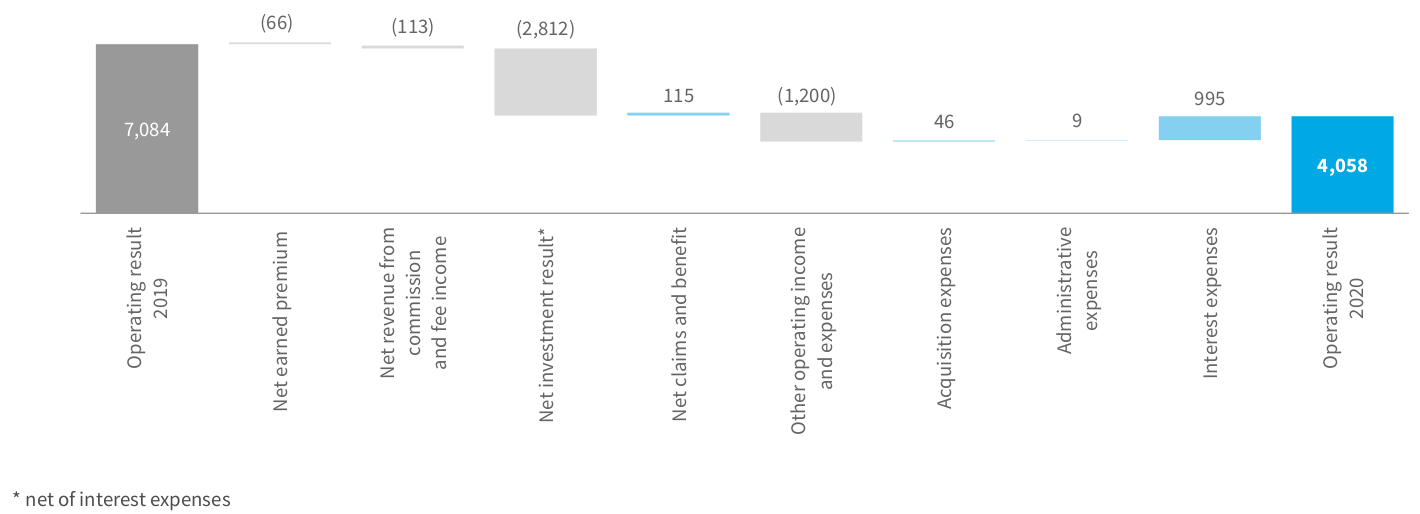

Major factors contributing to the consolidated financial result

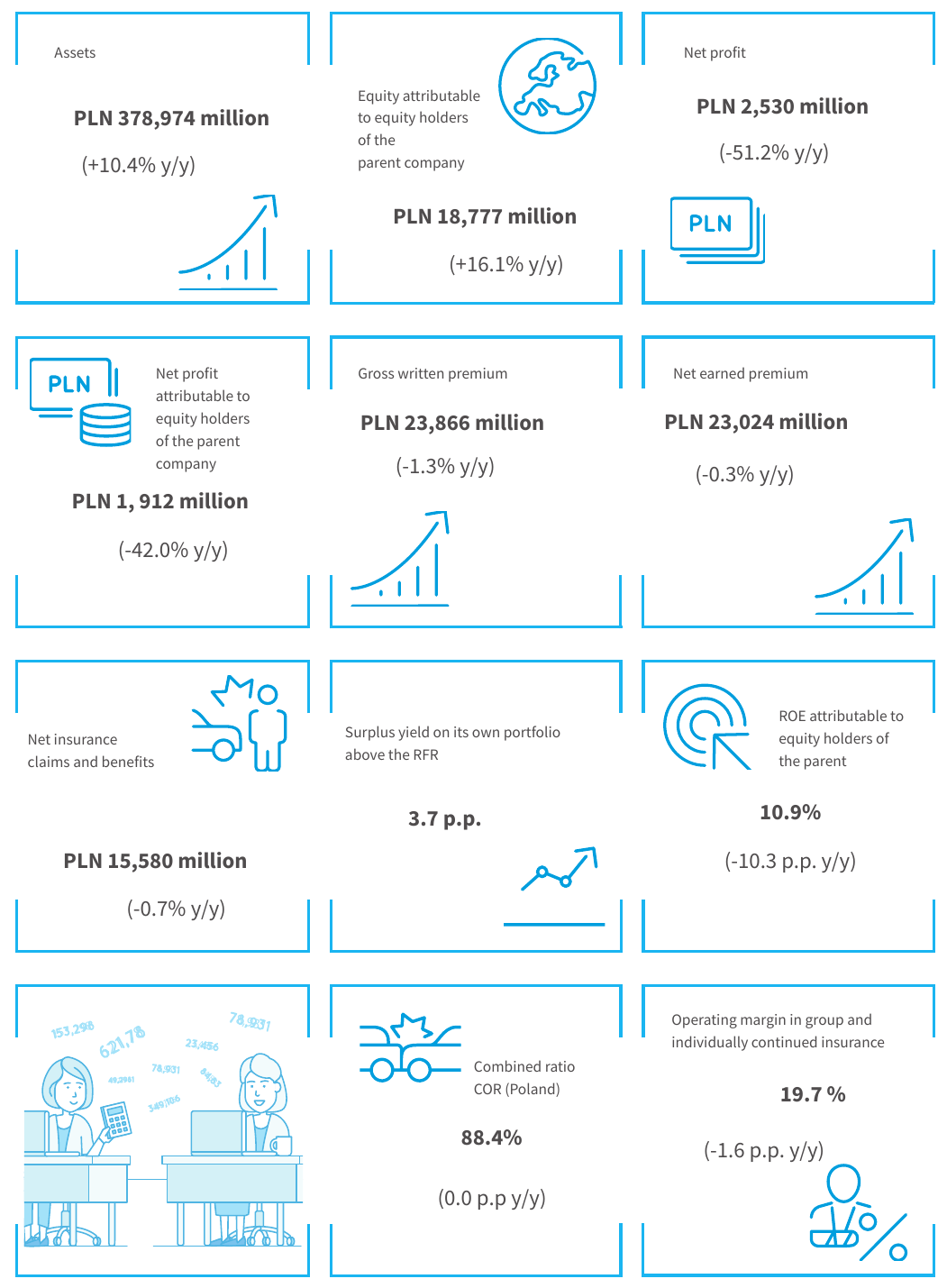

In 2020, the net profit attributable to PZU Group’s parent company shareholders was PLN 1,912 million, compared to PLN 3,295 million in 2019 (down 42.0%). Net profit reached PLN 2,530 million, i.e. PLN 2,655 million less than in 2019, and profit before tax stood at PLN 4,058 million, compared to PLN 7,080 million in the previous year.

The net result declined 23.6% compared to last year, net of non-recurring events1.

Operating profit in 2020 was PLN 4,058 million, down PLN 42.7 million compared to the result in 2019.

Operating profit was driven in particular by the following:

- higher profitability of the mass insurance segment resulting from the lower loss ratio in motor insurance (due to the lower frequency of claims);

- gross written premium down 1.3% y/y – in the case of life insurance, its level was determined by the growing sales of unit-linked products offered in cooperation with banks and development of the portfolio of group health products, and in the case of non-life, the lower motor insurance premium was related to the persisting COVID-19 pandemic;

- slightly lower operating result in the corporate insurance segment as the outcome of an increase in the loss ratio on the portfolio of general TPL insurance and various financial risks coupled with the concurrent dip in sales, chiefly of motor insurance;

- lower result in individual insurance due to the further development of protection products in the banking channel and of term products sold in own chain, the decrease in income from investments allocated according to transfer prices, the lower result on expiring portfolio of the annuity product and the decrease in acquisition expenses for unit-linked products;

- lower profitability in group and individually continued insurance with the concurrent growth in health insurance related to the growth in death-related benefit disbursements in Q4 2020;

- higher result on listed equities, mainly due to the increase in valuation of the logistics company;

- poorer performance of the banking business caused by: non-recurring effect of the impairment loss on goodwill arising from the acquisition of Alior Bank (PLN 746 million) and Bank Pekao (PLN 555 million), the impairment loss on assets arising from the acquisition of Alior Bank (i.e. trademark and relations with clients) in the amount of PLN 161 million, the higher costs of risk stemming from the establishment of additional loan provisions due to the COVID-19 pandemic, the decrease in interest rates that contributed to the decline in net interest income, and the increase in Q4 of provisions for legal risk related to the portfolio of foreign currency mortgage loans in Swiss francs in Bank Pekao.

