PZU Group's Capital and Dividend Policy

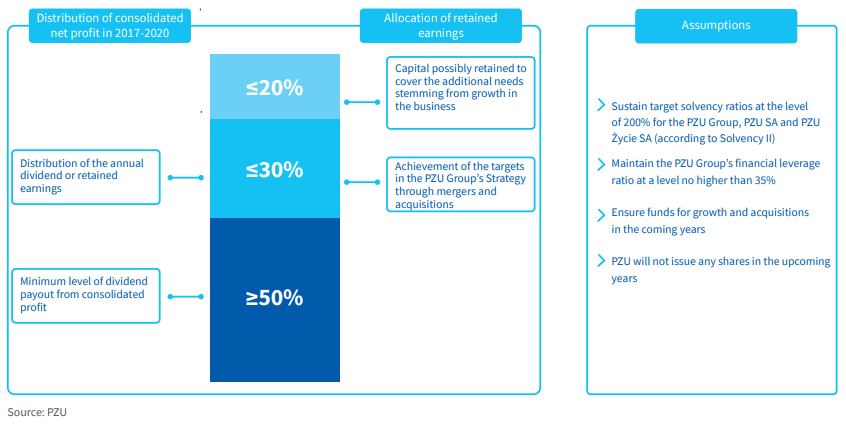

The PZU Group’s Capital and Dividend Policy in 2016-2020 was adopted in a PZU Supervisory Board resolution in 2016, and contains the following rules:

- The PZU Group endeavors to manage capital effectively and maximize the rate of return on equity for the parent company’s shareholders, in particular by maintaining the level of security and retaining capital resources for strategic growth objectives through acquisitions;

- the dividend amount proposed and paid out by the PZU Management Board for the financial year is determined on the basis of the PZU Group’s consolidated financial result attributable to the parent company, where:

- no more than 20% will be earmarked as retained earnings (supplementary capital) for goals associated with organic growth and innovations as well as execution of growth initiatives,

- no less than 50% is subject to payment as an annual dividend,

- the remaining part will be paid in the form of annual dividend or will increase retained earnings (supplementary capital) if in the given year significant expenditures are incurred in connection with execution of the PZU Group Strategy, including in particular, mergers and acquisitions;

with a reservation that:

- according to the Management Board’s plans and risk and solvency self-assessment of the parent company, the own funds of PZU and the Group following the declaration or payment of a dividend will remain at a level that will ensure fulfillment of the conditions specified in the PZU Capital and Dividend Policy;

- when determining the dividend the regulatory authority’s recommendations concerning dividends will be taken into consideration.

Distribution of the 2019 profit

Due to the expectation expressed by the Polish Financial Supervision Authority (KNF) in a letter dated 26 March 2020 addressed to the management boards of insurance undertakings, regarding the retention of all profit generated in previous years, the PZU Shareholder Meeting (in compliance with the Management Board’s recommendation and a positive opinion issued by the Supervisory Board) adopted a resolution to refrain from the disbursement of a dividend from the 2019 profit.

PZU Group’s Dividend and Capital Policy

-

3 December 2019 – KNF’s recommendation on paying dividends from the profits generated in 2019

According to KNF’s recommendation, dividends should be paid out only by insurance undertakings meeting certain financial criteria and ones that received a good or satisfactory score on their Test and Regulatory Assessment [Polish abbreviation: BION] for 2018. At the same time, the dividend payout should be limited to no more than 75% of the profit earned in 2019, while the coverage of the capital requirement for the quarter in which the dividend was distributed should be maintained at no less than 110%.

KNF permitted a dividend payout equal to the entire profit earned in 2019 (implying that it is not permissible to make distributions from any of the other capital accounts) provided that the capital requirement coverage (after expected dividends are deducted from own funds) as at 31 December 2019 and for the quarter in which the dividend is paid, is at least 175% for insurance undertakings operating in section I (life insurance) and at least 150% for insurance undertakings operating in section II (non-life insurance).

According to KNF’s recommendation, those undertakings that satisfy the above criteria, when deciding on the level of dividends, should take into account their additional capital needs within the period of 12 months from the approval date of the 2019 financial statements, which may result, among others, from changes in the market and legal environment.

-

26 March 2020 – KNF’s recommendation on paying dividends from the profits generated in 2019

The Chairman of the Polish Financial Supervision Authority, in his letter of 26 March 2020, sent to the management boards of insurance undertakings, expressed the expectation that in connection with the state of epidemic announced in Poland and its possible adverse economic consequences, insurance undertakings should retain the entirety of profit earned in previous years.

