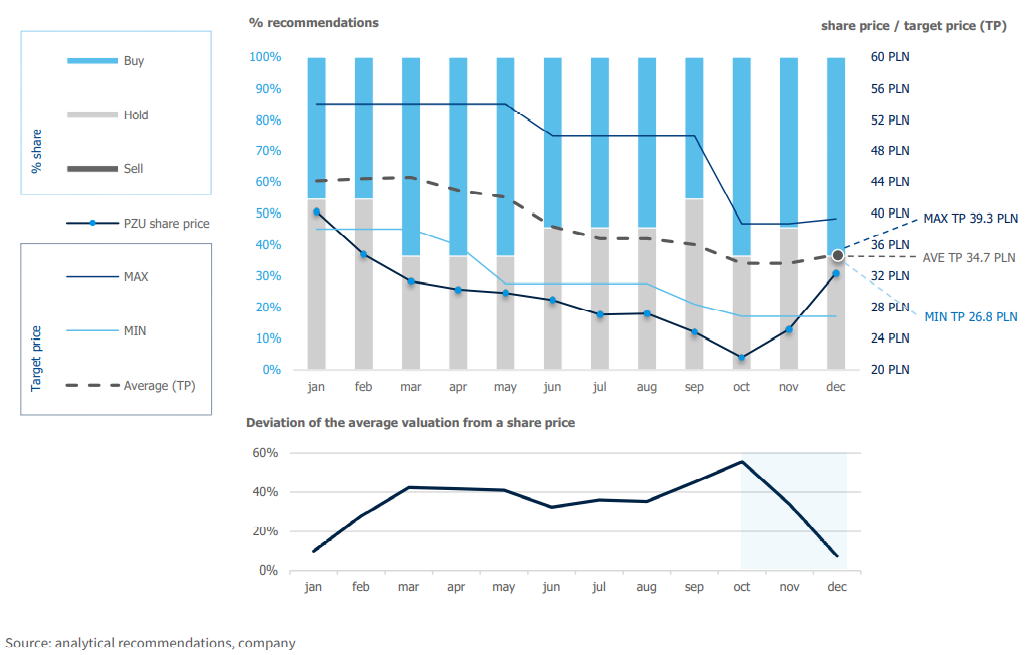

In 2020, all recommendations for PZU’s shares were positive or neutral. However, for most of the year, the actual price of the Company’s stock was lower than the minimum price set by analysts. The difference between the target prices according to analysts’ recommendations and the PZU share price was 34% on average. It was growing from the beginning of the year and reached 55.6% in October.

Analysts’ expectations concerning PZU’s share price in 2021 based on recommendations in effect at the end of December 2020

Source: analysts’ recommendations; company

Statistics on target prices according to recommendations

| 31 December 2019 | 31 December 2020 | Change | Price variance between the recommendations and the share price at the end of 2020 (PLN 32.36) | |

| Highest target price | 53.0 | 39.3 | (25.8%) | 21.5% |

| Average of the target prices | 44.1 | 34.7 | (21.3%) | 7.2% |

| Median of the target prices | 43.4 | 36.1 | (20.0%) | 11.6% |

| Lowest target price | 38.0 | 26.8 | (29.5%) | (17.2%) |

Source: analysts’ recommendations; company

In the middle of Q4 2020, in line with improved sentiments on global and local markets, the PZU share price rebounded strongly. At the end of the year, the difference between the recommendation prices and the actual share price shrank to just 7.2%, from 9.8% at the beginning of the year. During the last December session of 2020, the PZU share price stood at PLN 32.36. The minimum and maximum target prices for PZU’s stock in analysts’ forecasts active at the end of December 2020 (7 “buy” and 4 “hold” recommendations) were PLN 26.8 and PLN 39.3, respectively. The average target price was PLN 34.7.

Institutions issuing recommendations for PZU’s stock (as at 31 December 2020)

| Institution | Analyst | Contact details | |

| Citi | Andrzej Powierża | +48 22 690 35 66 | andrzej.powierza@citi.com |

| Haitong | Marta Czajkowska-Bałdyga | +48 22 330 62 51 | marta.czajkowska-baldyga@haitongib.com |

| HSBC | Thomas Fossard | +33 1 56 52 43 40 | thomas.fossard@hsbc.com |

| Ipopema | Łukasz Jańczak | +48 22 236 92 30 | lukasz.janczak@ipopema.pl |

| JP Morgan | Samuel Goodacre | +44 207 1346 720 | samuel.goodacre@jpmorgan.com |

| mBank | Michał Konarski | +48 22 697 47 37 | michal.konarski@mdm.pl |

| PKO BP | Jaromir Szortyka | +48 22 580 39 47 | jaromir.szortyka@pkobp.pl |

| Raiffeisen Centrobank | Oliver Simkovic | +43 1 51520 706 | oliver.simkovic@rbinternational.com |

| Trigon | Maciej Marcinowski | +48 22 4338 375 | maciej.marcinowski@trigon.pl |

| UBS | Michał Potyra | +27 11 322 7320 | michal.potyra@ubs.com |

| Wood & Company | Marta Jeżewska-Wasilewska | +48 22 222 15 48 | marta.jezewska-wasilewska@wood.com |

- About the report

- Results

- Market and business

- Capitals (IIRC)

- Strategy and outlook 2021+

- Risk and ethics

- Corporate governance

- Shares and bonds

- Equity and bond market

- PZU's share price

- Banking sector on the Warsaw Stock Exchange

- PZU's investor relations

- Analysts' recommendations regarding PZU's shares

- PZU Group's Capital and Dividend Policy

- Debt financing of PZU, Bank Pekao and Alior Bank

- Rating

- Calendar of PZU's major corporate events in 2021 Focus on: Shares and bonds - check the highlights of the year!

Investor Relations Team

e-mail: IR@pzu.pl

Magdalena Komaracka, IR Director, tel. +48 (22) 582 22 93

Piotr Wiśniewski, IR Manager, tel. +48 (22) 582 26 23

Aleksandra Jakima-Moskwa, tel. +48 (22) 582 26 17

Aleksandra Dachowska, tel. +48 (22) 582 43 92

Piotr Wąsiewicz, tel. +48 (22) 582 41 95