In the individual operating result items, the PZU Group posted:

- decrease in gross written premium by 1.3% to PLN 23,866 million. This was related mainly to motor insurance, both in the corporate insurance segment and in the mass insurance segment, and was driven by the lower number of insurance policies and a simultaneous fall in the average price. It was partly offset by higher premiums in the life insurance segments in unit-linked products offered in cooperation with the banks and the growth of the group health product portfolio. Moreover, the written premium in ADD and other insurance in the mass insurance segment increased, primarily as a result of the growing sales of insurance offered in cooperation with the Group’s banks, and providing insurance cover to physicians and medical personnel against a COVID-19 infection. After considering the reinsurers’ share and movement in the provision for unearned premiums, the net earned premium was PLN 23,024 million and was 0.3% lower than in 2019;

- 19.8% decrease in investment income which, after factoring in interest expenses2, amounted to PLN 7,352 million, as compared to PLN 9,169 million in 2019. The decrease related to in investment income in the banking business. It was triggered by the higher costs of risk due to the establishment of additional loan provisions for the anticipated deterioration in the quality of Pekao and Alior Bank’s loan portfolios, the decrease in interest rates that led to the decline in net interest income, and the increase of Bank Pekao’s provisions for legal risk related to the portfolio of foreign currency mortgage loans in Swiss francs. Alior Bank’s net interest income was driven down by the ruling of the Court of Justice of the European Union (CJEU) on the refund of part of the commission in the event of an early repayment of consumer loans. Investment income, excluding banking activity3, increased primarily thanks to a higher result earned on listed equities, in particular the higher valuation of the logistics company. The positive effect was partially offset by the poorer performance of the variable coupon debt portfolios (as a result of the lower interest rates), as well as the lower net investment results on the portfolio of assets held to cover the investment products. The investment result in the portfolio of assets to cover the investment products does not affect the PZU Group’s overall net result because it is balanced by the movement in net insurance claims and benefits;