By doing so, the Authority changed its position presented in KNF’s Communication of 3 December 2019 concerning the regulatory authority’s position on the objectives for the dividend policy of commercial banks, cooperative banks and affiliation banks and insurance and reinsurance undertakings in 2020, according to which the possibility of dividend payment up to the entire profit earned depended on the BION assessment, the solvency level in 2019 and the capital needs within 12 months from the moment of approving the financial statements for 2019, while the solvency requirements were set at the same values as in previous years.

Moreover, on 2 April 2020, the European Insurance and Occupational Pensions Authority (EIOPA) recommended a temporary suspension of dividend disbursements by European insurance undertakings.

-

21 April 2020 – Management Board’s recommendation on the distribution of PZU’s net profit

The PZU Management Board issued a recommendation to distribute the 2019 profit in compliance with the recommendations received from the regulatory authority. On 28 April 2020, the PZU Supervisory Board issued a favorable opinion on the PZU Management Board’s motion.

-

26 May 2020 – Ordinary Shareholder Meeting’s resolution on the distribution of PZU’s net profit

The PZU Ordinary Shareholder Meeting adopted a resolution on the distribution of PZU’s net profit for the financial year ended 31 December 2019, in which it resolved to distribute the profit of PLN 2,651 million in the following manner: PLN 7 million as an allowance to the Company Social Benefit Fund, PLN 2,644 million as supplementary capital.

KNF’s recommendation on paying dividends from the profits generated in 2020

On 16 December 2020, KNF took a stance on the dividend policy of insurance and reinsurance undertakings (download).

The document permits insurance undertakings to:

- disburse a dividend of up to 100% of the profit generated in 2019,

- disburse a dividend of up to 50% of the profit generated in 2020, provided that the criteria set by KNF have been fulfilled.

These criteria include a Regulatory Review and Evaluation (BION) assessment (i.e. risk assessment) and the coverage of a specific capital requirement on a standalone (unconsolidated) basis. Moreover, a company intending to disburse a dividend must not have experienced a situation involving a shortage of own funds to cover the capital requirement in any quarter and must not be covered by a short-term financial plan or remedial plan.

KNF also pointed out that, when deciding on the level of dividends, insurance undertakings should take into account their additional capital needs within the period of 12 months from the approval date of the 2020 financial statements, which may result, among others, from changes in the market and legal environment, in particular from the high degree of uncertainty about the future evolution of the coronavirus pandemic, as it may bring new adverse consequences for insurance, reinsurance and insurance-and-reinsurance undertakings.

Up until the date of this Report, the PZU Management Board has not adopted a resolution concerning the distribution of profit for 2020. A report containing audited information on PZU’s solvency ratios and financial standing on a standalone basis will be published Q2 2021.

Dividends paid by PZU from its earnings in the 2016-2020 financial years

| 2016 | 2017 | 2018 | 2019 | 2020 | |

| Consolidated profit attributable to the parent company (in PLN m) | 1,935 | 2,895 | 3,213 | 3,295 | 1,912 |

| PZU’s standalone profit (in PLN m) | 1,573 | 2,459 | 2,712 | 2,651 | 1,919 |

| Dividend paid for the year (in PLN m) | 1,209 | 2,159 | 2,418 | ** | *** |

| Dividend per share for the year (PLN) | 1.40 | 2.50 | 2.80 | ** | *** |

| Dividend per share on the date of record (PLN) | 2.08 | 1.40 | 2.50 | 2.80 | ** |

| Ratio of dividend payout to consolidated profit attributable to the parent company | 62.5% | 74.2% | 75.3% | ** | *** |

| (a) Movement in the share price y/y | (2.4%) | 26.9% | 4.1% | (8.8%) | (19.2%) |

| (b) Dividend yield during the year (%) * | 6.1% | 4.2% | 5.9% | 6.4% | ** |

| (a+b) Total Shareholder Return (TSR) | 3.7% | 31.2% | 10.1% | (2.4%) | (19.2%) |

* Yield calculated as the dividend (as at the dividend record date) in relation to the share price at the end of the previous reporting year

** The Ordinary Shareholder Meeting allocated no portion of the profit to the disbursement of a dividend (in accordance with KNF’s recommendation of 26 March 2020)

*** Up to the date of preparing this report on the activities of the PZU Group, the PZU Management Board has not adopted a resolution concerning the proposed distribution of profit for 2020

