CEO and the Chairman introduce to the most important achievements of the year

Letter to Shareholders

PZU in numbers - see what we have accomplished and how we built the value of the PZU Group

PZU in numbers

Discover more

Financial

performance

Share

performance

Sustainable

growth

Business

performance

Gross written premium and net profit of PZU since the IPO on the stock exchange

Sales and net profit 2010-2020

Discover more

net

profit

gross written

premium

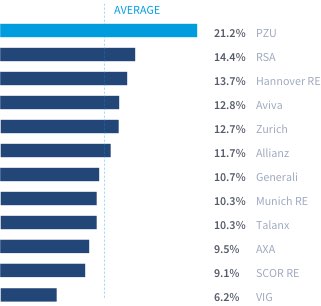

PZU Group’s ROE vs peers

ROE

Check out this interactive map.

See in which markets we are present in Europe.

We are leaders not only in Poland.

Market position

Discover morePoland

Estonia

Lithuania

Latvia

Ukraine

Meet the key groups of our stakeholders and see how we manage these relationships.

Stakeholders Map

Discover moreScroll to the right to see more

See the implementation of the #nowePZU strategy in 2020 and learn about the key elements of our new Strategy for 2021-2024.

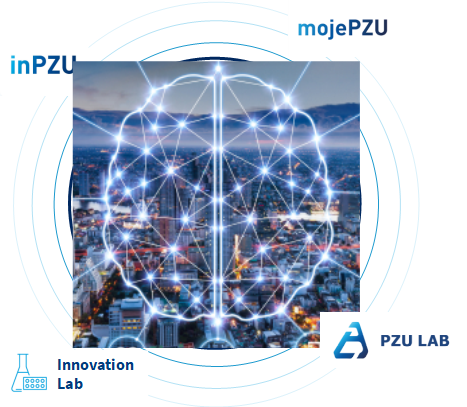

Innovation Strategy

Discover more Play videoSee how we manage capital, building value for our stakeholders.

Business: Value Creation Model

Discover moreCapital…

Financial capital – resource containing funds that arises by providing funding through loans or grants, or is generated through operating activity. These funds include shareholder funds, equity and external capital;

Intellectual capital – organization’s resource based on knowledge, experience, including among others intellectual property such as patents, copyrights, software, rights and licenses, the organization’s know how, motivation to improve and develop processes, leadership and cooperation and investments in new solutions and innovations facilitating development;

Infrastructural capital – physical objects used by the organization in the process of producing goods or rendering services (branches, centers) as well as the distribution network formed by agents, private persons conducting agency activity and other partners cooperating with the PZU Group;

Human capital – competences, know how, skills, experience and motivation of employees to develop and innovate, including the capacity of grasping and implementing the organization’s strategy;

Social and relational capital – reputation, earned trust and the quality of relations with clients, communities and other stakeholders;

Natural capital – renewable and unrenewable natural resources (including water, minerals and air as well as biodiversity and the protection of ecosystems) and processes whereby products or services are delivered

Business model

Insurance

Protection against the effects of events of chance – risk valuation, premium calculation and investment, payment of claims

Health

Health care – offering health insurance and medical care services, prophylactics, prevention, promoting a healthy lifestyle

Investments

Financial security protection – growing savings, capital accumulation programs

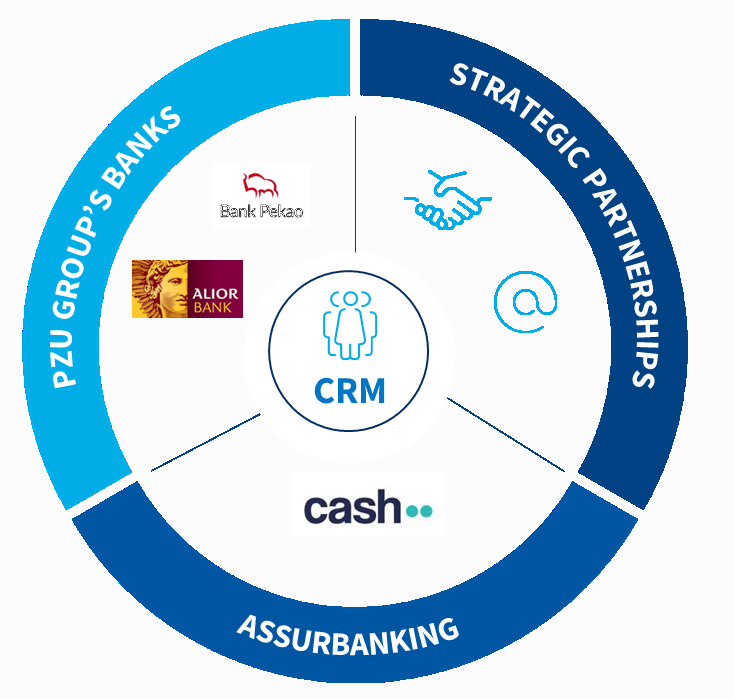

Banking and strategic partnerships

Conducting banking activities, including taking deposits, extending credits and loans, running bank accounts, handling cash settlements and rendering payment services