- the lower level of claims and benefits paid, which amounted to PLN 15,580 million, i.e. 0.7% less than in 2019. The decrease – in spite of the higher average payout – was observed primarily in motor insurance. It was the effect of the lower frequency of claims resulting from restrictions on domestic and international traffic imposed in connection with the COVID-19 pandemic. The increase in claims and benefits was reported in the group and individually continued insurance segment in connection with the rise in insureds’ and co-insureds’ death benefits in Q4 2020;

- acquisition expenses lower by 1.4% as they dropped from PLN 3,363 million in 2019 to PLN 3,317 million. This decline was the outcome of lower commission costs on motor insurance (driven by lower sales due to the slowdown on the lease market, price pressure and limitations on accessibility to agents and branches caused by the pandemic), as well as the decrease of indirect costs;

- decline in administrative expenses by 0.1%, to PLN 6,597 million, compared to PLN 6,606 million in 2019. Administrative expenses in the banking business (net of adjustments on account of the valuation of assets and liabilities to fair value) dropped by PLN 68 million, while in the insurance segment in Poland they increased by PLN 36 million, due among others to the growth of personnel costs in connection with the wage pressure and introduction in the sales segment of aid packages in connection with the COVID-19 pandemic;

- the growth of negative balance of other operating income and expenses to PLN 3,990 million, compared to PLN 2,790 million in 2019. This was caused primarily by the one-off impairment loss on goodwill arising from the acquisition of Alior Bank (PLN 746 million) and Bank Pekao (PLN 555 million), the impairment loss on assets arising from the acquisition of Alior Bank (i.e. trademark and relations with clients) in the amount of PLN 161 million, and the increase of the burden related to the levy on financial institutions from PLN 1,134 million in 2019 to PLN 1,203 million in 2020 (the outcome of the growth of value of assets subject to the levy, and not of the rate). At the same time, the Bank Guarantee Fund (BFG) fees decreased from PLN 611 million in 2019 to PLN 541 million in 2020.

| Key data from the consolidated profit and loss account | 2016 | 2017 | 2018 | 2019 | 2020 |

| in PLN m | in PLN m | in PLN m | in PLN m | in PLN m | |

| Gross written premiums | 20,219 | 22,847 | 23,470 | 24,191 | 23,866 |

| Net earned premium | 18,625 | 21,354 | 22,350 | 23,090 | 23,024 |

| Net revenues from commissions and fees | 740 | 2,312 | 3,355 | 3,279 | 3,166 |

| Net investment result* | 3,312 | 7,893 | 9,931 | 11,298 | 8,486 |

| Net insurance claims and benefits | (12,732) | (14,941) | (14,563) | (15,695) | (15,580) |

| Acquisition expenses | (2,613) | (2,901) | (3,130) | (3,363) | (3,317) |

| Administrative expenses | (2,923) | (5,357) | (6,609) | (6,606) | (6,597) |

| Interest expenses | (697) | (1,350) | (2,046) | (2,129) | (1,134) |

| Other operating income and expenses | (721) | (1,552) | (2,201) | (2,790) | (3,990) |

| Operating profit (loss) | 2,991 | 5,458 | 7,087 | 7,084 | 4,058 |

| Share in net profit (loss) of entities measured by the equity method | (3) | 16 | (1) | (4) | - |

| Profit (loss) before tax | 2,988 | 5,474 | 7,086 | 7,080 | 4,058 |

| Income tax | (614) | (1,289) | (1,718) | (1,895) | (1,528) |

| Net profit (loss) | 2,374 | 4,185 | 5,368 | 5,185 | 2,530 |

| Net profit (loss) attributable to equity holders of the parent company | 1,935 | 2,895 | 3,213 | 3,295 | 1,912 |

restated data for 2016-2019

* Including: interest income calculated using the effective interest rate, other net investment income, discontinuation income recognition of financial instruments and

investments, change in write-offs to expected credit losses and impairment losses on financial instruments, net change in the fair value of assets and liabilities measured

at fair value

Operating result of the PZU Group in 2020 (in PLN m)

1 from the acquisition of Alior Bank (PLN 746 million) and Bank Pekao (PLN 555 million), the impairment loss on assets arising from the acquisition of Alior Bank (i.e. trademark and relations with clients) in the amount of PLN 161 million (after adjustment for the impact exerted by deferred income tax and minority shareholdings the impact exerted on the net result attributable to the parent company’s shareholders was PLN 42 million) and the conversion effect of changing long-term contracts into annual renewable contracts in type P group insurance

2 including: interest income calculated using the effective interest rate, other net investment income, discontinuation income recognition of financial instruments and investments, change in write-offs to expected credit losses and impairment losses on financial instruments, net change in the fair value of assets and liabilities measured at fair value, interest expense

3 PZU Group net of the data for Bank Pekao and Alior Bank