Source: PZU's data

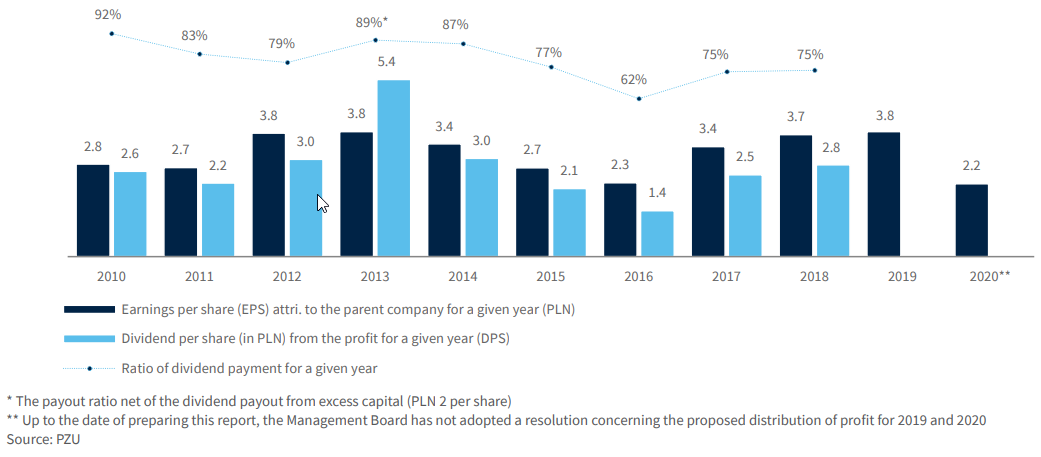

PZU’s earnings and dividend per share in 2010-2020

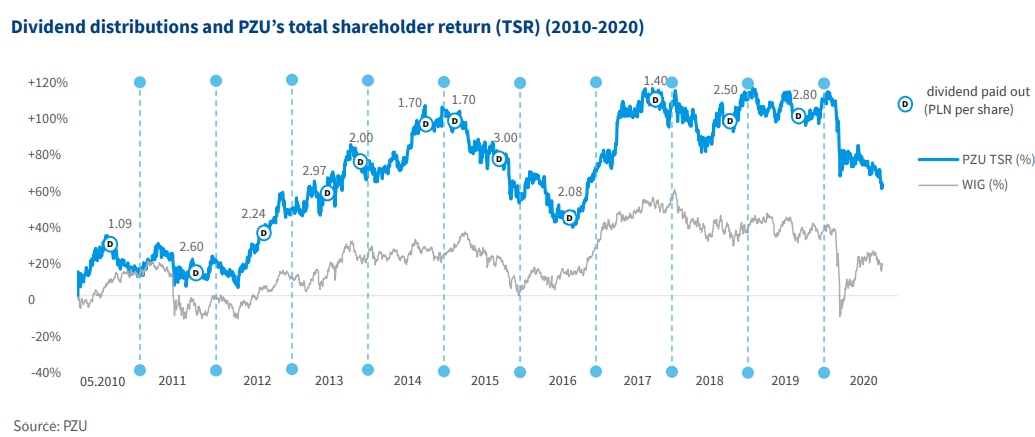

Dividend distributions and PZU’s total shareholder return (TSR) (2010-2020)

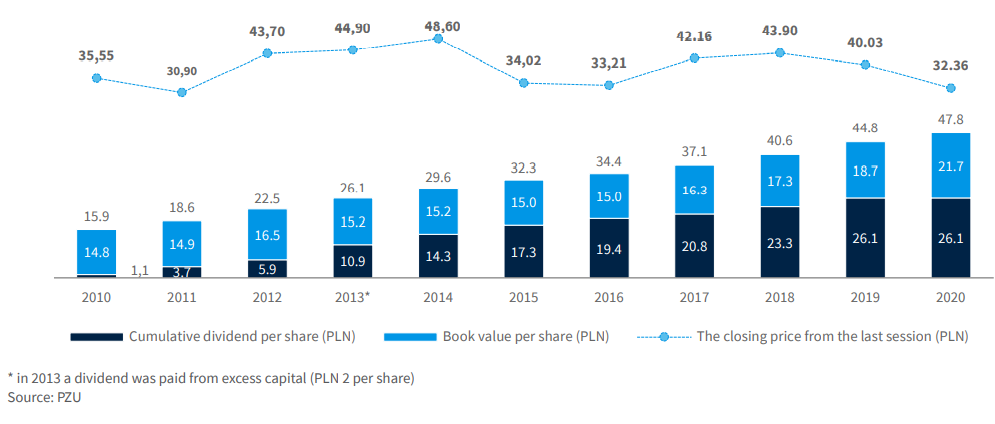

PZU’s book value per share and gross accumulated dividends per share in PLN (2010-2020)

1 The BION assessment is a thorough process involving the utilization of all available information in the regulator’s possession regarding an insurance/ reinsurance undertaking, including information obtained from licensing activities, desktop research and on-site inspection-related activities in an insurance/reinsurance undertaking as well as inquiries/questionnaires addressed to an insurance/reinsurance undertaking